I just looked at Friday's COB charts and weeklies. Well.. Here is my take. Best Wishes!

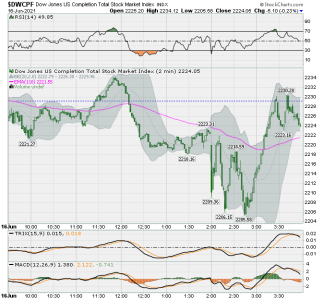

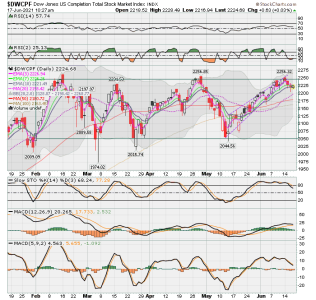

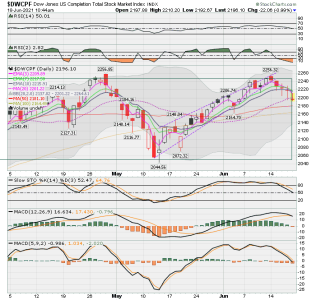

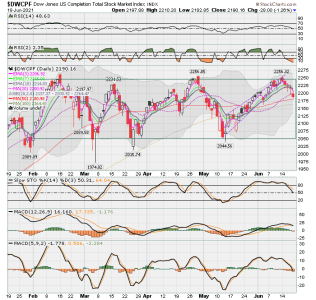

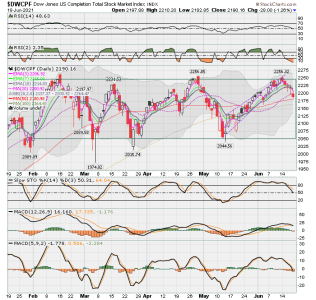

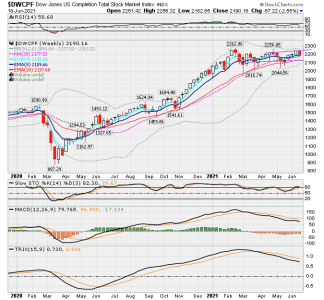

S Fund – Finished with -1.26% drop. Still within a midterm Trading range that started in February. It touched the 50 day EMA intraday on Friday, but still above it at 2190.16. If it breaks down from here, next support is 100 day at 2164.43…roughly 25 points. Slow Stochastic is now at 50.31 and RSI 14 is now below 50 at 48.63, and default MACD is just now crossing below its signal line, and so I suspect market will go lower. I noticed that IWM (Russell 2000) did drop 2.27% on Friday with high volume. So, that shows some conviction. BUT when I look at weekly chart, I notice it is going into a pipe (tightened Bollinger Bands). So, while I do believe price will drop some more, probably bringing the Slow stochastic below 20. I think I would like to see those weekly bands expand and for price to show direction before entry. Will see….

Daily

Weekly

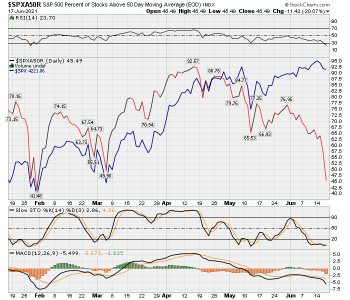

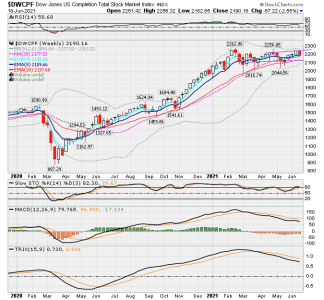

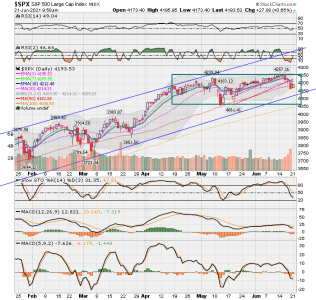

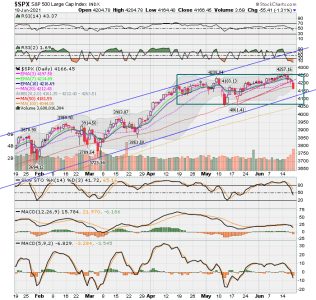

C Fund – dropped -1.31% on Friday, fell through its 50day EMA and almost touched the lower Bollinger Band. This happened on high volume, so seems likely this could continue down a bit longer. RSI, MACD default and Slow Stochastic also down. On Weekly chart, I noticed that price action this past week fell below a longer term trendline and rising wedge that goes back to March 2020. That is bearish. Also, noticed that during the past seven weekly price actions, this weekly chart has now formed a lower high and very slight lower low (bearish).

Daily

Weekly

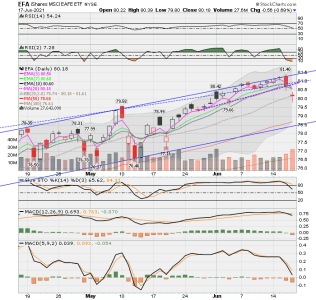

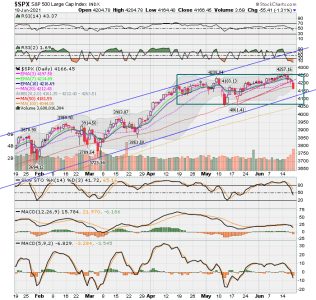

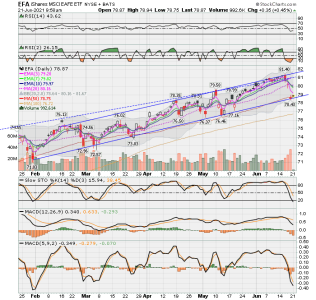

I Fund - On daily chart, price dropped 1.91%, but not on high volume and held at bottom longer term trendline, so that’s good. But indicators for RSI, Slow Stochastic and MACD default all dropping….With Slow Stochastic at 34.67. Maybe it goes down more too. On Weekly chart, its clear tge fund lost four weeks of gains. This past loss was on fairly high volume, so its showing some conviction, but it is not below mid-point of Bollinger Bands. It will be interesting to see how this week goes. It has not yet made a lower low. So, seems neutral for short-term.

Daily

Weekly