MrJohnRoss

Market Veteran

- Reaction score

- 58

Made a short term move to the F Fund for a few days. Mr. Market is curling down. Maybe this is the bottom, and it'll bounce right back on Monday, who knows for sure. But then again, maybe it's got a few more weeks of grinding lower. In any event, I'm going to temporarily step aside and follow my indicators. This kind of move bit me last year, but perhaps this time it really will be different. I'm going to follow my technical system, and leave "hope it goes back up" to others.

The Dow was down "only" -150 when I made the decision to move out of S yesterday. Had no idea it was going to fall so hard. Hate to sell on such a strong down day, but it is what it is.

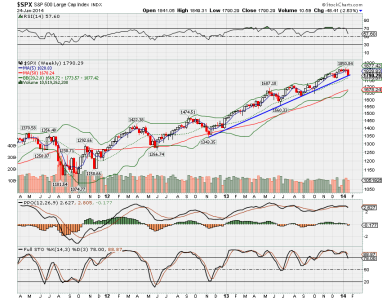

Although I expect a snap back rally over the next day or two, I don't think this is the end of the intermediate term downward move. IMHO, we have some more shaking and quaking before we stabilize and head higher (hopefully). It will be important to watch the longer term trend lines and see if they hold. If they don't, it could spell trouble.

Here's one of the charts I watch, the weekly S&P. Sitting right at that upward trend line going back to Nov 2012. A break below could spell trouble.