Hi Shitepoke!

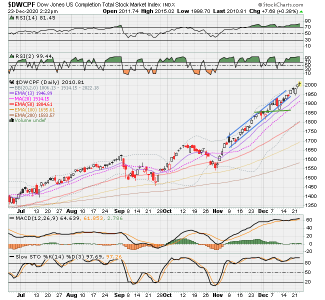

The Stochastics is an indicator that captures the momentum of the market by looking at the market's current price in relation to recent highs and lows taken over a period of time (set as 14 as a default setting, but you can change that). The formula is fairly simple, but why calculate it when you can just add it in to a chart as it is widely available in most charting softwares including StockCharts. I love it and include it in all of my charts along with MACD momentum oscillator and RSI. The Stochastic indicator is made up of two lines, just like MACD.

When Stochastic’s %K line (i.e. normally black or green) is at 70 or above, it indicates that the stock/market is overbought (price level is high, and a possible sell point). If the %K line is at or below 30 this indicates the stock/market is oversold (price level is low, and a possible buy point). I use 80 and 20 in my trading strategy based on my own review of many charts going back many years, and the views of other trader's strategies that I have read over the years.

I have observed that it seems that when %K line (black/green) drops below 20 and then crosses back up (prices going up), these tend to be good entry points at least until Stochastic reaches 80, and provided that the up thrust looks strong (steep quick slope up). Sometimes if not sure, I wait to see if (2nd indicator) MACD crosses up over its signal line as confirmation to the Stochastics indicator. Sometimes I look for other indications of a bottom, like large green candles, etc.

But using Stochastics alone is not 100% accurate at all times to indicate direction. Sometimes there are double dips/drops or whipsaws, or sometimes when it reaches below 20, price can continue downward. So, one must use other indicators like candles and moving averages and divergences to decide on entry. For my own strategy, I like to see the MACD indicator cross up and over its own signal line (red line) as well. But typically, by the time this happens, price could have already gone up quite a bit (may be even reaching the 80 line on the Stochastic), but based on the slope of the increase (strong up thrust), I will enter. Sometimes I take larger risk and go ahead and enter even if MACD has not yet crossed upward above its signal line, if MACD is sloping upward.

Traders use a wide variety of indicators with various settings based on what they have learned and observed, and they typically share those strategies on the internet. I have studied and read a lot of articles and I most like those strategies that include using Stochastic and MACD cross overs in conjunction.

Here are a few articles that you might like to read to learn more.

https://www.investopedia.com/articles/technical/073001.asp

https://www.sentimentrader.com/blog/stochastic-indicator-everything-you-need-to-know/

https://www.dailyfx.com/education/moving-average-convergence-divergence/macd-vs-stochastic.html

The information out there is vast. If you want to learn more about using indicators for investing, I suggest taking your time to dig into one indicator and then move on, but limit to using just a few that make the most sense to you. It can easily become overwhelming. Also, Indicators cannot predict the future (and no one can)!!! The market is largely driven by sentiment and Government intervention, more than fundamentals or so it seems to me. So apart from momentum indicators, I do believe in observing moving averages, drawing trendlines, and studying daily candles and market volume and looking for divergences between price and indicators. Heck, I did great for many years by just buy and holding for more than 20 years. The advantage of doing that is that you are not stressed and don't need to spend time looking at it. If you can invest and forget it, and I really mean forget it, that can work well and it did for me. but in 2013, I went in the opposite direction and really started doing a daily review... I am now trying to find a middle ground... not buy and hold but not daily management. Still trying to figure out how I can fagetaboutit for a week or two at a time... still have not had success in developing a strategy I am comfortable with. Hope I get it down for 2021!!!! :smile:

Best Wishes to You!! :smile: