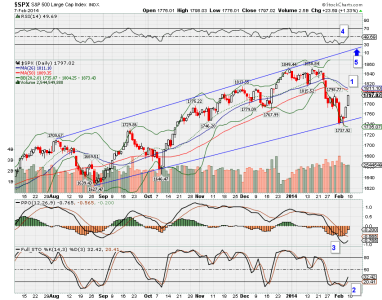

Regarding the TSP Funds, I've studied the charts and there doesn't seem to be enough evidence to make a move to equities at this juncture, IMHO. I'm not good enough to catch a falling knife exactly at the bottom, so I will likely move to the lily pad on my next IFT, which may be tomorrow morning. My timing systems will NEVER be able to predict the exact tops and bottoms of the market. Instead, they look for a change in trend, and ride that trend until it changes again. Oh sure, I can make some edumacated guesses as well as the next guy using support and resistance lines, Fibonacci ratio's etc., but sometimes the market has other ideas, and you just have to go with the flow.

As far as individual stocks go, I do track hundreds of them on a daily basis, and I'm seeing a blood bath for most of them. This is good news if you're waiting for bargains to show up. I've been building my cash position and doing some selective pruning from my stock portfolio, and I'm seeing some great stocks and ETF's that will be fun to ride on the next wave up. Yes, volatility can be a very good and profitable environment if you're well prepared.