-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intrepid_Timer's PUBLIC Account Talk

- Thread starter Intrepid_Timer

- Start date

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

Happy Birthday IT.

Birthday? Oh yeah, I remember it well. What a beautiful mess that was..................

Thanks!

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

Thanks for the B-day wishes!

“A man is not old until regrets take the place of dreams.”

― John Barrymore

― John Barrymore

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

“Everything's not going to go perfect. You're going to have some losses that you're going to have to bounce back from and some things that are a little unforeseen that you're going to have to deal with.”

― Tony Dungy

― Tony Dungy

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

With the supreme court ruling, here's a good song for the day:

Zac Brown Band Free Music Video - YouTube

Zac Brown Band Free Music Video - YouTube

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

I keep hearing this lack of health insurance law is going to be a tax and not a penalty. Um, aren't you suppose to tax things you earn, buy or sell, not what you don't have and don't plan on buying? Weird.............

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

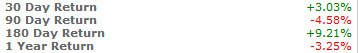

End of June update.

The below are my TSP returns in various time frames as calculated by an independent 3rd party:

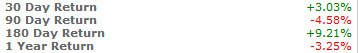

For comparison purposes, here are the returns of the S fund:

If one were using all the signals produced by my timing system in a self-directed IRA using funds similar to our S and F funds (or if we had more IFTs), their return YTD would be 19.96%.

My YTD returns as of Friday's close using 3X ETF long/short funds are:

TNA/TZA: 49.20%

FAS/FAZ: 62.26%

These are all updated and verified daily in my commentaries.

*My 30-day return matches what the S fund made, but I was only in the S fund for three days so my risk was greatly reduced.

The below are my TSP returns in various time frames as calculated by an independent 3rd party:

For comparison purposes, here are the returns of the S fund:

If one were using all the signals produced by my timing system in a self-directed IRA using funds similar to our S and F funds (or if we had more IFTs), their return YTD would be 19.96%.

My YTD returns as of Friday's close using 3X ETF long/short funds are:

TNA/TZA: 49.20%

FAS/FAZ: 62.26%

These are all updated and verified daily in my commentaries.

*My 30-day return matches what the S fund made, but I was only in the S fund for three days so my risk was greatly reduced.

Last edited:

Birchtree

TSP Talk Royalty

- Reaction score

- 143

You'll have to reduce your rates of return by the ordinary income taxes you are going to be forced to pay. Remember, our friends at the IRS will have a 1099 copy of every transaction you make - they'll track you like a blood hound. There is no escape from Big Brother regulations. So the better you do and the more money you make the more taxes you'll pay. Unless President Romney decides to do a roll back on tax rates or suspends the capital gains rates for a year or two - that's possible to energize the economy.

You'll have to reduce your rates of return by the ordinary income taxes you are going to be forced to pay. Remember, our friends at the IRS will have a 1099 copy of every transaction you make - they'll track you like a blood hound. There is no escape from Big Brother regulations. So the better you do and the more money you make the more taxes you'll pay. Unless President Romney decides to do a roll back on tax rates or suspends the capital gains rates for a year or two - that's possible to energize the economy.

Are gains in the ETF's taxed as short term capital gains (15%) then ?? But what about ETF trading in a IRA account ? Thanks.

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

You'll have to reduce your rates of return by the ordinary income taxes you are going to be forced to pay. Remember, our friends at the IRS will have a 1099 copy of every transaction you make - they'll track you like a blood hound. There is no escape from Big Brother regulations. So the better you do and the more money you make the more taxes you'll pay. Unless President Romney decides to do a roll back on tax rates or suspends the capital gains rates for a year or two - that's possible to energize the economy.

Not if you are trading in an IRA account. And what do taxes matter anyway? They can only tax profits. Taking home 70% of something is better than making nothing in cash or next to nothing in savings accounts, CDs or whatever.

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

Are gains in the ETF's taxed as short term capital gains (15%) then ?? But what about ETF trading in a IRA account ? Thanks.

Short term capital gains are taxed as ordinary income and dependent on your tax bracket while long term capital gains are taxed at 15%, for now anyway.

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

You'll have to reduce your rates of return by the ordinary income taxes you are going to be forced to pay. Remember, our friends at the IRS will have a 1099 copy of every transaction you make - they'll track you like a blood hound. There is no escape from Big Brother regulations. So the better you do and the more money you make the more taxes you'll pay. Unless President Romney decides to do a roll back on tax rates or suspends the capital gains rates for a year or two - that's possible to energize the economy.

Dang, sorry Birch:

"Here are some of the new taxes you're going to have to pay to pay for Obamacare:

A 3.8% surtax on "investment income" when your adjusted gross income is more than $200,000 ($250,000 for joint-filers). What is "investment income?" Dividends, interest, rent, capital gains, annuities, house sales, partnerships, etc. Taxes on dividends will rise from 15% to 18.8%--if Congress extends the Bush tax cuts. If Congress does not extend the Bush tax cuts, taxes on dividends will rise from 15% to a shocking 43.8%. (WSJ)"

Here Are The New Obamacare Taxes - Business Insider

"Here are some of the new taxes you're going to have to pay to pay for Obamacare:

A 3.8% surtax on "investment income" when your adjusted gross income is more than $200,000 ($250,000 for joint-filers). What is "investment income?" Dividends, interest, rent, capital gains, annuities, house sales, partnerships, etc. Taxes on dividends will rise from 15% to 18.8%--if Congress extends the Bush tax cuts. If Congress does not extend the Bush tax cuts, taxes on dividends will rise from 15% to a shocking 43.8%. (WSJ)"

Here Are The New Obamacare Taxes - Business Insider

Just more reasons that the American People have to put the GOP in charge of the Senate and White House, so that Obama Care can be repealed .... No way we can tolerate these type of tax increases !!

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

“I have a simple philosophy:

Fill what’s empty.

Empty what’s full.

Scratch where it itches.”

~ Alice Roosevelt Longworth

Fill what’s empty.

Empty what’s full.

Scratch where it itches.”

~ Alice Roosevelt Longworth

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

"I'd rather regret the things I've done than regret the things I haven't done."

- Lucille Ball

- Lucille Ball

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 79

End of June update.

The below are my TSP returns in various time frames as calculated by an independent 3rd party:

View attachment 19412

For comparison purposes, here are the returns of the S fund:

View attachment 19413

If one were using all the signals produced by my timing system in a self-directed IRA using funds similar to our S and F funds (or if we had more IFTs), their return YTD would be 19.96%.

My YTD returns as of Friday's close using 3X ETF long/short funds are:

TNA/TZA: 49.20%

FAS/FAZ: 62.26%

These are all updated and verified daily in my commentaries.

*My 30-day return matches what the S fund made, but I was only in the S fund for three days so my risk was greatly reduced.

Just for comparison:

Trend Following Wizards - June '12 | Au.Tra.Sy blog - Automated trading System