MrJohnRoss

Market Veteran

- Reaction score

- 58

Thanks! It will be interesting to see what happens. Are you thinking of going to safety or pressing forward?

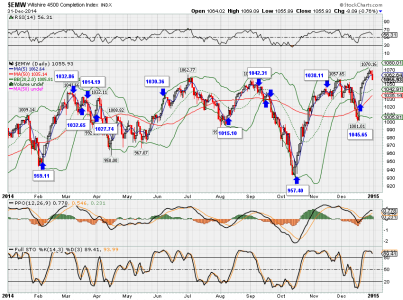

The charts don't look like we're in any kind of topping process, so I may stay put. A little short term pullback may be in order. Tomorrow is historically a bearish day.

Saw that felixthecat went to F yesterday. Maybe he has a crystal ball. Uptrend and FireGal may get jumped!