Yesterday I said that I didn't trust the big rally to open up the week (again). A gap up rally too. That strength led to all but one Seven Sentinel signals flipping to a buy while the lone hold out (BPCOMPQ), remained on a sell, although it came close to a buy itself. I said that the charts didn't look ready for another rally and given this was a holiday week I was concerned the big money was gaming the market in anticipation of Black Friday (and the following trading week).

I didn't know how we'd trade this week to give us that set-up, but I was leaning towards seeing more weakness as the Seven Sentinels (collectively) didn't appear ready to flip back to a buy yet.

Well, today the weakness was back, although it was only moderate and on light volume. But after yesterday's bounce, the Seven Sentinels flipped right back to a 7 of 7 sell on today's weakness. I knew I didn't like yesterday's action, and today was a kind of a vindication.

Here's the charts:

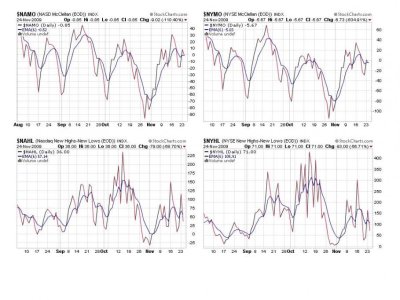

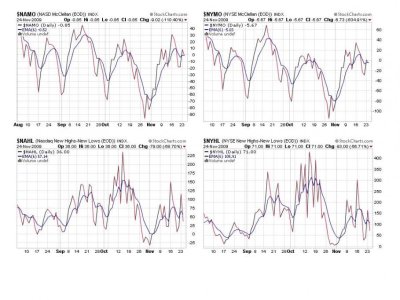

NAMO and NYMO are both sitting on their 6 day EMA here, but these two signals in particular did not move down that much after last weeks selling pressure, which led me to believe more downside pressure was in store for us shorter term. NAHL and NYHL have also flipped to sells on today's action.

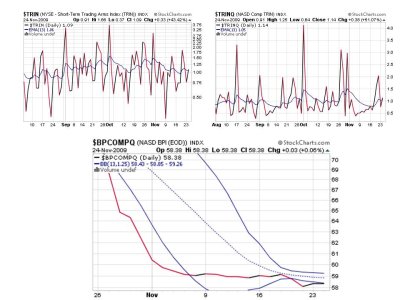

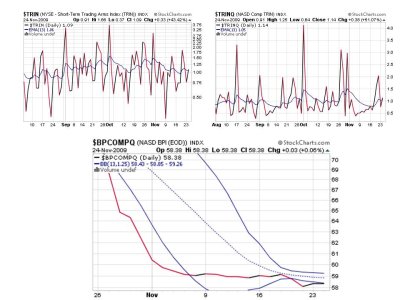

TRIN and TRINQ both flipped back to sells here, and we can see BPCOMPQ had some sideways action that is causing it to brush the lower bollinger band, but it has not actually crossed it yet.

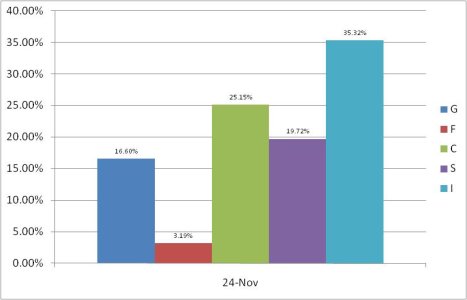

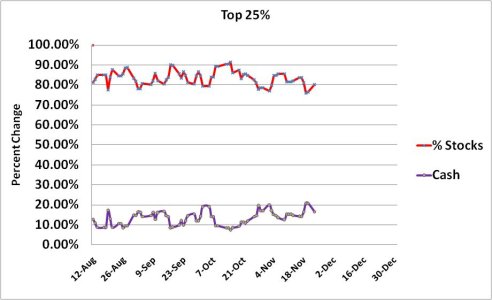

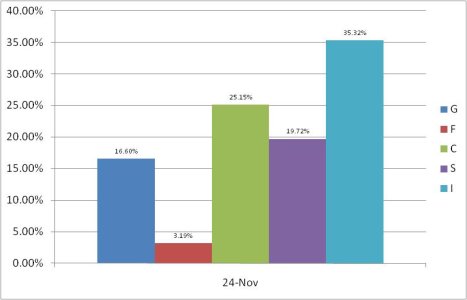

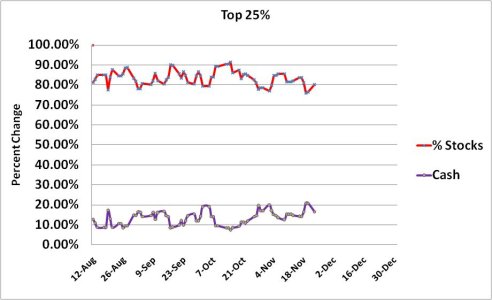

Our Top 25% put some cash back in the market on yesterday's strength, but other than that it's the same bullish position we've come to expect on a day to day trading basis.

So we remain on a sell with the Seven Sentinels system. I continue to be neutral on this market, but with a bearish bias. I am very interested to see how the market acts over the next few trading days. See you tomorrow.

I didn't know how we'd trade this week to give us that set-up, but I was leaning towards seeing more weakness as the Seven Sentinels (collectively) didn't appear ready to flip back to a buy yet.

Well, today the weakness was back, although it was only moderate and on light volume. But after yesterday's bounce, the Seven Sentinels flipped right back to a 7 of 7 sell on today's weakness. I knew I didn't like yesterday's action, and today was a kind of a vindication.

Here's the charts:

NAMO and NYMO are both sitting on their 6 day EMA here, but these two signals in particular did not move down that much after last weeks selling pressure, which led me to believe more downside pressure was in store for us shorter term. NAHL and NYHL have also flipped to sells on today's action.

TRIN and TRINQ both flipped back to sells here, and we can see BPCOMPQ had some sideways action that is causing it to brush the lower bollinger band, but it has not actually crossed it yet.

Our Top 25% put some cash back in the market on yesterday's strength, but other than that it's the same bullish position we've come to expect on a day to day trading basis.

So we remain on a sell with the Seven Sentinels system. I continue to be neutral on this market, but with a bearish bias. I am very interested to see how the market acts over the next few trading days. See you tomorrow.