DreamboatAnnie

TSP Legend

- Reaction score

- 854

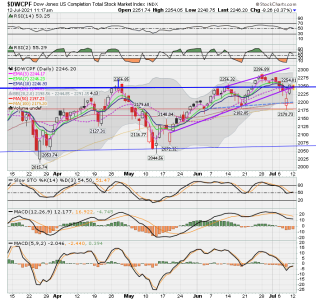

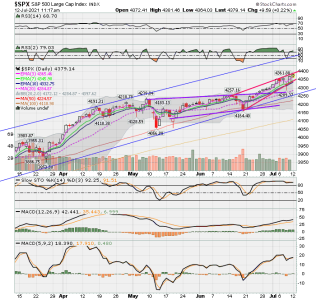

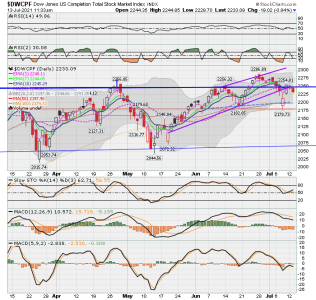

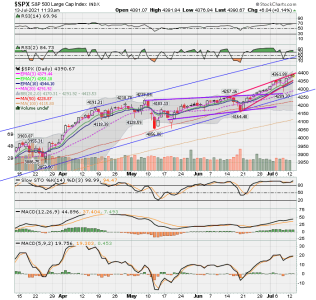

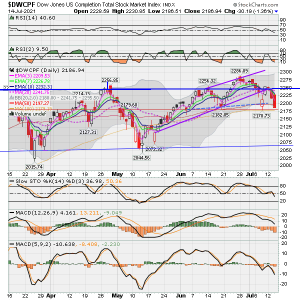

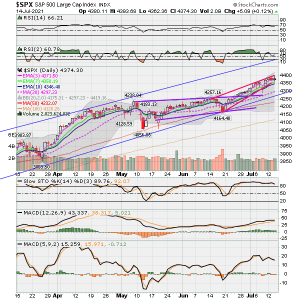

Your Welcome Flalaw! :smile: I am going to study the 20 point spread in Slow Stochastic (SloSto) for next few months just to see how it fares. If price had it up at 92 and then dropped to 72, that might not be too bad, but I would like to look at that more. RSI-2 seems to be too quick and can give lots of whipsawing, but I tend to keep eye on it. Right now its dropping on DWCPF, but the positives are that SloSto is rising and MACD histogram is rising, and price right now is above the lower blue trend line. But, if I had another IFT this month I would immediately move to C and I funds. I am preserving my two IFTs for an exit if price does rise high enough to pocket some gains (seems uncertain but earnings should be reporting this week), and have one IFT left to re-enter at a lower price point later this month. No telling how market will receive good news in earnings, plus still have Fed meeting to deal with this month.

Best wishes to all!

Best wishes to all!

Thank you for all of the detail! I think that what I was sensing was that "strength" of the trend and you are definitely right that you may experience a significant loss waiting for that much separation. I will do some more studying on the MACD and RSI - so many indicators, so little timeThanks Again, good luck!