Hi Flalaw, You raise some very good questions and observations on Slow Stochastic! :smile:

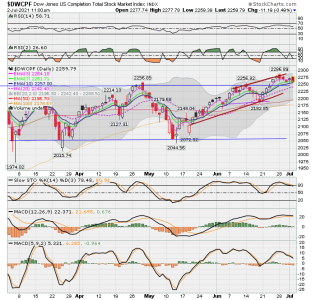

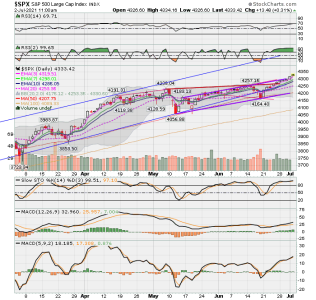

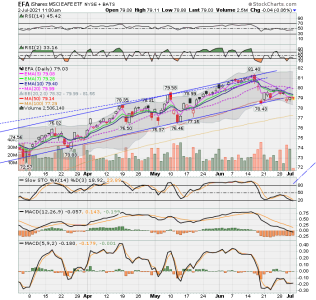

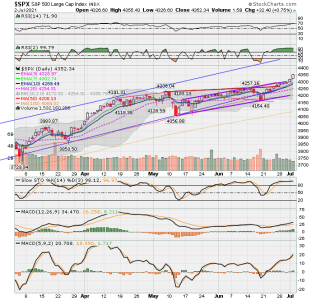

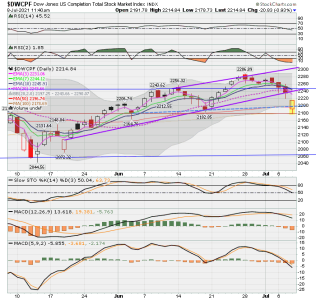

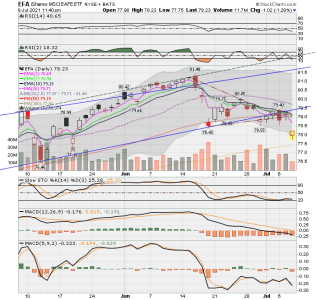

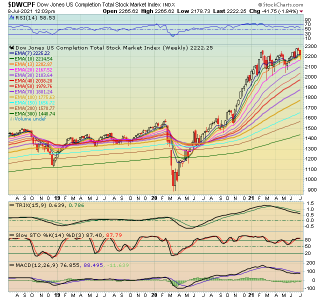

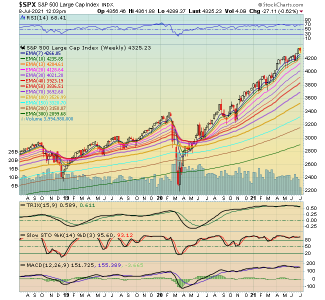

I always consider Slow Stochastic for entry/exit as part of review of indicators, candles and trendlines and the markets overall trend. I do place a good amount of confidence in Slow Stochastic momentum indicator for my decisions but I also use EMAs and trendlines heavily. It is probably my favorite indicator.

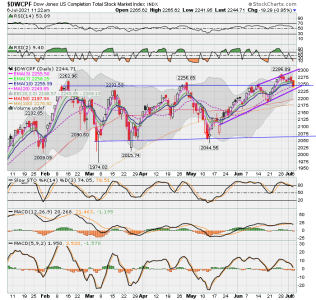

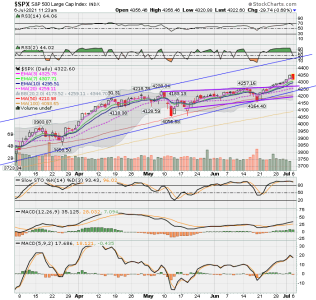

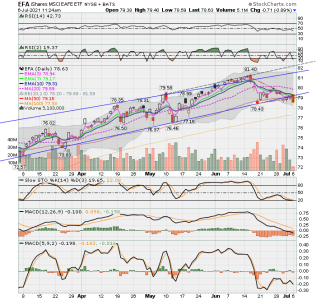

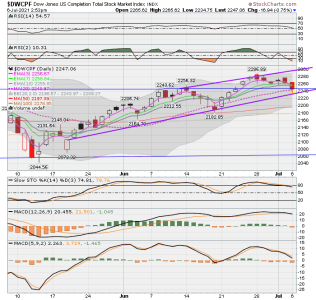

A good amount of "daylight" does occur when momentum is strong in either direction. If I use it for entry, after considering trends and EMAs, etc, I like to enter after it has dropped below 20 and is rising. I also like to see MACD (default setting=12, 26, 9) rise above its signal line within 3 days of the Stochastics signal line (%J, 14) rise above 20.. To me this confirms the short-term uptrend. Also, the severity of the Slope for both confirms the strength of the upswing. If MACD does not follow and cross its signal line upward that indicates to me that it could be failed or more likely a weak short uptrend. Also, if Slow Stochastic drops from above 80but does not reach 20 before it reverses and starts going back up, that also seems to indicate the new upswing is a bit weak.

Also, notice how price typically closes below 5 EMA when price is going to drop further. Also, price starts to pull away from upper Bollinger band and meander sideways for a bit. Also RSI 2 (faster than 14 default) often shows a down trend before Slow Sto drops below 80. I tend to think that if one waits to exit when the Stochastics %K line (14) and %D line (3) has a difference of 20, one could experience a fairly large loss. The two lines will not move at same rate due to mathematical formula behind how each line is computed.

See the differences between early November to December 2020 versus Feb-April 2021. Click Link for clearer view of wide chart. Notice how when price drops near end of December, RSI 2 was the best indicator (drops below 70) by a day or so faster than the other momentum indicators. Best Wishes to you and everyone* !! :smile:

CLICK LINK

https://schrts.co/ziMxvIJb