And that is why I'm not sure what I want to do today.....I was ready to go 100%G, even put in IFT but thinking of pulling it for the exact reason you posted. Even had my comments ready to go and mention the breakout lol. UGH September coming lol....where is that crystal ball :blink::laugh:

-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DreamboatAnnie's Account Talk

- Thread starter DreamboatAnnie

- Start date

DreamboatAnnie

TSP Legend

- Reaction score

- 887

LTJPFED, I am certain I exited too early last Thursday due to fear (Kabul) and what would happen this week plus I was going to be too busy on Friday to watch market. My exit parameters had not hit yet. Exit has always been tough...either get out too early and miss further run up, or exit too late and lose the gains.

I like to look for exit only after price hits Slow Stochastic 80. But I am now trying to decide on the exit trigger. Which is best? Signal line cross down on the DAILY chart's MACD 5,9,2 setting -OR- Signal line cross down on the HOURLY chart's MACD default setting (12,26,9) and TRIX.

Based on daily MACD5.9.2 I would have stayed in today (my current exit trigger), but watching as it looks like MACD default & TRIX are crossing down on Hourly chart today. Will be interesting to see which one wins out to provide best outcome. Humm... Of course, always working to tweak exit strategy! :smile:

Best wishes to you and Everyone*!!!

I like to look for exit only after price hits Slow Stochastic 80. But I am now trying to decide on the exit trigger. Which is best? Signal line cross down on the DAILY chart's MACD 5,9,2 setting -OR- Signal line cross down on the HOURLY chart's MACD default setting (12,26,9) and TRIX.

Based on daily MACD5.9.2 I would have stayed in today (my current exit trigger), but watching as it looks like MACD default & TRIX are crossing down on Hourly chart today. Will be interesting to see which one wins out to provide best outcome. Humm... Of course, always working to tweak exit strategy! :smile:

Best wishes to you and Everyone*!!!

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 887

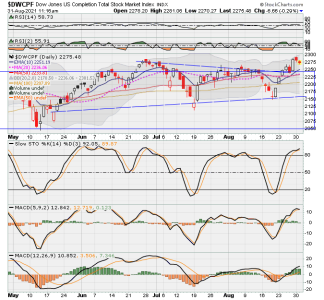

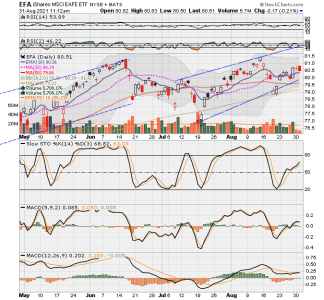

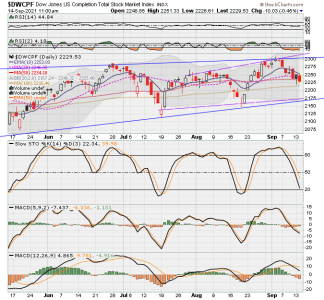

Here is the S fund COB Daily chart followed by Hourly chart. Shout out to the Blackbird! Hope your well!

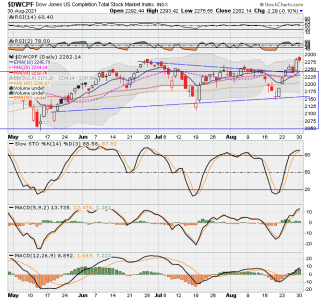

Daily S Fund (5.9.2 still up)

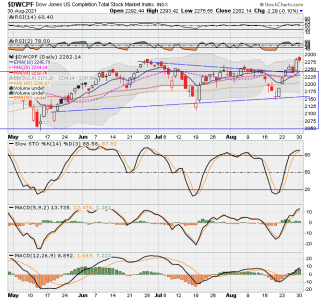

Hourly S Fund (both MACD & TRIX crossing down -remember just testing to see outcome, and only looking at it AFTER Slow Sto first reaches 80 having come up from a level below 20)

Daily S Fund (5.9.2 still up)

Hourly S Fund (both MACD & TRIX crossing down -remember just testing to see outcome, and only looking at it AFTER Slow Sto first reaches 80 having come up from a level below 20)

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

Charts...sorry but charts will be intermittent for next couple weeks.

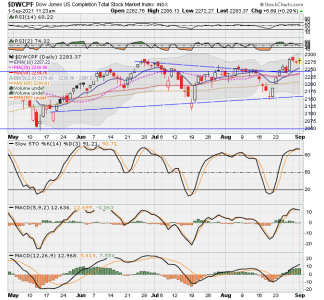

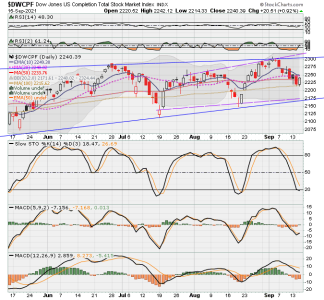

Here are charts for today as of a few mins ago.

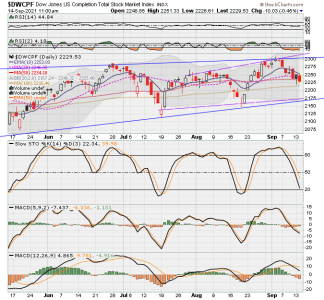

S Fund. :..MACD 5.9.2- continues to move down..

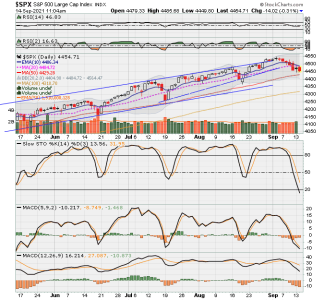

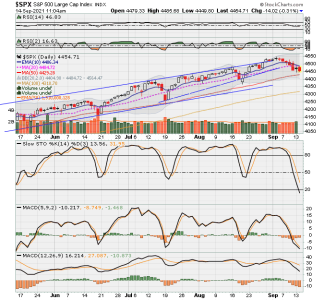

C Fund

below...This is old chart'''...discard. I tried posting C fund twice and finally saw tge download from Stockcharts did not work...twice! but its working now! :smile: ... Or maybe the user finally woke up...

but its working now! :smile: ... Or maybe the user finally woke up...

Here are charts for today as of a few mins ago.

S Fund. :..MACD 5.9.2- continues to move down..

C Fund

below...This is old chart'''...discard. I tried posting C fund twice and finally saw tge download from Stockcharts did not work...twice!

Attachments

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

Hi Flawlaw97, The price dropped in morning for C fund, but then recovered some. But, was still down when I posted charts earlier today.

MACD 5.9.2 momentum indicator is pointing down even though Slow Sto is still above 80 (embedded). It could turn around and go back up, but a little birdy whispering in my ear says its doubtful. ...would expect a little move downturn before it reloads! I will be ready as well to jump back in. I will try to stay light on my toes :dance: for rest of this year as it seems it should be time for a little correction, but who knows!

...would expect a little move downturn before it reloads! I will be ready as well to jump back in. I will try to stay light on my toes :dance: for rest of this year as it seems it should be time for a little correction, but who knows!

Best wishes to you and everyone*!!!

MACD 5.9.2 momentum indicator is pointing down even though Slow Sto is still above 80 (embedded). It could turn around and go back up, but a little birdy whispering in my ear says its doubtful.

Best wishes to you and everyone*!!!

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

DreamboatAnnie

TSP Legend

- Reaction score

- 887

Waiting for the RSi trough to turn green along with SloStochastic to start uptrending with daylight. 50MA as the resistance? Might be a little longer turn than the past three months. Thanks for the charts! Good luck to all.

Hi Flalaw97, yes..definitely agree the 50 day MA is acting as support although the intraday price did pierce the 50 day MA and got close to the 100 day. Also, looks like 10 EMA is getting closer to crossing below the 20 DMA as price continues with its recent overall down movement. Will see when it turns up. ... For now just watching..:smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 887

Good morning! Here are today's charts as of a few minutes ago.

Best wishes to you on your investments! :smile:

C Fund - Stochastic is now below 20 for possible entry, but watch ingfor MACD 5.9.2 to cross positive. will see...almost same thing for S fund, but looks like it's a few days slower as it is approaching the 20 line.

Best wishes to you on your investments! :smile:

C Fund - Stochastic is now below 20 for possible entry, but watch ingfor MACD 5.9.2 to cross positive. will see...almost same thing for S fund, but looks like it's a few days slower as it is approaching the 20 line.

DreamboatAnnie

TSP Legend

- Reaction score

- 887