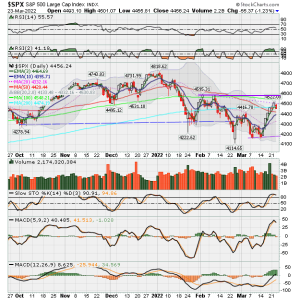

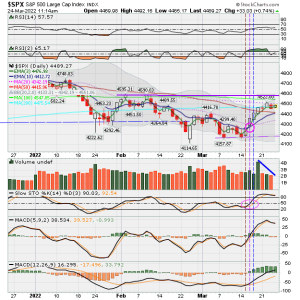

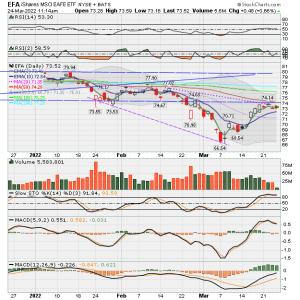

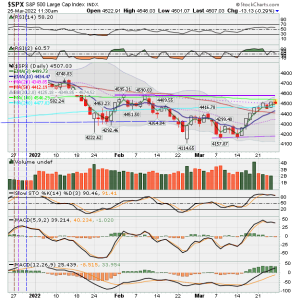

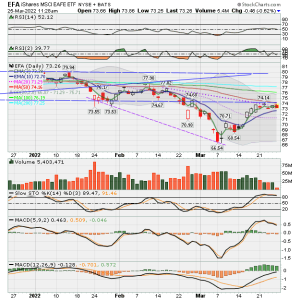

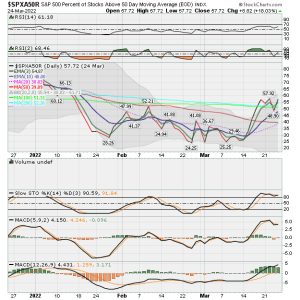

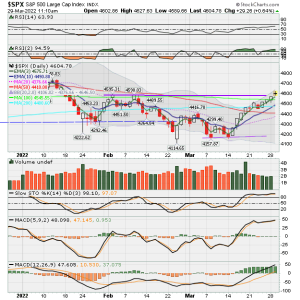

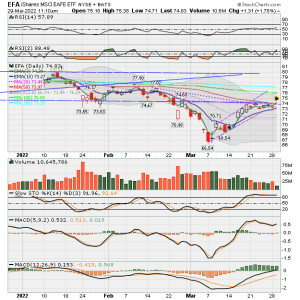

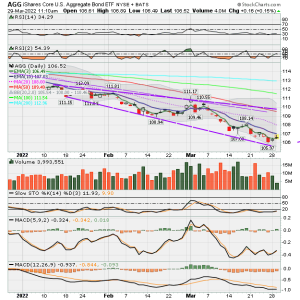

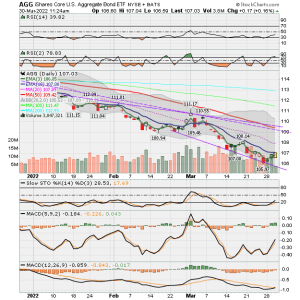

Being nimble has been tough for me. My main strategy involves getting into market AFTER Slow Stochastic drops below 20 and then starts to rise. For this last rally, it touched 20 and rose very quickly for S fund and C fund never even touched 20.

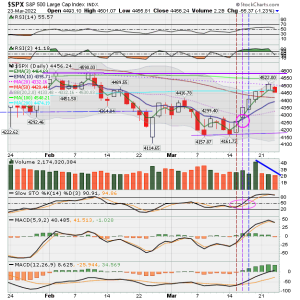

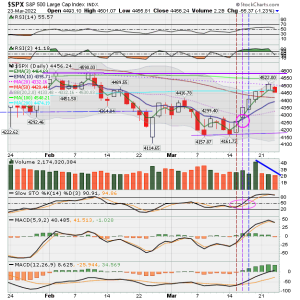

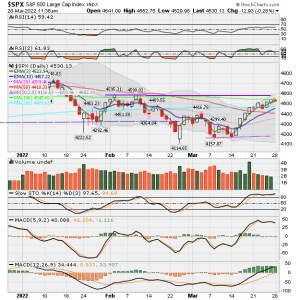

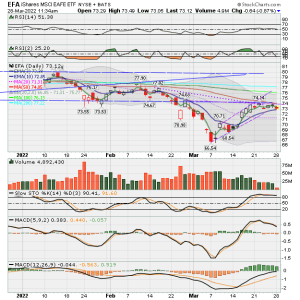

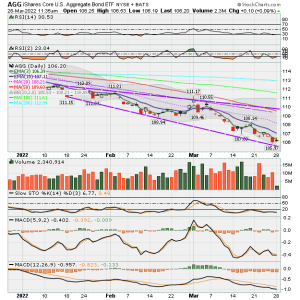

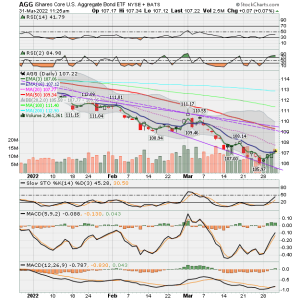

If you look at charts below, I drew in a few vertical lines to more clearly see Stochastics and MACD at start of this rally. As you can see S Fund chart, Slow Sto signal line didn't touch 20 until 3/15, then moved up on 3/16. On that day, price closed both above the 3 and 10 EMAs with gap up. So that day (3/16) or the next day (3/17 -3rd day) should have been entry. By the 4th day (3/18), Slow Sto was already hitting 80 and for me it was too late for entry.

Also, sometimes you don't see the indicator hit until COB so hindsight is always easiest to spot entry. In any case, decision had to be made quick to enter, or try an earlier entry not knowing if the knife was still dropping. I guess one could consider how much market had dropped, but with our down trend, I think it's high risky no matter what.

Not trying to give excuses but reality is that on my last entry on 2/25 (similar situation), it ended with exit on 3/1 for a bit of a loss as the rally was too short lived... So this time I was a bit gun shy...with good reason, so I missed the entry. That's okay because another drop is coming....eventually, so I am trying to stay patient! Don't want to chase it.