FAB1

Market Veteran

- Reaction score

- 34

Based on your current allocation 10/5/20/25 and noon prices....approx 1%...is that what you were looking for?

Yeah, I'll take 1% for sure.

what mathematical formulae did u use to reach ur hypotheziz?

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Based on your current allocation 10/5/20/25 and noon prices....approx 1%...is that what you were looking for?

Yeah, I'll take 1% for sure.

what mathematical formulae did u use to reach ur hypotheziz?

For any dog owners out there...

We lost our precious pup just about a month ago.

She died just a couple months shy of 18 yrs old!!

FAB1, Sorry to hear about your pup, we had a Basset about that old when he passed. Not a good time. WS.

Uhhh, the current rate x your current allocation...lol

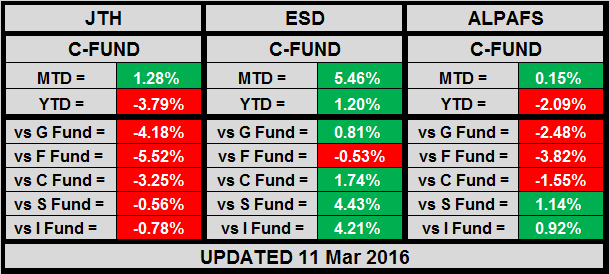

AGG -.16% x .10

.INX 1.34% x .05

DWCPF 1.79% x .20

EFA 2.52% x .25

add it all up...yum :yumyum:

Good evening

The rest of this month is a bit difficult to survey, because I'm working extended hours and am unable to watch both the Pre-Markets and the Pre-IFT deadline.

In the weekly blog I wrote "My expectations for the S&P 500 are to tag the overhead 2040 gap, then re-test the descending trendline, but before we do that, we may need to flag down along the descending trendline, before heading higher. If we do break above and pass a test of the descending trendline, then I'll expect we'll be well-poised to break above the 2015 Nov highs, where we'll make a run from 2121-2222, before hitting the summer slump."

As of now, we are essentially flagging down along the trendline with a very tight 3-day trading range. This tells us buyers aren't willing to step in, and sellers aren't willing to step out. For the moment, I'll consider this a win, if you consider where we've been and where we are now, I think we've made substantial progress which so happens to align with my statistical interpretation of how I believe the markets should play out. Although I believe I will be right, I should tell you that if we close below 1980, then I will be wrong, and will re-adjust my 2121-2222 projection, based on how that data has played out.

I would have taken my gains off the table today if I had any IFT's left for this month! Da... limits.

Thanks for staying in, keep strong brother, I'm looking for 2065 as the next price objective, we still have a peak ahead of us.

I would have taken my gains off the table today if I had any IFT's left for this month! Da... limits.

If we make it to 2065 I will have made back the 10% that I lost earlier this year. You have been spot on with your charts and helped many of us on the Forum make $$ who have listened and used your work to help make their investing decisions. Thanks and Please keep up the good work.