Sure things will/may open up eventually. Probably why the markets continue to move higher. The hopes. I get it and I agree that is hopeful for getting the economy back and running. However what about the social distancing that will be done everywhere? Let's be hypothetical here and say most people will abide by the rules and do what they should be doing. The customers will not be coming out for a while. My opinion is people will continue to stay home for a while.

Businesses will still lose profits. Every company from the local coffee shops to college campuses, from the Walmarts of the world to Ma and Pa hardware store, will be impacted by this, and have been. Money will continue to be lost, granted maybe not as bad as it would be if they stayed closed, but how long can some stay afloat? More layoffs, more companies going under. So you will have more online orders, think of Amazon, even your locals stores, grocery and otherwise that will take online orders. But not all businesses will be able to do this. Some businesses require foot traffic to make money. My friends own a coffee shop. Most likely they will lose money and eventually, if things don't revert back to more of the "norm", have to close. Some restaurants have carry out now through this. I imagine they might make a little more once they open but how is that going to work? We go to restaurants and have social distancing but when it comes time to eat or drink do you take your masks off? Dumb question right. Less staff required to keep open the restaurant. More layoffs.

So what happens in the next few quarters? Yes numbers might get better economically. People will be working more and some people will get out and test the waters. Some will take trips, go to a sporting event or concert, or maybe even an amusement park. But what will the landscape look like for those events? How many people will be reasonable? Everyone still maintain social distancing? Will companies have a full staff or will they only have half their staff working because now instead of allowing 50,000 people they can only allow 5,000 people in their park or event. More job losses because that business needs less staff.

I was on a conference call earlier today about our potential opening up. It is going to be a long process. I cannot even list everything they are going to be doing before they even begin to start letting staff back into their offices. Even then some people will be still teleworking for a while if not the rest of this year. This thing has definitely changed the landscape more than what some people think. It sounded like our people are trying to cover as much as possible to get staff back that need to be and a more "normal" work atmosphere. Conference rooms gone, they are turning them into potential offices due to spacing desks out more. They will be moving things around so you will have less people in office spaces. Shared spaces will be changed forever. I hope other businesses are thinking of all the things they need to do to re-open instead of just blindly opening their businesses.

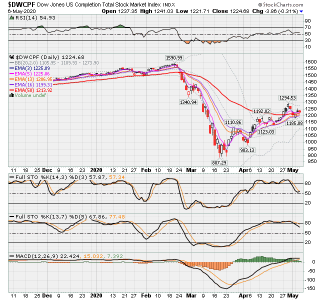

Market wise I'm still waiting on those pull backs. I missed out on these moves higher so been sitting in G.

Best of luck to everyone and really do hope we all get back to some sort of normal soon but I'm skeptical of the future being as great as some may think. Between the potentials of the virus still kicking ass and the economy not as strong as people will think once we "reopen" I just think it's going to take a while for us to recover. I hope I'm wrong.

Yep, even the F fund is down .10%. Looks like market is starting to move a bit higher...not losing as much as it did at open. still.....ugghhh...its still a crap sandwich! What is it that one trader always say??? Rule #1, The market is always right! Something about Rule #2, if you disagree, see rule #1... eeeeeeee…. yep, gotta stay humble....