-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DreamboatAnnie's Account Talk

- Thread starter DreamboatAnnie

- Start date

DreamboatAnnie

TSP Legend

- Reaction score

- 855

I tend to think it could go up more before hitting resistance. Not sure on move just yet...but leaning to move in...maybe tomorrow.

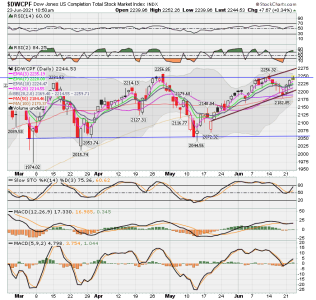

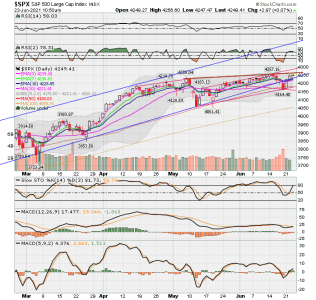

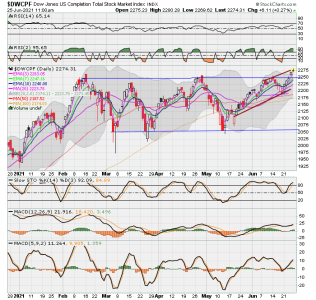

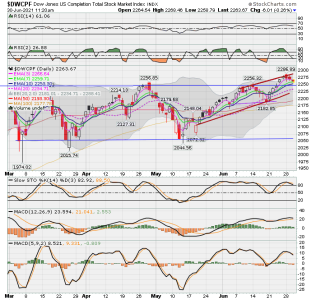

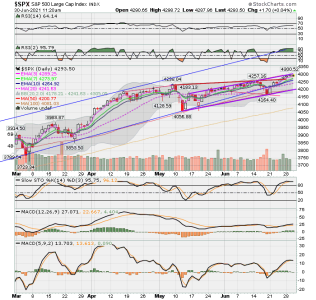

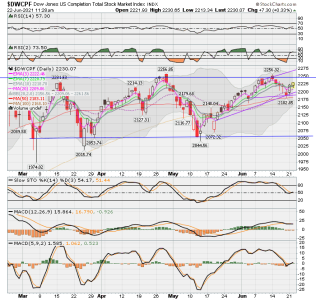

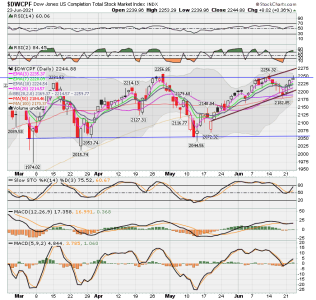

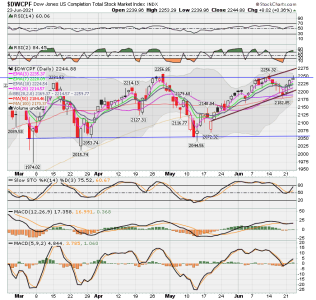

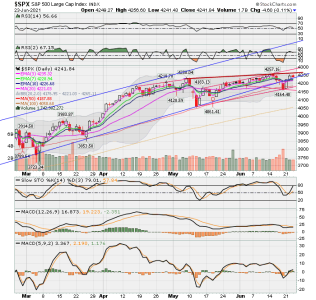

C Fund did fall below longer term trend line (blue) but popped back above it. Both C and S fund are above 3,7, 10, 20 MAs...good!

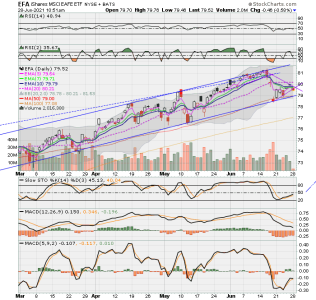

Here are charts with some new lines.

Best wishes!

C Fund did fall below longer term trend line (blue) but popped back above it. Both C and S fund are above 3,7, 10, 20 MAs...good!

Here are charts with some new lines.

Best wishes!

DreamboatAnnie

TSP Legend

- Reaction score

- 855

VIX and 10- year yield ($TNX) down a bit and Tran ($TRAN) and momentum($MTUM) going up and UUP dollar slightly up at this point in the day.

I noticed RSP, equal weight S and P, is struggling to capture it's 50 day MA. IWM also hitting a descending line of resistance that started last week. I think SPX and the Q's are being held up by just a handful of big tech companies. That's not enough to entice me to jump back in. I think I may wait til both SPX and DWCPF have cleared that long term sideways channel they've been in since the spring.

DreamboatAnnie

TSP Legend

- Reaction score

- 855

Hi Retread, I tend to see that as well... Its a hard decision based on roller coaster its been on for months now. I would be happy to catch one more little upswing this month. :smile:

I'll need to take look at RSP. Thanks!:smile: And Best wishes to you and everyone!

PS. As an extra view, I usually look at SPY (tradable EFT) that tracks SPX and IWM, but I am definitely going to check RSP (equal weight S&P) tonight.

I'll need to take look at RSP. Thanks!:smile: And Best wishes to you and everyone!

PS. As an extra view, I usually look at SPY (tradable EFT) that tracks SPX and IWM, but I am definitely going to check RSP (equal weight S&P) tonight.

DreamboatAnnie

TSP Legend

- Reaction score

- 855

DreamboatAnnie

TSP Legend

- Reaction score

- 855

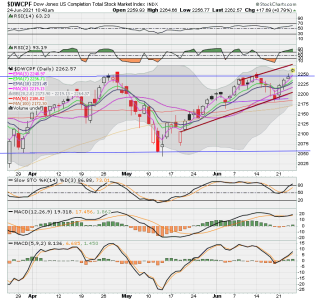

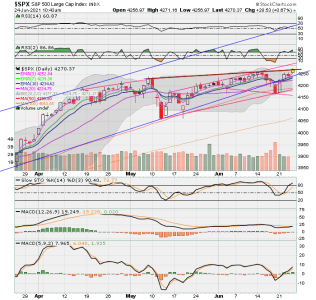

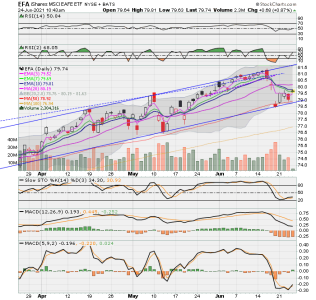

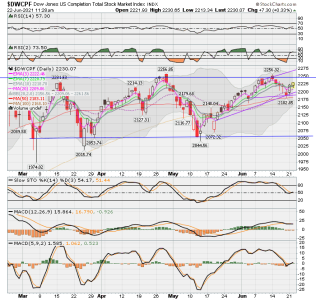

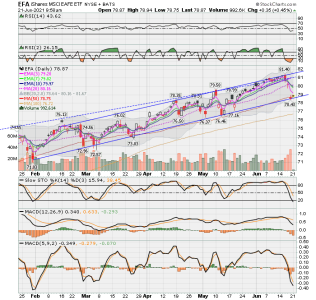

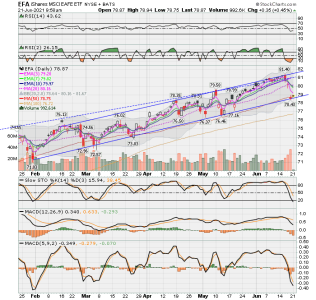

Here is how it closed, but doesn't look much different from this morning.. Oh well.... Nothing broke through any upper trendline. This roller coaster is driving me CRAZY, but Definitely feel like I missed the entry....it was a quick one. It is now back where it was 7-8 days ago for S and C fund... But, the I fund has not yet popped back.  On I fund, Slow Stochastic is starting to turn up but others still not changing direction.

On I fund, Slow Stochastic is starting to turn up but others still not changing direction.

After that miss, I think I'll go sulk and watch a ShowTime series! Hummm... Only 5 days left in June. Will see what happens....futures are up a little right now...

After that miss, I think I'll go sulk and watch a ShowTime series! Hummm... Only 5 days left in June. Will see what happens....futures are up a little right now...

DreamboatAnnie

TSP Legend

- Reaction score

- 855

DreamboatAnnie

TSP Legend

- Reaction score

- 855

Here is broader view of S fund. It will probably come back to test its new support line.

View attachment 49691

View attachment 49691

DreamboatAnnie

TSP Legend

- Reaction score

- 855

No entry

- Reaction score

- 2,505

Here is broader view of S fund. It will probably come back to test its new support line.

View attachment 49691

It doesn't look like this attachment worked. :scratchchin:

DreamboatAnnie

TSP Legend

- Reaction score

- 855

DreamboatAnnie

TSP Legend

- Reaction score

- 855

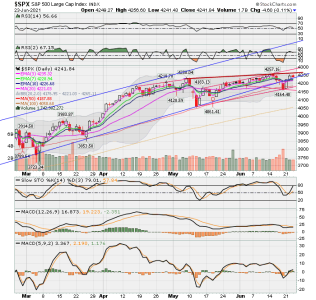

Market continues to rise, C fund making all time high. Looked neutral earlier but looking good now. Will see how things go on Monday.

Wishing you all a Great Weekend!

Wishing you all a Great Weekend!

DreamboatAnnie

TSP Legend

- Reaction score

- 855

DreamboatAnnie

TSP Legend

- Reaction score

- 855

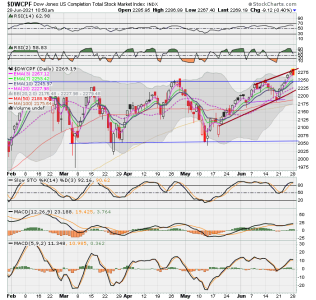

Here are WEEKLY charts for broader perspective. I will be out most of this week, so posting may be very sporadic if at all.

Hitting resistance, narrowed Bollinger Bands. Negative divergence with MACD. Hummm...???

Lower trend line is now resistance. Negative divergence with MACD in June. But looks to be continuing its chug uphill.

I fund just moving sideways a bit now... Ughh..Does look like it will move down per the indicators.

Hitting resistance, narrowed Bollinger Bands. Negative divergence with MACD. Hummm...???

Lower trend line is now resistance. Negative divergence with MACD in June. But looks to be continuing its chug uphill.

I fund just moving sideways a bit now... Ughh..Does look like it will move down per the indicators.

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 855

DreamboatAnnie

TSP Legend

- Reaction score

- 855

I entered 100% S fund a bit ago. I expect price to drop to test the new support line and then move up from there. Not wanting to waste IFT by waiting so jumped in a bit early. Best wishes to you all ! :smile: PS. yes I know, asking Tom to correct AT to S fund. But do have that correct with TSP.

DreamboatAnnie

TSP Legend

- Reaction score

- 855

Oh if it breaks through support at around 2248-2249, I would consider exit depending on how much it broke that support. Then the next line of support below that would be around 2228 (dark red line, when extended out)