DreamboatAnnie

TSP Legend

- Reaction score

- 851

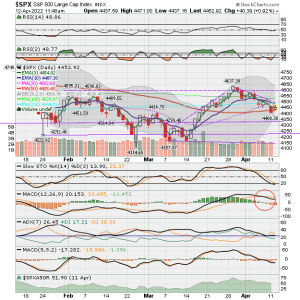

Yes, Whipsaw. I knew that eventually someone would figure out that I have been holding back. Yes, laugh if you must, but just know that this is the sad and true reason why I pace back and forth daily like a crazy cat (Epic! :cheesy . I scream and contort my body like they do in Matrix (or like Linda Blair's spinning head! ).

. I scream and contort my body like they do in Matrix (or like Linda Blair's spinning head! ).

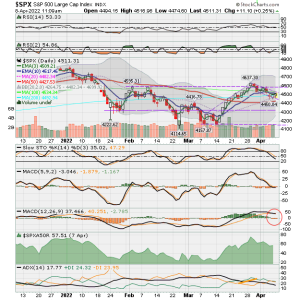

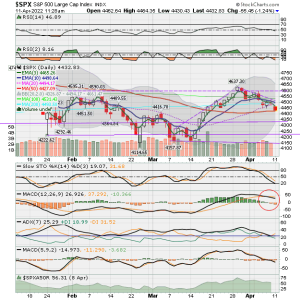

This is the reason my friend. And yes, I have become the chart and am now hopelessly lost in this matrix...quick ...hand me a lifeline! Too many indicators...too many lines...too many colors...never thought I'd say that! HELP!

This is the reason my friend. And yes, I have become the chart and am now hopelessly lost in this matrix...quick ...hand me a lifeline! Too many indicators...too many lines...too many colors...never thought I'd say that! HELP!

DBA, soon you will see the charts like Neo in the Matrix, with limits and trendlines moving in conjunction with economic projections and geo-political events, bollinger bands and moving averages all flowing like fluids across the chart in live motion... you will be... be the chart, DBA... the shortest line between two points is a straight line in the opposite direction! Na na na na na na naaaaa! :nuts: