quabit

Market Tracker

- Reaction score

- 24

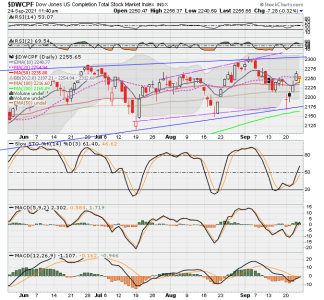

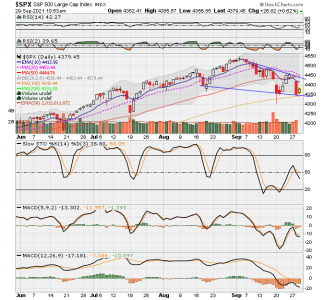

Daily charts as of a few mins ago. I am suppose to enter, albeit a day or two late but having reservations. Might just enter 40% or so.

View attachment 51143

View attachment 51146

View attachment 51144

I had a trade in on Tuesday when my chart was telling me is was about time to get in. I was thinking the Fed wouldn't disappoint but there were to many unknows going on I felt why chance it and pulled it. Anyway that is all water under the bridge now. I just wonder if this run up is a week early if so then there will be another chance to get in later in Oct early Nov if last years chart plays out the same. Plus the next Fed meeting is 2-3 Nov and all the taper talk will come back.

Seems the market used to drop fast and rise slow but that changed awhile ago and now we drop slower and rise fast making the decision harder to get in. Its like if you don't time it right you miss the big jump.

Last edited: