coolhand

TSP Legend

- Reaction score

- 530

So, Monday's action was not a continuation of last week's accelerated sell-off.

Looking at the charts, we can see we got a big bounce. Price is now well off the intraday low made Friday. Momentum may be turning and RSI exited an oversold condition. There is still plenty of upside resistance to cut through, however.

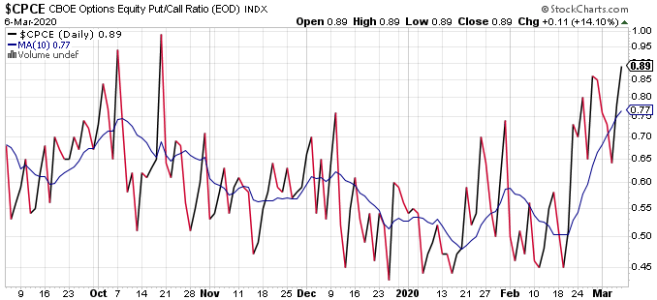

The CBOE is still leaning heavily bearish. TRIN and TRINQ are flat.

Breadth turned up, but remains negative.

Given volatility was at extreme levels, it is not a given that a bottom is in. I believe there is a good chance the lows get tested again. The only thing that gives me pause is the NAAIM reading, which still showed plenty of bulls.

I am remaining neutral.

Looking at the charts, we can see we got a big bounce. Price is now well off the intraday low made Friday. Momentum may be turning and RSI exited an oversold condition. There is still plenty of upside resistance to cut through, however.

The CBOE is still leaning heavily bearish. TRIN and TRINQ are flat.

Breadth turned up, but remains negative.

Given volatility was at extreme levels, it is not a given that a bottom is in. I believe there is a good chance the lows get tested again. The only thing that gives me pause is the NAAIM reading, which still showed plenty of bulls.

I am remaining neutral.

. Of course she told him what he needed to hear.

. Of course she told him what he needed to hear.