The problem with 9/17/2019, and ever since, is that banks don’t have the cash, because somebody has placed put options, and bought up all the banks’ bond holdings, betting that the market is going to crash.

The Congress (and Trump Admin) just reduced the cash reserve requirements of Dodd-Frank, AND loosened the Volker Rule about banks using on-hand cash to play in the stock market.

So- in summary- most of the safety-valves we put in place after the 2008 crash ARE NOW SOFTENED or Completely gone; and

the banks don’t have surplus cash to loan each other in an emergency; and

Somebody (s) have placed huge bets that the markets are going to collapse; and

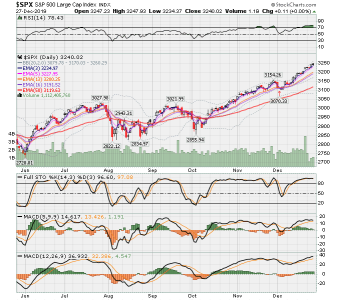

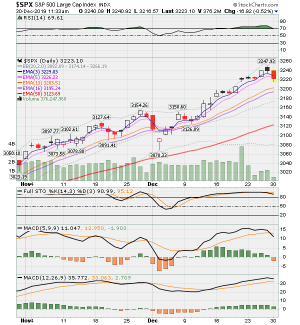

The FED has been quietly flooding the banks with cash, but insisting that nobody call it a QE3,(or 4, or 5, or whatever we are up to) ; and

The only thing keeping markets rising is that Fed QE cash flooding the market; and lowing interest rates again, even though they barely got them back up to half the normal rates level (about 2.5%) and

And at SOME POINT they (the FED) needs to STOP lowering rates, to save SOMETHING in case an emergency hits....

So I am a really , really thinking that by spring, either the economy HAS to start significant growth, or else the whole thing is going to come crashing down . Hard.

But then again, I’ve always been optimistic.

Sent from my iPhone using

TSP Talk Forums