DreamboatAnnie

TSP Legend

- Reaction score

- 851

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

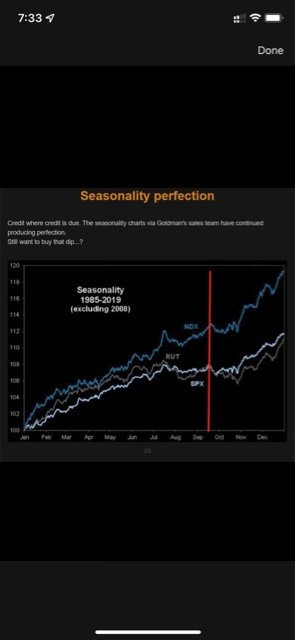

Ditto…Better safe than sorry. Until market continues to drop a couple more days and breaks SPX 4370 multiple tested support, trending remains bullish. Early September triple witching option expiration surely would add more volatility… will watch carefully for reentry next month.

Sent from my iPhone using TSP Talk Forums

I agree that this is the correction we have all been waioting for and there will be a good buy opportunity here soon, just not yet... Looking for the turn. Feel like the correction will happen over at least a few days and probably not until the end of Sept/early Oct but don't think it will happen so fast that we miss it (i.e. not all in one or two days). Good luck and eyes open for the reversal... Thanks again for the charts!

Great point RangerRay!. But GDP is definitely what I focused on. Isn't this like a 40% drop on the GDP estimate??? I didn't do the math but 6.2 down to 3.7% is material!

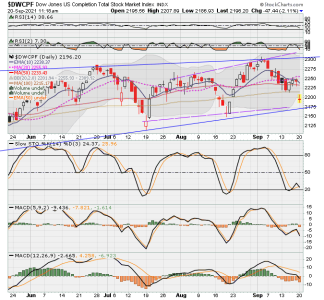

Daily charts as of a few mins ago. I am suppose to enter, albeit a day or two late but having reservations. Might just enter 40% or so.

Did you do it?