DreamboatAnnie

TSP Legend

- Reaction score

- 854

Decision made. Pocketing some gains ...dropped I fund and just keeping 15S fund.

Best wishes to you all! :smile:

Best wishes to you all! :smile:

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Well Todd.. lower prices are what we got. I'm still in at just 15%, and so far I plan to leave it unless it breaks out to downside.

Best wishes to you!:smile:

Here are the remaining charts... same exact settings as 6 month. These are for 4 month daily and 12 month daily.

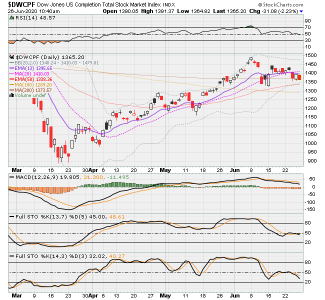

New Strategy is to enter and exit using 13 EMA and 20 SMA crossovers, but STILL considering the Full Stochastics especially when MACD is starting to flat line and Stochastics drops below its signal line to go below 80, after the uptrend is starting to get a bit long winded. Note: I do consider the 13 EMA going below the 50 SMA to be an absolute Stop/Exit when market has been in an uptrend.

Best wishes to you all!!!

4 Month Daily Charts

S Fund (DWCPF)

$DWCPF | SharpChart | StockCharts.com

C fund (SPX)

$SPX | SharpChart | StockCharts.com

I fund (EFA)

EFA | SharpChart | StockCharts.com

F Fund (AGG)

AGG | SharpChart | StockCharts.com

12 Month Daily Charts

S Fund (DWCPF)

$DWCPF | SharpChart | StockCharts.com

C fund (SPX)

http://schrts.co/jHkFNMwG

I fund (EFA)

http://schrts.co/FtcNsXWi

F Fund (AGG)

http://schrts.co/vCnKFwDt