DreamboatAnnie

TSP Legend

- Reaction score

- 854

Yep... 60G 40S reallocated some more to S fund.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

I believe we have seen the gains for now...maybe another day of light returns with the S fund likely to eek out tomorrow but lower highs may be in the cards for S. I do sense this Taliban problem is only going to worsen as the 8/31 date appears.Then again... Almost want to just pull some out to ensure some coin for this month...eeeeee.....:nuts:

Yep... 60G 40S reallocated some more to S fund.

I believe we have seen the gains for now...maybe another day of light returns with the S fund likely to eek out tomorrow but lower highs may be in the cards for S. I do sense this Taliban problem is only going to worsen as the 8/31 date appears.

10 yr bond will probably start to climb and not sure about inflation other than I think it will remain on the higher side. So, thinking about a move at the moment. Probably to lighten up and out on Thursday. Decisions.

Partial exit. Going 85%, 15%S (from 60/40). Taking more profit. Best wishes to you all ! :smile:

I don’t know about you, but the Lion King Rafiki quote, “It is Time” comes to mind. Exiting out since I don’t have any time to watch the markets due to yet another tropical system coming. Yikes!

Exited fully. From 15S,85G to 100%G. Best wishes to you all!

If someone is more familiar with how NAAIM is read, please feel free to correct my observations.

It is important to recognize that the NAAIM Exposure Index is not predictive in nature and is of little value in attempting to determine what the stock market will do in the future. The primary goal of most active managers is to manage the risk/reward relationship of the stock market and to stay in tune with what the market is doing at any given time.

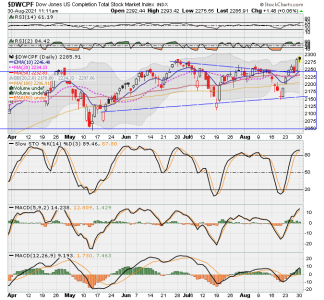

View attachment 46098

Here is a chart from the NAAIM website where they plot the NAAIM Number. I suspect that the numbers on the left side of the chart can go negative or more positive than what is shown, but that doesn't generally happen. Let's say that 60 is neutral (which it is on this chart). The further above that neutral line the number goes, the more bullish the reading. By the same token, the further lower that the number goes below the neutral line, the more bearish the reading.

For anyone reading this, don't over-analyze the reading. There is some subjectively involved. All you are trying to do is get a sense of how the smart money is positioned overall. Are they collectively bullish, bearish or somewhere in between?

My personal perspective on how I read the weekly NAAIM reading is also shaped by other data that changes week to week (not dramatically), but be aware that I have been using NAAIM for probably 10 years now and nothing takes the place of experience.