DreamboatAnnie

TSP Legend

- Reaction score

- 909

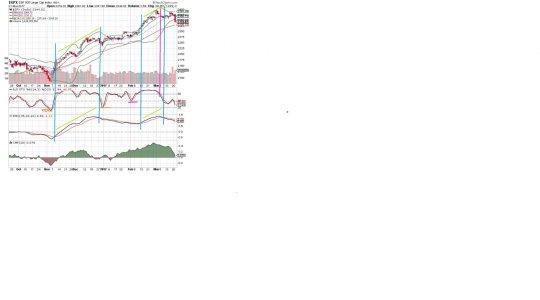

Hello! Looked at charts again...nice two days here. I really want to jump in with thought that the force is strong with Trump! Lol... But All kidding aside, the prospect of tax plan in a few weeks was loved by the market yesterday. But in looking at daily charts, the MACD is still stealthily moving like a snakes weaving above and below its signal line but in a very slight sloping down trend while price continues to move up. Is that what they call divergence??

In any case, its too rich right now and if I am going to follow my strategy I must wait for Slow Stochastic to drop below 20. What causes me to want to go against that is that maybe all we have is weak but steady upthrusts...throughout Spring (the mother of all earnings season each year)! I don't want to miss out on that. So starting to think to buy in soon and ride out any drops. I think drops are temporary and long term market is continuing to move up. Certainly, for now, the WEEKLY charts support that with EMAs lines all sloped up and MACD above its signal line. But still holding in G for now. Ughhhh.....

Best wishes to you on your Investments and Hope you have a Fun weekend!!!!!!! :smile:

In any case, its too rich right now and if I am going to follow my strategy I must wait for Slow Stochastic to drop below 20. What causes me to want to go against that is that maybe all we have is weak but steady upthrusts...throughout Spring (the mother of all earnings season each year)! I don't want to miss out on that. So starting to think to buy in soon and ride out any drops. I think drops are temporary and long term market is continuing to move up. Certainly, for now, the WEEKLY charts support that with EMAs lines all sloped up and MACD above its signal line. But still holding in G for now. Ughhhh.....

Best wishes to you on your Investments and Hope you have a Fun weekend!!!!!!! :smile: