DBA...good luck with ur trade. Good news from Coolhand today on his interp of NAAIM numbers (post # 8257). Always nice when he swings thru for his take on things...

EJJ

Curious why you divert from ur old strategy on equities...remember Birtchtree...he would always talk about taking the emotions out of a trade.

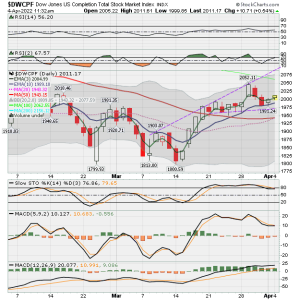

DreamboatAnnie;670088]I entered C fund 50%. Hoping this is only a small pull back and with upswing to continue in April.

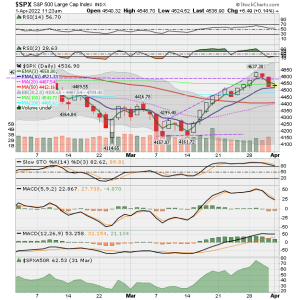

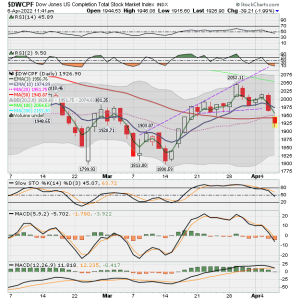

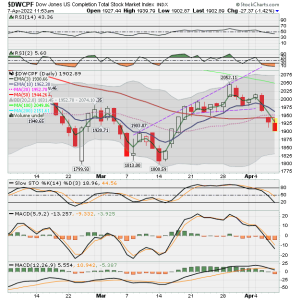

Price did get above both 100 and 200 MAs. So, looks like strength...will see... This is not a move in line with my strategy...

This is not a move in line with my strategy...

EJJ

Curious why you divert from ur old strategy on equities...remember Birtchtree...he would always talk about taking the emotions out of a trade.

DreamboatAnnie;670088]I entered C fund 50%. Hoping this is only a small pull back and with upswing to continue in April.

Price did get above both 100 and 200 MAs. So, looks like strength...will see...