JTH

TSP Legend

- Reaction score

- 1,158

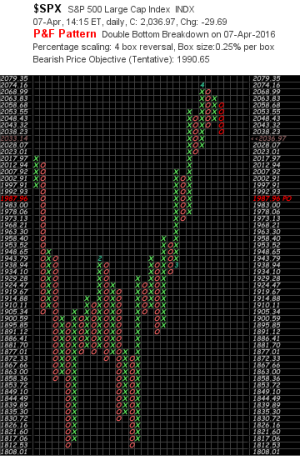

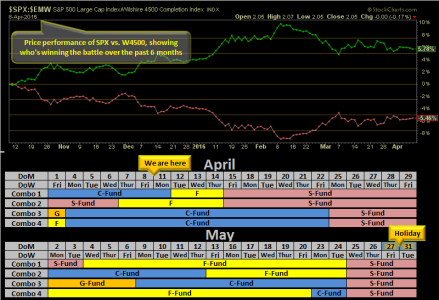

Not expecting a crash, more of a slide. But I'll be on the fence for now. Cheers JTH.

I happen to think you're right, a slow slide seems in order for the next few days. The best part about all of this, if I had 20+ years of trading experience, the odds of me being right are about the same. But I do believe the odds of us reacting correctly do increase over time & experience