WorkFE

TSP Legend

- Reaction score

- 516

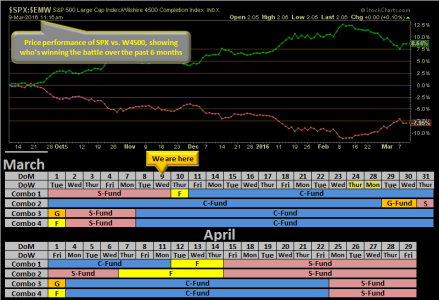

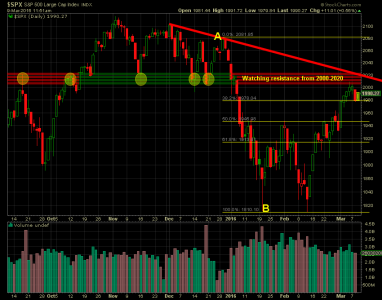

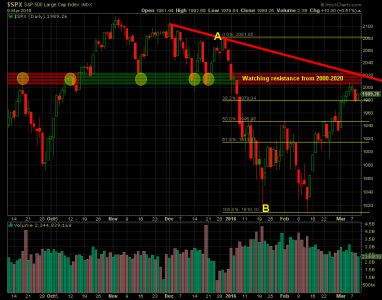

At this time, I believe we are gearing up for a 6-8% March, and there may not be another opportunity to jump in.

I could live with that. While sitting in equities all year, early on I took some lumps. It has fought back pretty good, a 6-8 March would help me sleep.