Spaf

Honorary Hall of Fame Member

- Reaction score

- 45

imported post

Market actions of last week were a bit violent. While a pull back was a possibility, the actual volume loss was unexpected. My system can't react to such voraciousness. It's like the soft patch turned into a a wash out!

In the last 15 days 9-20 to 10-8 the TSP funds have recorded gains/losses accordingly: G = .02, F = (.02), C = .01, S = .12, I = .46

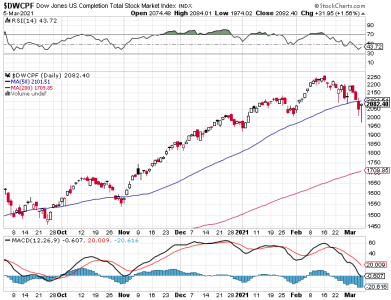

Market returns are now at a critical point, presently declining to the point of possibly crossing under the moving average of 20 days and reversing signals of the P-SAR.

Current market sentiment is critical for Q4: The price of oil and other commodities, economic performance and corporate profitability are the factors likely to affect the stock market. The longer oil stays at $50 a barrel or more, and it shows no sign right now of falling, the more it will eat into consumer purchasing power, economic growth and stock prices. Future economic growth is another wild card. Recent data have given a mixed picture, with jobs creation falling short of expectations.

Presently we are in the marginal area of Bears vs Bulls. Economics are playing hard against the market. The Bearish decline of trending cycles has not been clearly broken. The present reality is one of caution, with no clear signals of what will happen tomorrow.

My consideration is that conditions now have too great a risk. Should be in the G fund, untill turbulent conditions clear.

Attached is the S&P Yahoo chart ending 10-8-04. What Monday brings:*??

Market actions of last week were a bit violent. While a pull back was a possibility, the actual volume loss was unexpected. My system can't react to such voraciousness. It's like the soft patch turned into a a wash out!

In the last 15 days 9-20 to 10-8 the TSP funds have recorded gains/losses accordingly: G = .02, F = (.02), C = .01, S = .12, I = .46

Market returns are now at a critical point, presently declining to the point of possibly crossing under the moving average of 20 days and reversing signals of the P-SAR.

Current market sentiment is critical for Q4: The price of oil and other commodities, economic performance and corporate profitability are the factors likely to affect the stock market. The longer oil stays at $50 a barrel or more, and it shows no sign right now of falling, the more it will eat into consumer purchasing power, economic growth and stock prices. Future economic growth is another wild card. Recent data have given a mixed picture, with jobs creation falling short of expectations.

Presently we are in the marginal area of Bears vs Bulls. Economics are playing hard against the market. The Bearish decline of trending cycles has not been clearly broken. The present reality is one of caution, with no clear signals of what will happen tomorrow.

My consideration is that conditions now have too great a risk. Should be in the G fund, untill turbulent conditions clear.

Attached is the S&P Yahoo chart ending 10-8-04. What Monday brings:*??