JTH

TSP Legend

- Reaction score

- 1,158

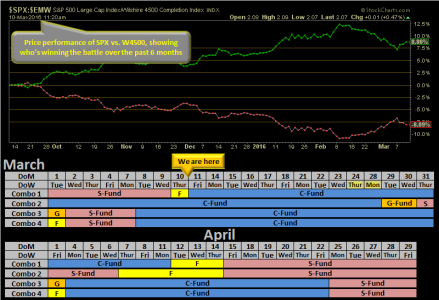

JTH-ESD, IFT Eob today, from 100S to 100F

From my weekend blog: "At this time I plan to follow the path, which means the system will IFT for 1-day into the F-Fund on Thur 10-Mar, then move into the C-Fund. This will lead into the best combo for April which starts in the C-Fund. "

JTH-ESD, IFT EoB today, from 100F to 100C