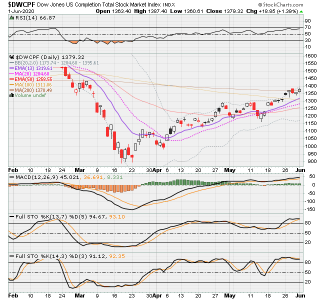

So what I see is this...Sideways trading channel from about mid July to late November (dark blue trend lines). Today's action dropped it down to the bottom of lows we had in August and October last year. That acted as support today. Also, there was some support from the PINK 20 SMA (mid-point) of Bollinger Band. But if it breaks that blue line, the next line of support would likely be at the 100 day SMA (gold line).

Also, noticing how the February drop had a large gap down, followed by a few down days (but hovering) when the Lower blue trend line acted as support, before it had another large gap down, more support formed before the next gap down, and then free falling some more to the bottom. Today, we had a large gap down (obviously) but now comparing what today's chart action looks like in comparison to the the late February start of drop.... That does have me a bit worried.

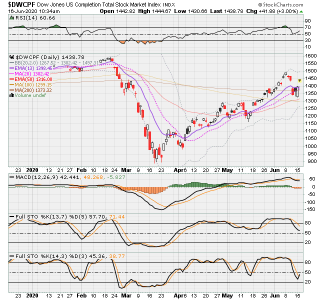

Earlier the DOW mini was up 185, then about 2 hours ago was only up 95 and now ….I just checked DOW mini Futures again and its up 385 points! That is great! But still only about a Quarter of the drop that happened today. So, not sure about that. I may take some off table tomorrow.... just to be on the safe side... not sure that this will even make up for the drop today covering only 10% invested. Gosh... I don't want to exit but will need to do the math. Also, no more IFTs to get back in … so an exit now could be premature... then again... no telling.... so sad that we must contend with only 1 actual buy in each month.