JTH

TSP Legend

- Reaction score

- 1,158

I'm with ya JTH

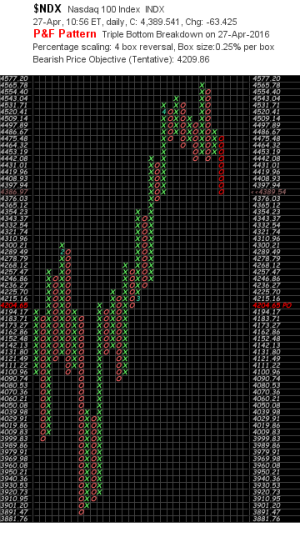

Hi JTH: Earnings....Shmearnings... I keep thinking we're starting to see a pullback, then whamo....not so much....the action still seems choppy and sideways.. I'm out till May anyway but I wouldn't buy until we either crossover 2101, or until we see a sustained downtrend under 2037. At least I can play the pivots and seasonality even with this insane CB and oil intervention. If oil continues up, I'm guessing we see new highs soon despite the bad earnings. Best to all you guys!

FS

Thanks friend, you may have noticed the most recent top is at 2111, I don't believe this is by accident, people are superstitious and like round numbers. I still think my 2121-2222 projection is possible, but as you mentioned we're starting to see the introduction of volatility, and I'm keeping a very close eye on that.