DreamboatAnnie

TSP Legend

- Reaction score

- 851

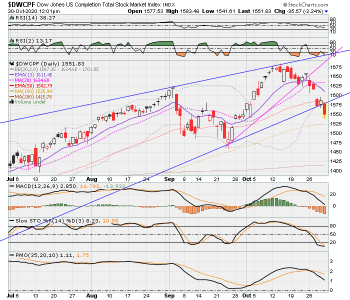

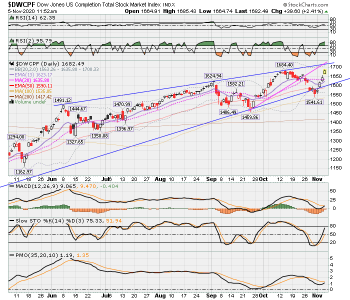

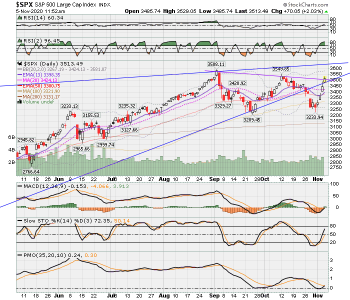

Here are charts as of a few minutes ago. Price in S Fund is just barely holding into tge longer term trend line and hugging tge bottom Bollinger band. I have taken the full drop at 35%... but if it breaks that long term line, I WILL exit....ughhh... I know that Long-Term it will eventually go back up, but gotta think about this more this morning....still contemplating exit....lol...my luck is I hit the door at the bottom!