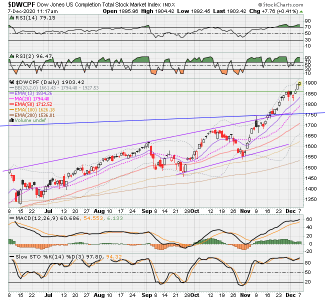

I agree too. have to sit on my hands to wait; but, am waiting for a good entry point.

as for stimulus talks... last news conference sounded positive on a relief package; but, Pelosi seemed to be saying it would be passed with a budget. I think most agencies are planning for another continuing resolution not a budget - not till after the inauguration. that means any relief package will have to be a separate budget item, and there is no news about that yet. so, I think even though the market is still in an up trend, many of the positive moves are not supported and we will get our pull back before continuing on. quabit - I have to laugh - I've done the same thing too many times in the past, thought I was jumping in before missing the boat only to get hit with the wave.

have to remind myself don't get greedy, there is always going to be a good entry point. if we've missed this one, we can catch the next.

good luck to all who are gaining, hope you continue to make bank.