bmneveu

TSP Pro

- Reaction score

- 92

If anyone knows of some other ETF's that did especially well during the last rally, let us know. This forum is for sharing and learning, so don't keep it a secret.

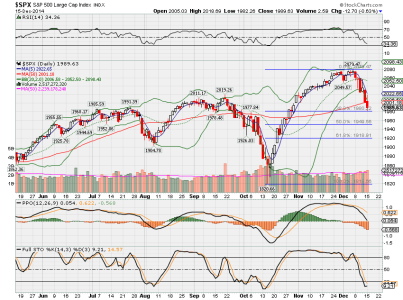

This got me thinking about what a 3x bear oil fund looks like right about now. I found DWTI. Only October 15th it opened at 42.39. On December 5th it closed at 70.24. At a quick glance that looks like about a 75% gain during your time period. But if you zoom out, it has almost a 500% gain since late June. Now THAT is nuts!