News and data continue to be very light and share volume quite thin. As a result we had another slow day of trading action. While the major averages were mixed, I think the nod continues to go to the bulls as the averages were higher overall.

The only data point today was the Fed's Beige Book and it's generally not a market mover. In the report, the Fed reiterated that national economic activity grew at a modest to moderate pace from late November through December. The market didn't appear to have much reaction to this release and continued its choppy action.

Tomorrow, jobless claims and retail sales are the most notable reports on tap. Those may help pick up share volume activity and give the market something more substantial from which to derive short term direction. Also on tap is the latest European Central Bank announcement and that too can be a trading catalyst.

Here's today's charts:

NAMO and NYMO remain on buys.

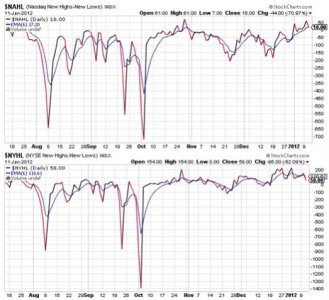

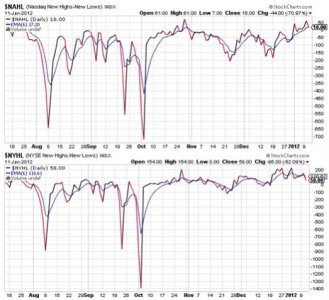

NAHL and NYHL both moved lower today, with NAHL sitting on its trigger point, while NYHL flipped to a sell. I attribute the lack of news and light volume to the turn lower here, so I'm not concerned with these readings.

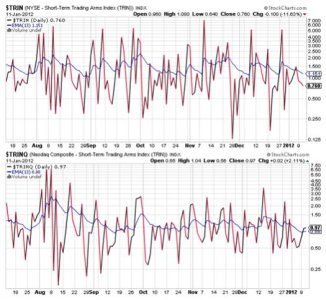

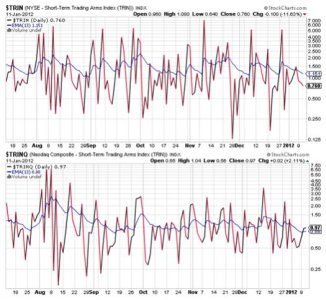

TRIN and TRINQ remained largely where they were yesterday. Buy and sell respectively.

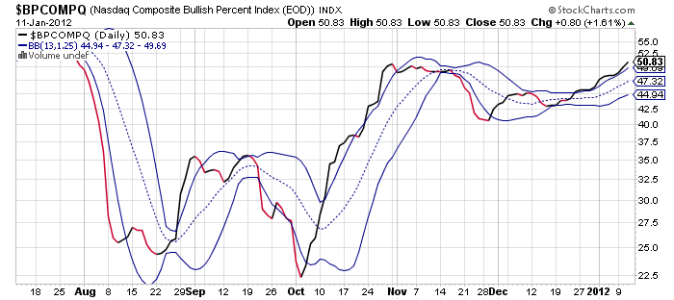

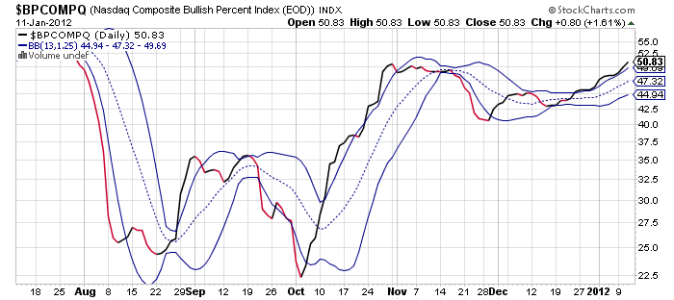

BPCOMPQ rose yet again and remains in a buy condition.

So the signals are mixed and that keeps the Seven Sentinels in a buy condition.

The charts continue to look bullish so remain in a 100% S fund allocation.

The only data point today was the Fed's Beige Book and it's generally not a market mover. In the report, the Fed reiterated that national economic activity grew at a modest to moderate pace from late November through December. The market didn't appear to have much reaction to this release and continued its choppy action.

Tomorrow, jobless claims and retail sales are the most notable reports on tap. Those may help pick up share volume activity and give the market something more substantial from which to derive short term direction. Also on tap is the latest European Central Bank announcement and that too can be a trading catalyst.

Here's today's charts:

NAMO and NYMO remain on buys.

NAHL and NYHL both moved lower today, with NAHL sitting on its trigger point, while NYHL flipped to a sell. I attribute the lack of news and light volume to the turn lower here, so I'm not concerned with these readings.

TRIN and TRINQ remained largely where they were yesterday. Buy and sell respectively.

BPCOMPQ rose yet again and remains in a buy condition.

So the signals are mixed and that keeps the Seven Sentinels in a buy condition.

The charts continue to look bullish so remain in a 100% S fund allocation.