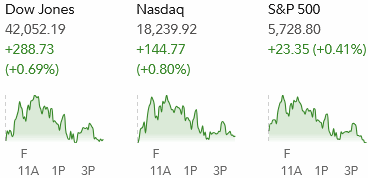

Stocks closed with solid gains on Friday, but once again the indices closed well off their highs, and the gains were just a fraction of Thursday's dramatic losses. The jobs report was so weak on Friday when compared to estimates that it was surprising to see any positive close at all. To complicate things, the dollar and bond yields rallied again on this soft data - the opposite of what we might expect, so something seems to be going on.

Estimates for the October jobs report were all over the map, but the consensus was looking for a gain of somewhere near 125,000 jobs so the 12,000 jobs added was a major league miss. Not only that but there was a gain of 40,000 government jobs so the private sector actually lost 28,000 jobs.

The hurricanes and the Boeing strike were a big reason for the miss, but didn't the economists making the estimates know about these?

So we had a dreadful economic report, which surprised me in more than one way. I had been saying that we would not see any negative surprises before the election, so that was wrong. But perhaps with mail in ballots and early voting it won't have that much of an impact on the election - just guessing.

Speaking of guessing; there have been some very interesting crosswinds in recent weeks and one is why Treasury Yields and the dollar are still soaring after that weak data. If I had to guess I would say that this data will make the Fed more dovish (lower rates) and that will be good for the economy. The bond market always seems to be one step ahead of the stock market. Also, both presidential candidates have done some hefty promising on spending and / or tax cuts that would be inflationary, if delivered.

But the jobs miss all but guarantees a 0.25% rate cut by the Fed at their meeting on Thursday. What may be surprising is that there is basically a 0% chance of a 0.50% cut so perhaps investors are OK with the hurricane and Boeing strike as the excuse for Friday's anomalous data.

The 10-year Treasury Yield closed over 4.36% on Friday, the highest close in months and stocks are starting to feel the pressure.

Thanks to our friends at sentimentrader.com, we come to learn that a sharp rally in yields following a Fed interest rate cut isn't necessarily a bad thing for the stock market. It hasn't happened in 25 years, but prior times that the 10-year Yield rallied 65 basis points (a 0.65% move higher in the yield) stocks tended to do well in the short-term, and the very well in the longer-term.

Chart provided courtesy of www.sentimentrader.com

Why would that be? Like I said, it creates a more growth oriented economy as the Fed cuts rates.

Another crosswind is the shift in some of the election betting markets recently. Trump went from a double digit lead to win the election on predicit.org, to being a couple of points behind. As we talked about before, specific market sectors behave differently depending on the economic approach of the winning administration and a Trump presidency had been getting priced. Now we see a shift, although interestingly not all betting sites saw a reversal, but certainly there was a tilt toward Harris last week by the bettors.

For instance, on predictit.org, Harris is now up 53 - 51 (basically the odds of winning), but on Polymarket.com Trump has a 10 point lead 55 to 45. Think there is some inside baseball going on somewhere?

Of course this matters for many reasons but the back and forth particularly influences those different sectors in the market. For instance, it is a common belief that Trump would be more bitcoin friendly and, after a big fall rally, bitcoin pulled back almost 10% last week.

Anyway, we have another big week on hand with the election and its aftermath, plus the the Fed FOMC meeting on Thursday with a 0.25% rate cut likely.

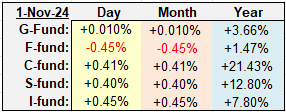

The S&P 500 (C-fund) gained a respectable 0.41% on Friday, but that was well off the morning highs, and it was a fairly feeble bounce after Thursday's near 2% losses. It is still above its 50-day EMA but it did fail at the 20-day EMA and one of the rising support lines last week. There is an open gap near 5610 that could be a lure for the bears if the bulls can't hold that 50-day average.

The DWCPF (S-fund) is hanging in there above some key support, but I see the small caps futures are down fairly sharply on Sunday night so unless something changes before the opening bell, that 50-day average near 2150 could be tested next.

The I-fund: The EFA tracking ETF was up 0.20% on Friday, but the I-fund was given a 0.45% again. You can see the TSP's eventual final daily price and return posted on our site each evening.

The EFA remains in the descending channel below some key support but trying to hold onto September's low.

BND (Bonds / F-fund) is also in a harrowing descending channel as yields continue to move higher. I speculated above that this could be investors pricing in better future economic data because of the Fed's series of rate cuts, or it could be because of the higher expectations for inflation based on campaign promises.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

| Daily TSP Funds Return More returns |

Estimates for the October jobs report were all over the map, but the consensus was looking for a gain of somewhere near 125,000 jobs so the 12,000 jobs added was a major league miss. Not only that but there was a gain of 40,000 government jobs so the private sector actually lost 28,000 jobs.

The hurricanes and the Boeing strike were a big reason for the miss, but didn't the economists making the estimates know about these?

So we had a dreadful economic report, which surprised me in more than one way. I had been saying that we would not see any negative surprises before the election, so that was wrong. But perhaps with mail in ballots and early voting it won't have that much of an impact on the election - just guessing.

Speaking of guessing; there have been some very interesting crosswinds in recent weeks and one is why Treasury Yields and the dollar are still soaring after that weak data. If I had to guess I would say that this data will make the Fed more dovish (lower rates) and that will be good for the economy. The bond market always seems to be one step ahead of the stock market. Also, both presidential candidates have done some hefty promising on spending and / or tax cuts that would be inflationary, if delivered.

But the jobs miss all but guarantees a 0.25% rate cut by the Fed at their meeting on Thursday. What may be surprising is that there is basically a 0% chance of a 0.50% cut so perhaps investors are OK with the hurricane and Boeing strike as the excuse for Friday's anomalous data.

The 10-year Treasury Yield closed over 4.36% on Friday, the highest close in months and stocks are starting to feel the pressure.

Thanks to our friends at sentimentrader.com, we come to learn that a sharp rally in yields following a Fed interest rate cut isn't necessarily a bad thing for the stock market. It hasn't happened in 25 years, but prior times that the 10-year Yield rallied 65 basis points (a 0.65% move higher in the yield) stocks tended to do well in the short-term, and the very well in the longer-term.

Chart provided courtesy of www.sentimentrader.com

Why would that be? Like I said, it creates a more growth oriented economy as the Fed cuts rates.

Another crosswind is the shift in some of the election betting markets recently. Trump went from a double digit lead to win the election on predicit.org, to being a couple of points behind. As we talked about before, specific market sectors behave differently depending on the economic approach of the winning administration and a Trump presidency had been getting priced. Now we see a shift, although interestingly not all betting sites saw a reversal, but certainly there was a tilt toward Harris last week by the bettors.

For instance, on predictit.org, Harris is now up 53 - 51 (basically the odds of winning), but on Polymarket.com Trump has a 10 point lead 55 to 45. Think there is some inside baseball going on somewhere?

Of course this matters for many reasons but the back and forth particularly influences those different sectors in the market. For instance, it is a common belief that Trump would be more bitcoin friendly and, after a big fall rally, bitcoin pulled back almost 10% last week.

Anyway, we have another big week on hand with the election and its aftermath, plus the the Fed FOMC meeting on Thursday with a 0.25% rate cut likely.

The S&P 500 (C-fund) gained a respectable 0.41% on Friday, but that was well off the morning highs, and it was a fairly feeble bounce after Thursday's near 2% losses. It is still above its 50-day EMA but it did fail at the 20-day EMA and one of the rising support lines last week. There is an open gap near 5610 that could be a lure for the bears if the bulls can't hold that 50-day average.

The DWCPF (S-fund) is hanging in there above some key support, but I see the small caps futures are down fairly sharply on Sunday night so unless something changes before the opening bell, that 50-day average near 2150 could be tested next.

The I-fund: The EFA tracking ETF was up 0.20% on Friday, but the I-fund was given a 0.45% again. You can see the TSP's eventual final daily price and return posted on our site each evening.

The EFA remains in the descending channel below some key support but trying to hold onto September's low.

BND (Bonds / F-fund) is also in a harrowing descending channel as yields continue to move higher. I speculated above that this could be investors pricing in better future economic data because of the Fed's series of rate cuts, or it could be because of the higher expectations for inflation based on campaign promises.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.