DreamboatAnnie

TSP Legend

- Reaction score

- 786

Lol... Yes! I was out, then in and then got scared again and wanted out but stayed in!! Go figure! When I'm in, I want to get out. When I'm out, I want to get in.... then go back and forth a few times!

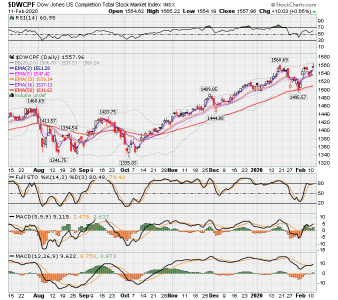

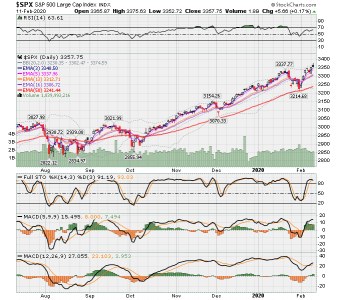

Now... read some articles that quabit posted on your thread about repo market and QE Lite.... lol.. drinkin a beer and thats the best term I can come up with, but you know what i mean!

Anyways, the article says NY Fed said QE Lite will end in mid-February. So now me thinks, when does the market start to freak out about the music stopping?? Should we exit in a week or so, or wait until around start of Feb?? At some, point, without Fed saying the musics not gonna stop, those in the know will start to jump out... ehh... me just ponders a bit to much whilst drinking a lil beer!

Best wishes to you Whipsaw and to Everyone* !!!!!!

PS. I did start my weekend just a weee early!

Now... read some articles that quabit posted on your thread about repo market and QE Lite.... lol.. drinkin a beer and thats the best term I can come up with, but you know what i mean!

Anyways, the article says NY Fed said QE Lite will end in mid-February. So now me thinks, when does the market start to freak out about the music stopping?? Should we exit in a week or so, or wait until around start of Feb?? At some, point, without Fed saying the musics not gonna stop, those in the know will start to jump out... ehh... me just ponders a bit to much whilst drinking a lil beer!

Best wishes to you Whipsaw and to Everyone* !!!!!!

PS. I did start my weekend just a weee early!