DreamboatAnnie

TSP Legend

- Reaction score

- 854

I am exiting S and I funds. Still debating on C fund...:notrust: The lab created virus continues to strike the entire World and there is too much fear in the markets.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

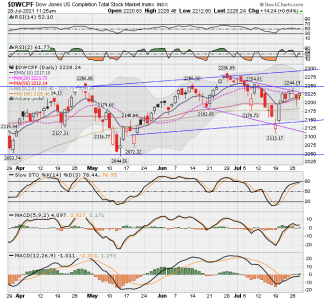

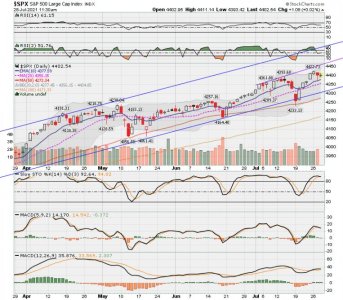

Your four month charts all look good. All trending within their channels, no need for alarm.