You can think what you'd like, but I'm not buying the programmed selling error report as the reason for the carnage. That's a smokescreen in a world of computerized trading. I won't speculate on it, but I'm not buying it in any event.

Today was the biggest one-day decline for the S&P this year. The VIX spiked as much as 60% at one point, and the dollar gained an additional 0.9%. Of course the Euro is taking the brunt of that pain and no end appears to be in sight.

The yield on the 10-year Note fell under 3.40, which was lowest level seen so far this year. And today also saw the highest trading volume of the year on the NYSE.

The fear over a Euro meltdown is real and the market senses that it's about to get worse. At least that's my take.

Programmed trading error...get real.

I can tell you what's real though. The Seven Sentinels sell signal that was issued last Friday. If you took advantage of it, you caught the Monday rally and side-stepped some major selling pressure thereafter. And while we are oversold in a big way, that's no guarantee it's over.

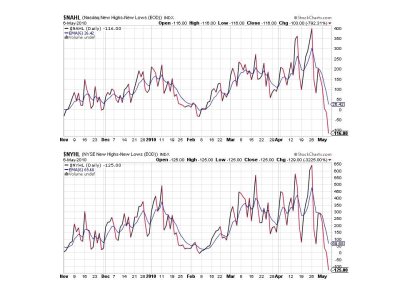

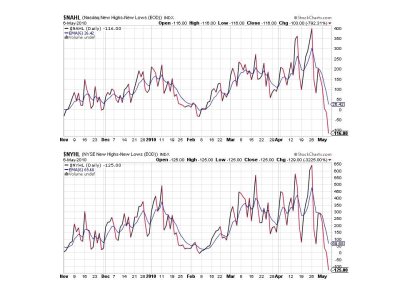

Here's today's charts:

We can see the panic in these charts. Down hard.

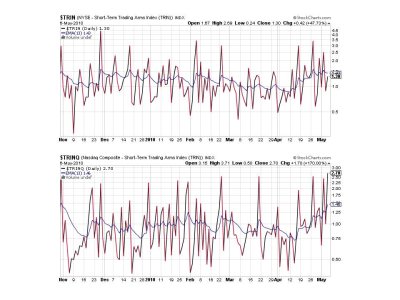

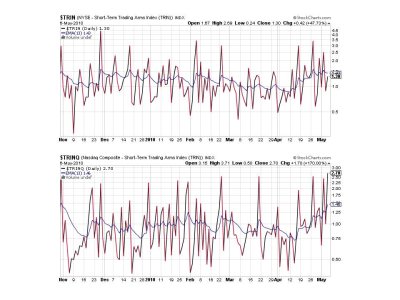

Same thing here.

TRIN managed to stay on a buy, but TRINQ didn't.

Yesterday I said BPCOMPQ looked like it was about to fall off a cliff. It did. Major red flag here unless this market reverses soon.

So we have 6 of 7 signals flashing sells, which keeps the system on a sell. What happens tomorrow after a day like today is difficult to gauge. If the fear is real it may be telling us things are about to go from bad to worse. We could bounce tomorrow, but that wouldn't make me bullish. Not if the market knows something we don't. We'll have to watch the charts for a clue. And right now they are downright ugly.

That's all for this evening, see you tomorrow.

Today was the biggest one-day decline for the S&P this year. The VIX spiked as much as 60% at one point, and the dollar gained an additional 0.9%. Of course the Euro is taking the brunt of that pain and no end appears to be in sight.

The yield on the 10-year Note fell under 3.40, which was lowest level seen so far this year. And today also saw the highest trading volume of the year on the NYSE.

The fear over a Euro meltdown is real and the market senses that it's about to get worse. At least that's my take.

Programmed trading error...get real.

I can tell you what's real though. The Seven Sentinels sell signal that was issued last Friday. If you took advantage of it, you caught the Monday rally and side-stepped some major selling pressure thereafter. And while we are oversold in a big way, that's no guarantee it's over.

Here's today's charts:

We can see the panic in these charts. Down hard.

Same thing here.

TRIN managed to stay on a buy, but TRINQ didn't.

Yesterday I said BPCOMPQ looked like it was about to fall off a cliff. It did. Major red flag here unless this market reverses soon.

So we have 6 of 7 signals flashing sells, which keeps the system on a sell. What happens tomorrow after a day like today is difficult to gauge. If the fear is real it may be telling us things are about to go from bad to worse. We could bounce tomorrow, but that wouldn't make me bullish. Not if the market knows something we don't. We'll have to watch the charts for a clue. And right now they are downright ugly.

That's all for this evening, see you tomorrow.