-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

James48843 Account Talk

- Thread starter James48843

- Start date

userque

TSP Legend

- Reaction score

- 36

So what you are saying is that you withdrew prematurely???...

"That's what she said."

James48843

TSP Talk Royalty

- Reaction score

- 992

Seeking fellow TSPTALK friends

who might be interested in an entrepenurial opportunity-

I'm getting closer to retirement- perhaps somewhere from 4 months to 2 years from pulling the plug and changing careers. .

And I'm getting ready to start a new adventure as something I've ALWAYS wanted to try- my hand at a business. (Or, more properly, a set of businesses).

The first business I am going to do, will involve chartering out a sailing vessel. Bareboat chartering a 32 foot (or thereabouts) nice, recent Sailboat, from a slip in the Great Lakes. It will be the beginning of a multi-sailboat leasing company, which I will run from my home looking at the dock/marina in Michigan.

Shortly after I establish that business (Expected to commence in Spring, 2020) , I would like to establish a deluxe Air B-N-B type operation within a 3 bedroom condo just down the street. I will operate and maintain it, and, based on local history, I see significant demand year around for this particular property.

Now, I have never done an AIR-B-N-B type operation before. The numbers are pretty good- and I am interested in finding some other fine TSPTALK related friends who might be interested in doing a venture-capital investment partnership with me on this deal.

Specifically, I'm interested in finding like 3 or 4 partners, who each would be willing to kick in on the order of around 50K. In return, they would get a small piece of ownership of the business (I do not yet know exactly what that would look like. It might be a partnership share, or a S-Corporation share, or something) , and a regular return on investment.

this is NOT an official offer or anything here.

I thinking I'm able to set up the Sailboat Chartering business myself.

But I'd like to find some partners to assist with doing the AIRBNB business. That one is going to need more thought into the setup, the operations, and the potential mental strength from more than just me. I want to combine with several other folks to give that one a try.

I'm just gauging interest if anybody out there would be willing to join me in doing my first attempts at an AIRBNB company.

I have some links to show a prospective investor/partner the area I am talking about, and a possible condo that is now up for sale, so you can see what type of property it is, and how this would work.

Message me if you are interested.

Jim

who might be interested in an entrepenurial opportunity-

I'm getting closer to retirement- perhaps somewhere from 4 months to 2 years from pulling the plug and changing careers. .

And I'm getting ready to start a new adventure as something I've ALWAYS wanted to try- my hand at a business. (Or, more properly, a set of businesses).

The first business I am going to do, will involve chartering out a sailing vessel. Bareboat chartering a 32 foot (or thereabouts) nice, recent Sailboat, from a slip in the Great Lakes. It will be the beginning of a multi-sailboat leasing company, which I will run from my home looking at the dock/marina in Michigan.

Shortly after I establish that business (Expected to commence in Spring, 2020) , I would like to establish a deluxe Air B-N-B type operation within a 3 bedroom condo just down the street. I will operate and maintain it, and, based on local history, I see significant demand year around for this particular property.

Now, I have never done an AIR-B-N-B type operation before. The numbers are pretty good- and I am interested in finding some other fine TSPTALK related friends who might be interested in doing a venture-capital investment partnership with me on this deal.

Specifically, I'm interested in finding like 3 or 4 partners, who each would be willing to kick in on the order of around 50K. In return, they would get a small piece of ownership of the business (I do not yet know exactly what that would look like. It might be a partnership share, or a S-Corporation share, or something) , and a regular return on investment.

this is NOT an official offer or anything here.

I thinking I'm able to set up the Sailboat Chartering business myself.

But I'd like to find some partners to assist with doing the AIRBNB business. That one is going to need more thought into the setup, the operations, and the potential mental strength from more than just me. I want to combine with several other folks to give that one a try.

I'm just gauging interest if anybody out there would be willing to join me in doing my first attempts at an AIRBNB company.

I have some links to show a prospective investor/partner the area I am talking about, and a possible condo that is now up for sale, so you can see what type of property it is, and how this would work.

Message me if you are interested.

Jim

James48843

TSP Talk Royalty

- Reaction score

- 992

Something is not right. My hair is itching. It makes no sense to me. But I’m gonna follow it.

Moving to L-Income 90%, and F fund 10%.

No explanation available. Hanging on for trouble due to itchy scalp.

Sent from my iPhone using TSP Talk Forums

Moving to L-Income 90%, and F fund 10%.

No explanation available. Hanging on for trouble due to itchy scalp.

Sent from my iPhone using TSP Talk Forums

James48843

TSP Talk Royalty

- Reaction score

- 992

June has been very very good to me, considering I spent most of the month in safety. autotracker is showing that I've gained 2.99% with one day to go this month, and today is up. That's a nice thing.

So I am going to be bold again, and just entered an IFT to move to 90% "S" and 10% "I", effective the COB on Monday. That will be the 1st of the next month, so I am hoping we get a good July out of the deal. Wish me luck.

So I am going to be bold again, and just entered an IFT to move to 90% "S" and 10% "I", effective the COB on Monday. That will be the 1st of the next month, so I am hoping we get a good July out of the deal. Wish me luck.

Boghie

Market Veteran

- Reaction score

- 413

June has been very very good to me, considering I spent most of the month in safety. autotracker is showing that I've gained 2.99% with one day to go this month, and today is up. That's a nice thing.

So I am going to be bold again, and just entered an IFT to move to 90% "S" and 10% "I", effective the COB on Monday. That will be the 1st of the next month, so I am hoping we get a good July out of the deal. Wish me luck.

Better to burn out than rust away:laugh:

It has been a great month - and, in fact, a great year. Personally, I don't see any valid reason to not be invested. The only issue is 'Summer', because 'Summer'. Could be a 30% year!!!

James48843

TSP Talk Royalty

- Reaction score

- 992

Hemorrhage.

I do believe that is the word I am searching for.

I do believe that is the word I am searching for.

James48843

TSP Talk Royalty

- Reaction score

- 992

It's been a while since things have been clearer on the charts.

Today things became MUCH clearer for me.

I am seeing a clear downturn here- the S&P 500 should fall at LEAST 40 more points, if I am correct, and move to around 2950 to 2940 shortly.

I know that's not a huge downside, but the support that had been at recent levels has been eroding, and it looks pretty clear to me that we're in a for a short term retracement downward.

I'm sitting in L-income, (my go to for safety) and waiting for a good spot to appear to jump back in.

Peace.-- out.

Today things became MUCH clearer for me.

I am seeing a clear downturn here- the S&P 500 should fall at LEAST 40 more points, if I am correct, and move to around 2950 to 2940 shortly.

I know that's not a huge downside, but the support that had been at recent levels has been eroding, and it looks pretty clear to me that we're in a for a short term retracement downward.

I'm sitting in L-income, (my go to for safety) and waiting for a good spot to appear to jump back in.

Peace.-- out.

James48843

TSP Talk Royalty

- Reaction score

- 992

How does L-Income work for you as a safe haven?

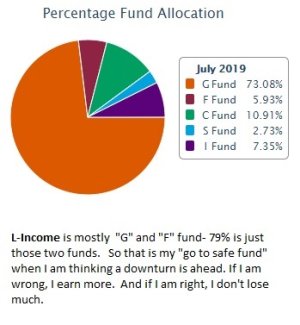

The L-Income fund is MOSTLY "G" and "F" fund. 73% "G" fund, and 6% "F" fund. Both of those are what I consider extreme safety.

If I am correct, and the market is headed downwards, that almost 80% of my savings is in a safe place, and that "F" fund may even bounce higher.

So I am not going to be out a whole lot.

On the other hand, there is a small amount of "C", and a tiny amount of "S" and "I" in there- so on the off chance that I am wrong, and the markets go higher, I STILL have a positive outcome.

- Reaction score

- 2,644

On the other hand, there is a small amount of "C", and a tiny amount of "S" and "I" in there- so on the off chance that I am wrong, and the markets go higher, I STILL have a positive outcome.

I like that idea James. Over the years my mistakes always seem to lean on the "I'm too bearish" side, and I have always considered a bull market strategy of keeping some percentage in stocks at all times. Once we're in the bear (as indicators dictate), that would change.

Don Hays, an old money manager, used to say to keep a minimum of 55% in stocks at all times because of the historical positive bias for stocks in the long term.

That's a little too aggressive for me, but I forget if that was just in bull markets. It's been a while since I read his stuff.

James48843

TSP Talk Royalty

- Reaction score

- 992

I'm still seeing quite a bit more downside here, and in slow motion. Easily to 2940, maybe to the 2900 area or lower on the S&P500.

Still awaiting my L -Income place- I only wish I had a little less in my "I"Fund (currently holding 10%) and more in "F". (Currently at 1%.)

I may use this month's second move to swap the I and F around, keeping my 73% in "L-Income.

Still awaiting my L -Income place- I only wish I had a little less in my "I"Fund (currently holding 10%) and more in "F". (Currently at 1%.)

I may use this month's second move to swap the I and F around, keeping my 73% in "L-Income.

James48843

TSP Talk Royalty

- Reaction score

- 992

The crystal ball is a bit less fuzzy today.

I'm seeing the large caps are almost ready to stop falling. My target looks to be 2930 to 2950. If it hits 2950 I am seriously thinking I may jump back in.

The small caps are more fuzzy. $EMW looks to me now like 1410 to 1400 is likely.

IF impeachment heats up, then all bets are off, and I would be in uncharted territory.

Not going to jump in today, but I am watching closely and may move soon.

good luck.

I'm seeing the large caps are almost ready to stop falling. My target looks to be 2930 to 2950. If it hits 2950 I am seriously thinking I may jump back in.

The small caps are more fuzzy. $EMW looks to me now like 1410 to 1400 is likely.

IF impeachment heats up, then all bets are off, and I would be in uncharted territory.

Not going to jump in today, but I am watching closely and may move soon.

good luck.

James48843

TSP Talk Royalty

- Reaction score

- 992

Another thing is hitting my radar- The overnight lending issue is big.

Here is something from Bloomberg on what I am talking about. This is not normal:

**********

the Federal Reserve is having to create money to buy bonds from the Treasury so that the bond auctions don't fail.

That is not normal, and is dangerously unsustainable in the longer term.

Sent from my iPhone using TSP Talk Forums

Here is something from Bloomberg on what I am talking about. This is not normal:

**********

Buckle up: Repo Meltdown Shows Budget Deficit Has Limits

https://www.bloomberg.com/opinion/articles/2019-09-26/repo-meltdown-shows-budget-deficit-has-limits

The repo market madness lives on for a ninth day.

The Federal Reserve Bank of New York announced Wednesday that it would increase the size of its next overnight system repurchase agreement operation to a $100 billion maximum, from $75 billion previously, and also raise the limit on its 14-day term repo operation to $60 billion from $30 billion. Simply put, the bank wants to flood the funding market with enough cash to soak up all the securities that dealers submit 1 and leave no doubt that the critical financial-system plumbing is in fine working order ahead of the end of the quarter.

By now, just about everyone has heard the explanations for this persistent liquidity squeeze, which has lasted long enough to refute the earlier notion that it was merely a one-day confluence of unfortunate events. To some, the main structural issue is that banking regulations are disrupting the financial system’s inner workings. Others say the Fed has simply found the lower bound for reserves necessary to control short-term rates and can move forward accordingly.

In addition to those two assessments, I’d offer another angle that’s largely flown under the radar: The chaos in repo markets was a long time coming given the widening U.S. budget deficits and the lenders that are financing that shortfall.

the Federal Reserve is having to create money to buy bonds from the Treasury so that the bond auctions don't fail.

That is not normal, and is dangerously unsustainable in the longer term.

Sent from my iPhone using TSP Talk Forums

Mcqlives

Market Veteran

- Reaction score

- 24

https://www.yahoo.com/finance/news/china-defaults-set-worsen-7-213101573.html

Something similar is coming home with China's bond markets...See attached. This is on Yahoo this morning so it is hitting "mainstream" news instead of the dedicated financial sources. In many ways that worries me more that the information in the article. As my grandfather always said (he was a newspaper reporter) "Always look behind the headlines, skip the front page, always look under the fold, and then ask yourself what else is known but didn't get written"

Something similar is coming home with China's bond markets...See attached. This is on Yahoo this morning so it is hitting "mainstream" news instead of the dedicated financial sources. In many ways that worries me more that the information in the article. As my grandfather always said (he was a newspaper reporter) "Always look behind the headlines, skip the front page, always look under the fold, and then ask yourself what else is known but didn't get written"

James48843

TSP Talk Royalty

- Reaction score

- 992

https://www.yahoo.com/finance/news/china-defaults-set-worsen-7-213101573.html

Something similar is coming home with China's bond markets...See attached. This is on Yahoo this morning so it is hitting "mainstream" news instead of the dedicated financial sources. In many ways that worries me more that the information in the article. As my grandfather always said (he was a newspaper reporter) "Always look behind the headlines, skip the front page, always look under the fold, and then ask yourself what else is known but didn't get written"

Very interesting. That one sounds like it's more about construction companies in China, which are about to get hit bad. I have no idea what the world' s economies are going to look like three or four years from now.

Note: I HOPE- that with the discussion of the changing of the "I" fund tracking, that the TSP Board consider doing this- instead of just switching out the I find index, that maybe they consider doing TWO I Funds- the current one remains as the I fund, and a new fund be created that includes the emerging markets ("E fund?" ) . I think that is a solution to consider.

Jim

James48843

TSP Talk Royalty

- Reaction score

- 992

I just reviewed where we are this morning-

Nothing changes for me. I STILL see further downward movement. We MAY get a slight bounce back on Monday, but I don't see anything saying we've reached the bottom on this oscillation.

I'm staying in safety. I'm going to TWEAK a little, and take some out of "S" and put more into "F". This is my higher-level safety position.

77% = L Income

1% = G

8% = F

1% = C

5% = S

8% = I

Just because.

Have a great weekend.

Nothing changes for me. I STILL see further downward movement. We MAY get a slight bounce back on Monday, but I don't see anything saying we've reached the bottom on this oscillation.

I'm staying in safety. I'm going to TWEAK a little, and take some out of "S" and put more into "F". This is my higher-level safety position.

77% = L Income

1% = G

8% = F

1% = C

5% = S

8% = I

Just because.

Have a great weekend.

James48843

TSP Talk Royalty

- Reaction score

- 992

Small Caps are taking a beating today- and that is leading me to believe the blood letting still has a way to go. A long way, possibly.

I'm seeing S&P 500 fall at least another 1%, with the S&P500 MORE LIKELY THAN NOT to fall below 2910 in the next two sessions.

https://stockcharts.com/freecharts/gallery.html?$SPX

Monday COULD be a slight relief, but even if it is, then I think we're headed downwards some more.

Small Caps also being hit hard- I'm seeing the $EMW (Wilshire Completion Index, close to our "S" fund) heading down more as well, down to below the 200 day moving average at 1391 early next week as well.

https://stockcharts.com/freecharts/gallery.html?$EMW

Good luck.

I'm seeing S&P 500 fall at least another 1%, with the S&P500 MORE LIKELY THAN NOT to fall below 2910 in the next two sessions.

https://stockcharts.com/freecharts/gallery.html?$SPX

Monday COULD be a slight relief, but even if it is, then I think we're headed downwards some more.

Small Caps also being hit hard- I'm seeing the $EMW (Wilshire Completion Index, close to our "S" fund) heading down more as well, down to below the 200 day moving average at 1391 early next week as well.

https://stockcharts.com/freecharts/gallery.html?$EMW

Good luck.

James48843

TSP Talk Royalty

- Reaction score

- 992

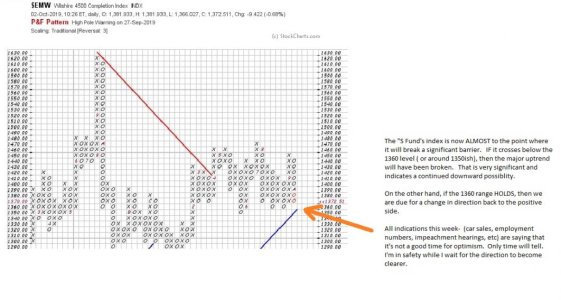

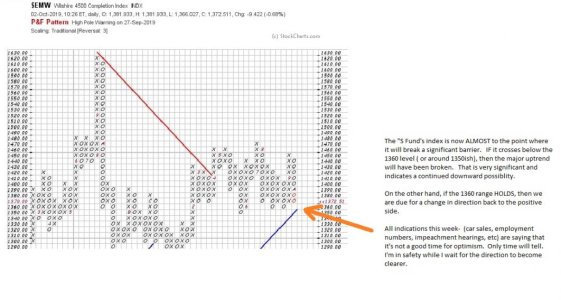

Still seeing more bloodshed today. Here's what the Wilshre 4500 completion fund is doing- (S fund)- it's getting clobbered, AND may be crossing a significant threshold today.

I'm being very cautious (for me, that is unusual) and sitting with most in L-Income and "F" fund as my two biggest holdings right now. Got to sort out where we go moving forward. Today is not a good day to decide what that is going to be.

I'm being very cautious (for me, that is unusual) and sitting with most in L-Income and "F" fund as my two biggest holdings right now. Got to sort out where we go moving forward. Today is not a good day to decide what that is going to be.

James48843

TSP Talk Royalty

- Reaction score

- 992

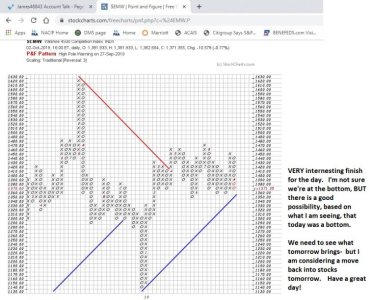

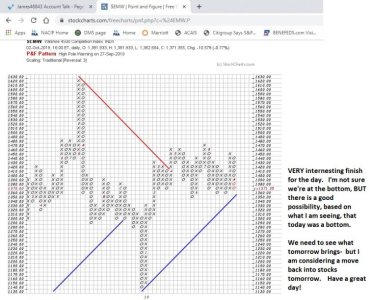

A BOTTOM?? MAYBE. or maybe not.

We MAY be close to the bottom here.

Unless, of course, it's the external factors driving this one down, but it appears that we are now within 10 points of a bottom on the "S" fund's chart.

I will be watching carefully tomorrow. If if drops slightly, and then solidifies before noon, that is about an even chance that I will risk jumping back in tomorrow. If it drops a large amount, however, I will stay on the sidelines longer. Good luck.

We MAY be close to the bottom here.

Unless, of course, it's the external factors driving this one down, but it appears that we are now within 10 points of a bottom on the "S" fund's chart.

I will be watching carefully tomorrow. If if drops slightly, and then solidifies before noon, that is about an even chance that I will risk jumping back in tomorrow. If it drops a large amount, however, I will stay on the sidelines longer. Good luck.

Similar threads

- Replies

- 0

- Views

- 164

- Replies

- 0

- Views

- 172

- Replies

- 3

- Views

- 220

- Replies

- 0

- Views

- 119