-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DreamboatAnnie's Account Talk

- Thread starter DreamboatAnnie

- Start date

Tsunami

TSP Pro

- Reaction score

- 62

DBA, you mentioned the Money Flow indicator. That jogged my memory of Money Flow T's, which can be used to time both tops and bottoms. Here are videos that explain how to set the left side of a T, then the center post of the, then from that you can calculate when the top or bottom will occur. Parker Binion was the very smart sidekick of the late Terry Laundry, but went into the private investing world when Terry passed away back in 2011. Hmm, good to see he's doing well: https://www.linkedin.com/in/parkerbinion

https://www.youtube.com/watch?v=8NOUqw0aJ7w (watch this one first)

https://www.youtube.com/watch?v=u3KOFdAqstA (this one second)

https://www.youtube.com/watch?v=8NOUqw0aJ7w (this one third)

https://www.youtube.com/watch?v=IrKUxKyOGyI (more T-Theory stuff)

Looking around for a current example, I don't see an obvious one for $SPX, but for QQQ:

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=1&mn=0&dy=0&id=p68468092162

I see a potential T. If you start with the price low in one election day, 11/4/16...then use the recent Money Flow peak on 2/21/17 as the center-post...that calculates out to a peak for QQQ on around June 10th.

https://www.youtube.com/watch?v=8NOUqw0aJ7w (watch this one first)

https://www.youtube.com/watch?v=u3KOFdAqstA (this one second)

https://www.youtube.com/watch?v=8NOUqw0aJ7w (this one third)

https://www.youtube.com/watch?v=IrKUxKyOGyI (more T-Theory stuff)

Looking around for a current example, I don't see an obvious one for $SPX, but for QQQ:

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=1&mn=0&dy=0&id=p68468092162

I see a potential T. If you start with the price low in one election day, 11/4/16...then use the recent Money Flow peak on 2/21/17 as the center-post...that calculates out to a peak for QQQ on around June 10th.

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Hi. Decided to move in 25S-25C-25I. Short term/few day play. Hoping for a small bounce and then exit. Reason: On C and S funds, Slow Stochastic has gone below 20 and on one fund rising. However, this is a risky move because the EMA on one fund has 10 EMA crossed below 20EMA and in the other 10 EMA has crossed below 50 EMA.. even worse. Plus price looks like it wants to slide down further along lower Bollinger Band. But per strategy I should have entered yesterday. I missed it, but moving forward even though this is a bit scary. Hoping for a small bounce before exit. I will not stay in more than 2 days unless I see MACD/PMO or EMAs reversing course and see cross overs going upward. I expect further drop but you just never know. Positive news about Tax reform could make it jump and recover. Will see......

Best Wishes to You all on your investments!!!!!! :smile:

Best Wishes to You all on your investments!!!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Thank you Tsunami! I really appreciate the information and I will look into all of this. Just now getting into money flow. There is an indicator on Stockcharts that I am liking as you likely saw on the charts that posted. Not sure how much I will delve into it, but I do like the CMF indicator... wish I had been watching it before my last entry but glad to use it now... :smile:

DBA, you mentioned the Money Flow indicator. That jogged my memory of Money Flow T's, which can be used to time both tops and bottoms. Here are videos that explain how to set the left side of a T, then the center post of the, then from that you can calculate when the top or bottom will occur. Parker Binion was the very smart sidekick of the late Terry Laundry, but went into the private investing world when Terry passed away back in 2011. Hmm, good to see he's doing well: https://www.linkedin.com/in/parkerbinion

https://www.youtube.com/watch?v=8NOUqw0aJ7w (watch this one first)

https://www.youtube.com/watch?v=u3KOFdAqstA (this one second)

https://www.youtube.com/watch?v=8NOUqw0aJ7w (this one third)

https://www.youtube.com/watch?v=IrKUxKyOGyI (more T-Theory stuff)

Looking around for a current example, I don't see an obvious one for $SPX, but for QQQ:

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=1&mn=0&dy=0&id=p68468092162

I see a potential T. If you start with the price low in one election day, 11/4/16...then use the recent Money Flow peak on 2/21/17 as the center-post...that calculates out to a peak for QQQ on around June 10th.

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Well looking at charts to see if there was a cross over showing a strong course reversal.Hi. Decided to move in 25S-25C-25I. Short term/few day play. Hoping for a small bounce and then exit. Reason: On C and S funds, Slow Stochastic has gone below 20 and on one fund rising. However, this is a risky move because the EMA on one fund has 10 EMA crossed below 20EMA and in the other 10 EMA has crossed below 50 EMA.. even worse. Plus price looks like it wants to slide down further along lower Bollinger Band. But per strategy I should have entered yesterday. I missed it, but moving forward even though this is a bit scary. Hoping for a small bounce before exit. I will not stay in more than 2 days unless I see MACD/PMO or EMAs reversing course and see cross overs going upward. I expect further drop but you just never know. Positive news about Tax reform could make it jump and recover. Will see......

Best Wishes to You all on your investments!!!!!! :smile:

C fund - no MACD crossover and its running flat right now. Money flow is up. Slow Stochastic is around 73 or so and headed up. I would like to exit when it hits 80 unless there are cross overs indicating stronger days ahead. Price is up now .11%. 10 day EMA is dead even with 20, but intraday it is above the 20EMA.

S fund (DWCPF) - Pretty much the same as C fund except that MACD is sloped up and looks like it could cross its signal line to go positive by end of day or tomorrow. Slow Stochastic is around 75 or so and moving up. Would like to exit once it gets above 80 unless these are cross overs indicating stronger days ahead. Price is now at .20%. The 10 day EMA is still below the 20 and very slightly angled up. It is meshed with the 50... if it drops below 50 its an immediate exit signal. Intraday the 10 is above the 20 EMA... but its early in the day. No telling what happens during the last hour of the trading day.

I Fund - All EMAs still sloped up with good spread between them and 10 over 20 and 20 over 50. Price close to upper Bollinger, Slow stochastic at about 80 and MACD is starting to move horizontally (not much slope) but still positive/above its signal line. ouchy... price at <.32%> right now. Intraday 10 is trying to cross above 20, looks like it will do that since the Slow Stochastic is at about 40 and rising but money flow is down intraday (on daily it is rising). MACD is above its signal line but looks like it might start to move negative... going sideways now. Humm.....????? Political talk is the mover?

At this point, I am staying in another day. I could exit the I fund (as we have unlimited exits to G after our first 2 IFTs of the month are used up). But I am going to give it another day to see. I am mainly waiting for Slow Stochastic to hit 80 unless the outlook becomes more promising. Again, I think political talk is the primary driver. I hope there is more positive talk!!! But better be out when the music stops!

Best Wishes to Everyone on Your Investments!!!!!!!!! :smile:

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Exiting the I fund. So will be in 25S and 25C at COB today. Still positive on this trade. Still risky in equities. One more day....

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Tsunami... I watched videos. Very interesting. Not too difficult to understand and I like that it is so visual. So divergence between price and indicator marks, if there is divergence marks the T post and helps with gauging possible timeframe for topping. Nice! Videos make clear this is not always the case but just another indicator tool to consider. Thanks again... very useful information! :smile:

Best wishes to you and everyone on your Investments!!!!!!!! :smile:

Best wishes to you and everyone on your Investments!!!!!!!! :smile:

DBA, you mentioned the Money Flow indicator. That jogged my memory of Money Flow T's, which can be used to time both tops and bottoms. Here are videos that explain how to set the left side of a T, then the center post of the, then from that you can calculate when the top or bottom will occur. Parker Binion was the very smart sidekick of the late Terry Laundry, but went into the private investing world when Terry passed away back in 2011. Hmm, good to see he's doing well: https://www.linkedin.com/in/parkerbinion

https://www.youtube.com/watch?v=8NOUqw0aJ7w (watch this one first)

https://www.youtube.com/watch?v=u3KOFdAqstA (this one second)

https://www.youtube.com/watch?v=8NOUqw0aJ7w (this one third)

https://www.youtube.com/watch?v=IrKUxKyOGyI (more T-Theory stuff)

Looking around for a current example, I don't see an obvious one for $SPX, but for QQQ:

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=1&mn=0&dy=0&id=p68468092162

I see a potential T. If you start with the price low in one election day, 11/4/16...then use the recent Money Flow peak on 2/21/17 as the center-post...that calculates out to a peak for QQQ on around June 10th.

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Interesting article..Safehaven. I was surprised to read the text in the chart. This was posted Sunday about this week's activity. The article talks about fibs. But what caught my eye was that the chart narrative talks about lunar timeframes/cycles, which some folks follow. That part seems spot on so far for this week. So very curious to see how his prediction for tomorrow turns out! (click on the larger image icon to see it clearly and read the chart narrative...interesting!)

Best Wishes to Everyone on your Investments!!!!!!! :smile:

Short Term Stock Market Bottom Close | Brad Gudgeon | Safehaven.com

Best Wishes to Everyone on your Investments!!!!!!! :smile:

Short Term Stock Market Bottom Close | Brad Gudgeon | Safehaven.com

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Charts Analysis - So decided to stay in one more day. I am hoping it is an up day. I finally have time tonight to review charts in depth.

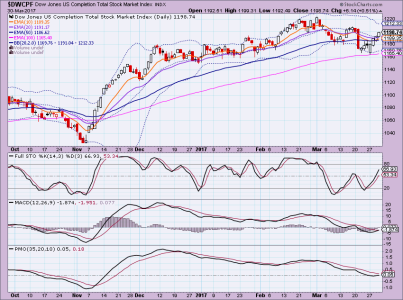

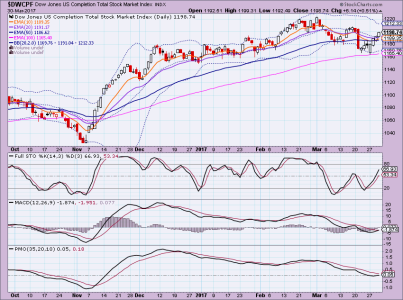

S Fund -DWCPF - Daily - 6 month

Dow Jones U.S. Completion Total Stock Market Index, XX WCPF Advanced Chart - (DJW) XX

WCPF Advanced Chart - (DJW) XX WCPF, Dow Jones U.S. Completion Total Stock Market Index Stock Price - BigCharts.com

WCPF, Dow Jones U.S. Completion Total Stock Market Index Stock Price - BigCharts.com

NOTES: What I see is lower highs and lower lows since the March 1 high. So the last time it hit below 20 on the Slow Stochastic was on 3/23-3/24 and because MACD was below its signal line, once Slow Stochastic started to rise, I considered it a weak bounce. Also, when I entered the 10 EMA was below 50. Since then and over the past few days, MACD started to move up and looks like it wants to cross up to go positive. Also, the 10 EMA has gone above the 50 heading upward and looks like it will soon go above the 20 EMA. Slow Stochastic also now gone above 80.

Normally I would want to stay in, and it very well may continue on up. But I am going to be cautious and exit tomorrow because of the lower lows and lower highls and because the Bollinger bands are wide and look like there will start to be some consolidation.

Could be a bad call, but I'm exiting tomorrow. We get new IFTs next week, so if I am wrong, I can reassess; though I will likely wait for another drop. Hopefully price is positive or doesn't drop too much so I get a positive trade. Will see.... OBVIOUSLY, If there is lots of positive information coming out about tax cuts, I should think the market will go up and I will lose out.. uggh... I'm outta here!!! :nuts: Good night!!!!

OBVIOUSLY, If there is lots of positive information coming out about tax cuts, I should think the market will go up and I will lose out.. uggh... I'm outta here!!! :nuts: Good night!!!!

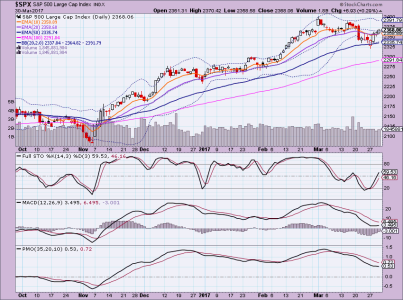

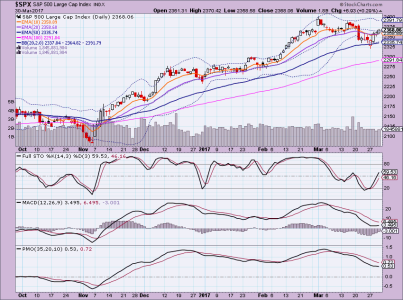

C FUND - 6 MONTH - SPX (Pretty much seeing the same thing)

S&P 500 Index, SPX Advanced Chart - (SNC) SPX, S&P 500 Index Stock Price - BigCharts.com

Best Wishes to Everyone on your Investments!!!!!!!!!!!

S Fund -DWCPF - Daily - 6 month

Dow Jones U.S. Completion Total Stock Market Index, XX

NOTES: What I see is lower highs and lower lows since the March 1 high. So the last time it hit below 20 on the Slow Stochastic was on 3/23-3/24 and because MACD was below its signal line, once Slow Stochastic started to rise, I considered it a weak bounce. Also, when I entered the 10 EMA was below 50. Since then and over the past few days, MACD started to move up and looks like it wants to cross up to go positive. Also, the 10 EMA has gone above the 50 heading upward and looks like it will soon go above the 20 EMA. Slow Stochastic also now gone above 80.

Normally I would want to stay in, and it very well may continue on up. But I am going to be cautious and exit tomorrow because of the lower lows and lower highls and because the Bollinger bands are wide and look like there will start to be some consolidation.

Could be a bad call, but I'm exiting tomorrow. We get new IFTs next week, so if I am wrong, I can reassess; though I will likely wait for another drop. Hopefully price is positive or doesn't drop too much so I get a positive trade. Will see....

C FUND - 6 MONTH - SPX (Pretty much seeing the same thing)

S&P 500 Index, SPX Advanced Chart - (SNC) SPX, S&P 500 Index Stock Price - BigCharts.com

Best Wishes to Everyone on your Investments!!!!!!!!!!!

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

So I just watched the Ira Epstein video that Nnuut posts on that thread. I was following along great but then noticed that the Slow Stochastic on the Dow and S&P are way different from the ones I have on my charts via BigCharts.com . I guess I will need to look into what settings he is using. Big Chart defaults have the levels just going above 80-90 today and on Ira's charts he has these at 42 and 53 or something like that. Hummm... maybe this is another area I should look at for possible future tweaks.

Best Wishes everyone !!!!! :smile:

Best Wishes everyone !!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Ahhh... Ira Epstein must be using settings that are closer to a Full Stochastic.

Here is S fund chart with Full Stochastic. So on these charts Stochastics not yet hitting 80. Still plan to exit. Best wishes to all!!!!!!!!! :smile:

$DWCPF - SharpCharts Workbench - StockCharts.com

Also, same thing in image.

C fund

$SPX - SharpCharts Workbench - StockCharts.com

Here is S fund chart with Full Stochastic. So on these charts Stochastics not yet hitting 80. Still plan to exit. Best wishes to all!!!!!!!!! :smile:

$DWCPF - SharpCharts Workbench - StockCharts.com

Also, same thing in image.

C fund

$SPX - SharpCharts Workbench - StockCharts.com

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

OH gosh.... Rethinking the exit. I am remembering that the last day of a quarter can often fade into the close, AFTER the cut off. So with that in mind, I am going to delay my exit until next week. As I am only in 50%, I can break the fall by investing the remaining 50% if it hits a lower point. I still believe the market is going up this year, so if I can survive the nail biting longer I should be okay.... :cheesy:

Hope you all have a great weekend! Best Wishes to you on your Investments!!!!!!!!!! :smile:

P.S. I decided to try out the 30-day free trial from Stockcharts. Nice! I like not re-creating every chart each day. Will see how it works out.

And just because.... here is a pretty oil painting by Graham Gercken, Australian painter.

Hope you all have a great weekend! Best Wishes to you on your Investments!!!!!!!!!! :smile:

P.S. I decided to try out the 30-day free trial from Stockcharts. Nice! I like not re-creating every chart each day. Will see how it works out.

And just because.... here is a pretty oil painting by Graham Gercken, Australian painter.

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Latest charts - Still looking for an exit. S fund is closing on 80 on Slow Stochastic but C fund is puttering out. Thing is MACD is going positive over its signal line on S fund so I want to stay in that fund. .. seems like S fund wants to continue up. But looked at Weekly charts and that seems to tell a different story.

I understand is likely more on Tax plan this week... could be good for market. Also few financial reports on Wednesday and Jobs on Friday. Humm......

Hoping you all had a great weekend! Best Wishes on Your Investments!!!!! :smile:

S Fund - $DWCPF - SharpCharts Workbench - StockCharts.com

View attachment 41037

C Fund - $SPX - SharpCharts Workbench - StockCharts.com

View attachment 41038

I Fund - EFA - SharpCharts Workbench - StockCharts.com

View attachment 41039

F Fund - AGG - SharpCharts Workbench - StockCharts.com

View attachment 41040

I understand is likely more on Tax plan this week... could be good for market. Also few financial reports on Wednesday and Jobs on Friday. Humm......

Hoping you all had a great weekend! Best Wishes on Your Investments!!!!! :smile:

S Fund - $DWCPF - SharpCharts Workbench - StockCharts.com

View attachment 41037

C Fund - $SPX - SharpCharts Workbench - StockCharts.com

View attachment 41038

I Fund - EFA - SharpCharts Workbench - StockCharts.com

View attachment 41039

F Fund - AGG - SharpCharts Workbench - StockCharts.com

View attachment 41040

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Hi WS, Can't say I have but that's a Great Compliment... I'll take it!!

Ugghhh.... Dow & S&P are down!!! Ouchy!!! So that means I am definitely staying in for now at 25%C and 25%S.

Hope for turnaround Tuesday.??? .. Financials Wednesday

Come on Trump... talk SWEET! Tell me what I want to hear!!!... BIG Tax Cut ...Tax Cut... Tax Cut!!!!

Best wishes to you and everyone!!!!!!!!!!! :smile:

Ugghhh.... Dow & S&P are down!!! Ouchy!!! So that means I am definitely staying in for now at 25%C and 25%S.

Hope for turnaround Tuesday.??? .. Financials Wednesday

Come on Trump... talk SWEET! Tell me what I want to hear!!!... BIG Tax Cut ...Tax Cut... Tax Cut!!!!

Best wishes to you and everyone!!!!!!!!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Well... turnaround Tuesday is okay but was hoping for more. As usual!!! :cheesy: So since we are so close to mid-point of Bollinger bands, I think I will keep my 50% in and decide on what to do with the other 50% later. If it ever gets on a roll up, will try to buy in quick.

Oh Trump where are you and why are you not talking up the market??? Hummm... was he playing golf yesterday????? Oh yes.. that is right he was meeting with the Egyptian President. Hey... but my confidence is high!!! I guess I will roll the dice and stay in another day!!!

Hope you are having a Beautiful Day and Best Wishes on Your Investments!!!!!!!!!!!! :smile:

P.S. Have you noticed how we don't care as much about the Fed? But wait... Fed minutes come out tomorrow. So, as long as it is not earth-shattering we should be good.

Oh Trump where are you and why are you not talking up the market??? Hummm... was he playing golf yesterday????? Oh yes.. that is right he was meeting with the Egyptian President. Hey... but my confidence is high!!! I guess I will roll the dice and stay in another day!!!

Hope you are having a Beautiful Day and Best Wishes on Your Investments!!!!!!!!!!!! :smile:

P.S. Have you noticed how we don't care as much about the Fed? But wait... Fed minutes come out tomorrow. So, as long as it is not earth-shattering we should be good.

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Here's a nice song! Haven't heard of Vanessa Williams in quite some time. Beautiful artist and singer!!!! :smile: