My new strategy: (Thought twice about posting my “secret” strategy.. but I figure if Double Tree can post their Secret Awesome Cookie Recipe… which I tried a few days ago, I can post my new Strategy…plus I’m pretty sure you’d be crazy to follow it considering my history…lol)

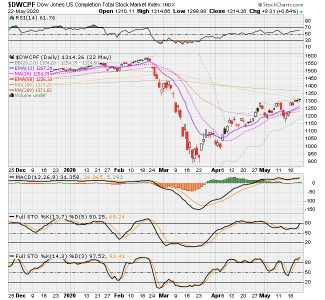

Rule #1: Enter when 13-day Exponential Moving Average (EMA) crosses above 20-day Simple Moving Average (SMA)-same as Bollinger Band mid-point and Exit when opposite occurs. I Should review MACD and Stochastics (20 and 80) for possible earlier or later entry/exits and review of candle patterns and major resistance and support and watch for early exits when 20 EMA or 50 SMA are sloped down. But, the 13/20 crossovers should be my primary indicator.

Rule #2 – If market is dropping, at minimum, must “Stop” and Exit when 13 EMA drops below 50 SMA to limit losses. You should have already exited if you followed Rule #1 so this is the “Special Rule” for DBA when she insists on being a “Meathead”! :blink:

Rule #3 – If market has dropped enough intraday to likely cause you to go negative

for year, y

ou must Exit! Don’t be stubborn DBA! Yes, I do talk to myself all the time…don’t care ...I’m now old enough to claim senility!

GET OUT!

Note: Rule #2&3 are to ensure that losses are kept to a minimum….no riding major drops down (like I did in December 2018...too hard to make up)! This strategy is based on reviewing charts for last few years and crashes of 1987, 2000-2001, 2008-2009, and 2020. I know it’s not perfect but it’s not too bad ---at least from what I am seeing.

Please do not take this as trading advice! This is just me thinking out loud and I'm definitely not a trader-expert, etc. But I do welcome comments on strategy with one exception: I already know some of you think there are too many lines on my charts, but I like that …plus all the purdy colors!

Hey…I need something to stare at and ponder each night before I go to sleep!!!

Just for the record, I want a strategy that makes me some money, gets me out early enough to minimize losses during large drops, allows me to be invested longer without using a buy and hold strategy, and is something fairly SIMPLE. So, in short, I want it ALL!!!! Lol…. But then again who doesn’t?

Now the hard part, when do I enter given that 13 is above 20??? Thinking to jump off my Lilly pad… does the water look okay out there?

That wouldn't make sense but how would it be to be making interest, instead of paying it, on a six figure mortgage? There's a lot of people who would refinance and take out some cash to spend... and get interest for doing it.

That wouldn't make sense but how would it be to be making interest, instead of paying it, on a six figure mortgage? There's a lot of people who would refinance and take out some cash to spend... and get interest for doing it.