coolhand

TSP Legend

- Reaction score

- 530

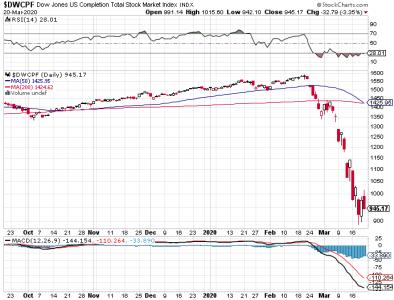

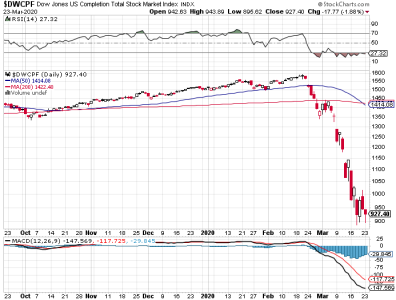

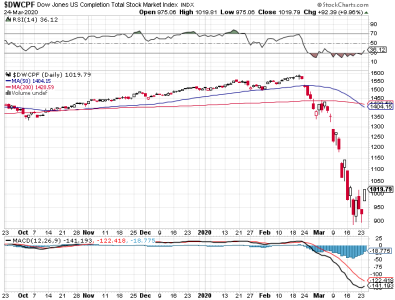

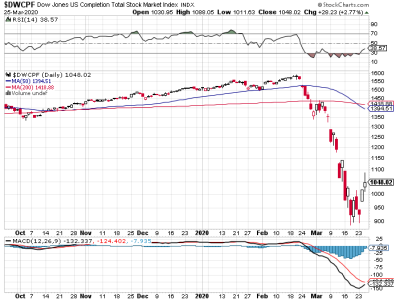

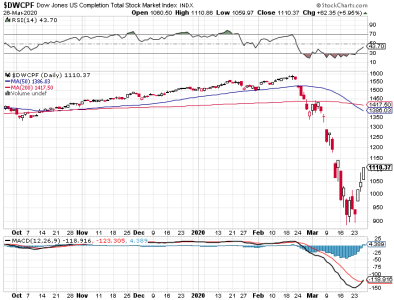

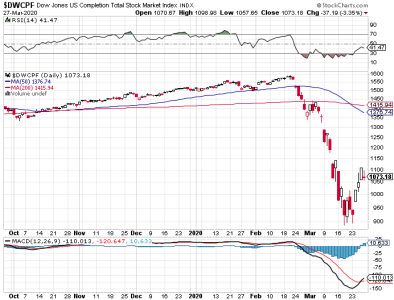

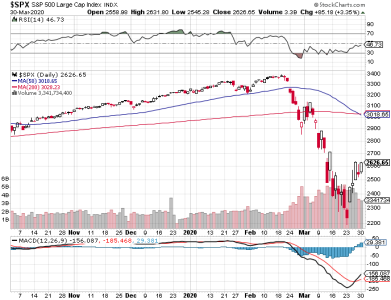

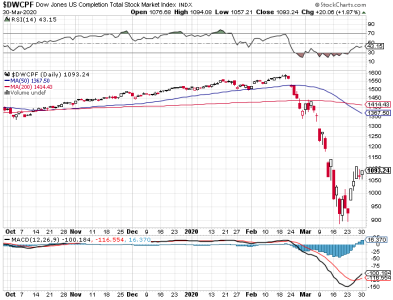

I'm not sure if I believe the price on the DWCPF or not. The charts say it was up almost 5.9%, but the S&P was up only marginally. I've never seen that kind of separation before. I'm assuming it's correct.

In any event, the market bounced today. It still doesn't change the trend. Futures are down again this evening.

NAAIM came in even more bearish this week. They can't get much more bearish after this reading. Beware.

Breadth bounced, but remains bearish.

It's still too soon to look for a bottom I think. I remain bearish.

In any event, the market bounced today. It still doesn't change the trend. Futures are down again this evening.

NAAIM came in even more bearish this week. They can't get much more bearish after this reading. Beware.

Breadth bounced, but remains bearish.

It's still too soon to look for a bottom I think. I remain bearish.