-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dr Faustus's Account Talk

- Thread starter DrFaustus

- Start date

Cactus is right ... DMA ( or MDA, as they are more commonly know ) is a Daily Moving Average. A 3 DMA for the S fund for Nov 14 would be ( 35.6505 + 35.6438 + 35.8300 )/3 = 35.7081. These are indeed short term averages ... the more common long term ones ( a 200 DMA, for example ) are used by the "buy-and-hold" crowd. It takes a LOT of movement in a given direction to move these long-term values significantly. Well, we all know how I feel about about "buy-and-hold."

Anyway ...

I'm going to be in a conference this week and therefore I'll be unable to respond in a timely fashion ( ie, by noon ) to market moves. However, that doesn't mean that I can't share what my curves are saying ...

Right now, the S-fund is in an ALERT status - meaning that the market is trading sideways and could go either up or down. If the S-fund looks like it's going to close down by 0.85% or more tomorrow ( Nov 17), my curves indicate that a SELL signal will be generated. Act accordingly ...

Anyway ...

I'm going to be in a conference this week and therefore I'll be unable to respond in a timely fashion ( ie, by noon ) to market moves. However, that doesn't mean that I can't share what my curves are saying ...

Right now, the S-fund is in an ALERT status - meaning that the market is trading sideways and could go either up or down. If the S-fund looks like it's going to close down by 0.85% or more tomorrow ( Nov 17), my curves indicate that a SELL signal will be generated. Act accordingly ...

TSPIntel

TSP Analyst

- Reaction score

- 12

Thank U so much Cactus and Dr. Faustus 4 the clarification... on DMAS... My Conical Prognostic (Trend [Fed], Cycles [Moons Phases], Seasonality [Months], and Moving Market Events [Economics Indicators].... is indicating to stay on S-Fund till end next week if the TSP.GOV would be open that day... otherwise I may stay till the Monday of the following week... I mean Dec 1st...

TSPIntel ... yer welcome. : ) My charts are suggesting a "stay the course" action as well, which is a little scary given that Wed ( 11/26 ) is most likely going to be a low-volume day and thus prone to wild moves. Oh well, I don't seem to be doing that badly so far this year. : )

Well, the indices are all telling me to get out of the S fund come Monday. The large drop on Friday is indeed cause for alarm but there are a couple of factors to keep in mind. 1) It's a Friday after a holiday (and Black Friday at that), so it was probably a low-volume day and thus subject to wild swings. Which is a reason to "stay the course." However, a drop that large might indicate that the market has no underlying strength (shock) and is therefore indicating the markets might drop further on Monday. Hard to tell which set of reasoning is the most valid. Watch the market indicators on Monday ... if it doesn't look like we're going to be heading into positive territory, my advice is to BAIL, BAIL, BAIL !!!

jkenjohnson

Market Veteran

- Reaction score

- 24

I can't win .... lol

That's exactly the way I feel. At this rate I won't even make 10% this year.

As a buy and hold aficianado I never have to make those difficult decisions to get in or out. I just ride the cycles.

Interesting, Birch! I never knew you were a buy-and-holder. And a very successful one at that. Hard to argue against buy-and-hold with a person of your credibility/record. Maybe I should take notice! : )

Last edited:

WorkFE

TSP Legend

- Reaction score

- 516

2014 hasn't been my year

I'll take a + whatever year over a - whatever year anytime.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

A general survey question to the readers ... what premium services do you subscribe to and whose returns do you watch? Do you have a strategy you employ?

services: none.

watch: alevin, amoeba, birchtree, bmneveu, boghie, fireweathermet, jonfresno, jpcavin, jth, mrbowl, pessoptimist, whipsaw (regularly), and another 1/2 dozen or so (irregularly).

strategy: hit and git, in long for short periods of time during maximum volitility events.

services: none.

watch: alevin, amoeba, birchtree, bmneveu, boghie, fireweathermet, jonfresno, jpcavin, jth, mrbowl, pessoptimist, whipsaw (regularly), and another 1/2 dozen or so (irregularly).

Interesting ... do you watch those folks because you like their returns, their market philosophies, both? ( just curious, in case you were wondering )

I'm sure I've mentioned before that I was a big believer in the 'dead cat bounce' strategy ... I'd get in on a down day, wait for a turn-around and then get out. This strategy worked - ok - for me, I was able to make a bit of money doing it. But of course, it rankled when the market would keep going up n up and I wasn't in it! So that, plus the removal of the daily IFTs in favor of this twice-a-month thing ( grumble, grumble ) prompted me to develop my 'system.' I say system in quotes because it's little more than market watching with some overhead. The only real way to make money with a buy-n-hold strategy is to get ahead of the trends. Birch seems to be real good at that. But I'd be willing to bet that it takes a bit more effort than I'm willing to give at this point.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Interesting ... do you watch those folks because you like their returns, their market philosophies, both? ( just curious, in case you were wondering )

I'm sure I've mentioned before that I was a big believer in the 'dead cat bounce' strategy ... I'd get in on a down day, wait for a turn-around and then get out. This strategy worked - ok - for me, I was able to make a bit of money doing it. But of course, it rankled when the market would keep going up n up and I wasn't in it! So that, plus the removal of the daily IFTs in favor of this twice-a-month thing ( grumble, grumble ) prompted me to develop my 'system.' I say system in quotes because it's little more than market watching with some overhead. The only real way to make money with a buy-n-hold strategy is to get ahead of the trends. Birch seems to be real good at that. But I'd be willing to bet that it takes a bit more effort than I'm willing to give at this point.

i watch them as 'indicator species' to come up with a broad mix of 'market feel' to help read the tea leaves. each is different, together it is a powerful mix.

tsp trade limitations cause me to have to anticipate trades and 'front run' the signal those 12 and myself generate to try to scalp a few percent on hot hits.

i am on track for 6.5% this year unless i do something stupid.

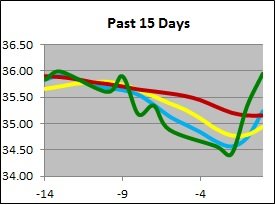

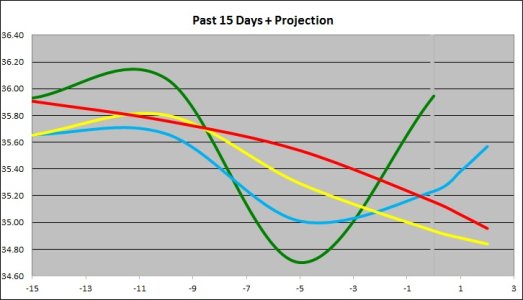

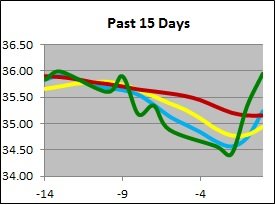

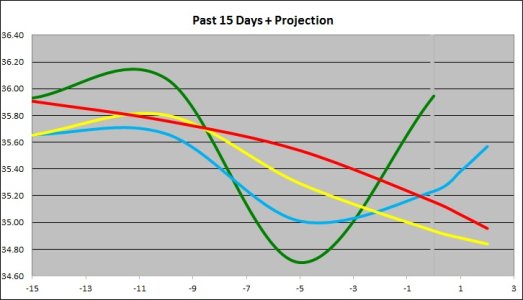

We've had a huge rise is the S fund over the past couple of days and it might seem like a good idea to get back into the fund. Here's what my chart is showing:

Blue is the short-term MDA, Yellow is the mid-term, Red is long term. This huge uptick has apparently forced the long term MDA to level out and it just may change to going up. However, the fact that the market has gone up so much in such a short time gives me pause. My project chart (below) is still indicating an ALERT status, mostly due to the fact that the long term MDA is still trending down.

Looking at the market today, we see a leveling off ... as of this writing, the W4500 is up a whopping .04%. Which seems to support my niggle : now is not a good time to get in. So I'm going to continue to sit on the sidelines for a couple more days and see if this "Santa Claus" rally will continue to hold. My guess is that it wont ....

Blue is the short-term MDA, Yellow is the mid-term, Red is long term. This huge uptick has apparently forced the long term MDA to level out and it just may change to going up. However, the fact that the market has gone up so much in such a short time gives me pause. My project chart (below) is still indicating an ALERT status, mostly due to the fact that the long term MDA is still trending down.

Looking at the market today, we see a leveling off ... as of this writing, the W4500 is up a whopping .04%. Which seems to support my niggle : now is not a good time to get in. So I'm going to continue to sit on the sidelines for a couple more days and see if this "Santa Claus" rally will continue to hold. My guess is that it wont ....

Last edited:

Similar threads

- Replies

- 0

- Views

- 329

- Replies

- 0

- Views

- 3K

- Replies

- 0

- Views

- 643

- Replies

- 0

- Views

- 628