DreamboatAnnie

TSP Legend

- Reaction score

- 854

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Exited to G fund

Is it wrong that I am secretly rooting for Sparky714 to reach 100% gain in the tracker. I hope I not jinxing him/her but I find it so fascinating that I check it everyday like rooting for some underdog to make it to the World series.

DB

So when you make these moves; is it just interfund transfersor also account distribution or some combination depending…?

Is it wrong that I am secretly rooting for Sparky714 to reach 100% gain in the tracker. I hope I not jinxing him/her but I find it so fascinating that I check it everyday like rooting for some underdog to make it to the World series.

Nothing wrong with that. We should all be rooting for each other to make as much money as possible!

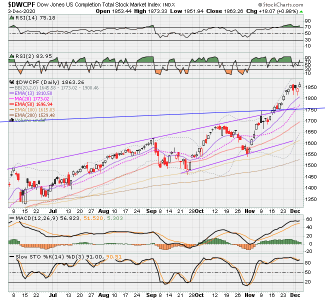

When does the Santa rally usually start

DB

Thank you. (not that you need me to) but, I concur with your sentiment up to the end of the year. my concern going into next year is the disfunction of congress to get a budget and/or relief package passed - and other things mentioned below. I did see the seasonal chart. I also have a chart from a few years ago (can't recall where I got it now - one of the other threads here) - i'll post it below. it agrees with the seasonal chart in that best time to get back in during December is later mid-month. however, I was only thinking of taking advantage of the seasonal rally and then do a wait an see till around February. so, many financial events will happen or come due in Jan/earl Feb time that may have an impact on markets. You have commercial insurance renewals, commercial real-estate loans due or renewing, traditional start of private real-estate market, jobless numbers, another quarter, etc. I'd like to see the direction the market wants to go after that before jumping back in full time. maybe unfounded, but I feel like there is this big drop looming and I don't want to get caught in it.

sorry this wasn't short. my totally uneducated thoughts.

BTW - learning a lot from your thread and the other threads you mention. many, many thanks to you and good luck to us all!