Sorry I took so long to post. I've been away from home all day and got back late.

I thought we might see lingering weakness that turned to strength on Thursday, but we only got strength. Sorry for missing that call. :laugh:

I said early in the week that buy and hold is probably the best way to play this market for now and Thursday was evidence of that. I am going 100% stocks in TSP on Friday. Please keep in mind that my TSP account is not my primary account. I transferred my entire balance last summer into a self-directed account. I still have contributions going into TSP, but my balance is modest. I've been long TNA in my IRA, which was up more than 5% today.

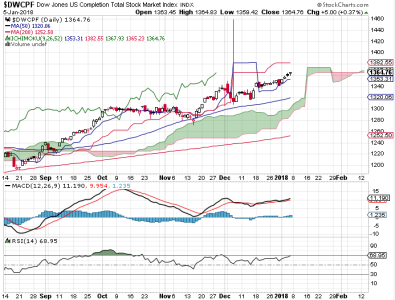

No explanation should be needed for these charts. They are overbought, but are emphatically telling you what direction we're headed.

It is very hard to trust sell signals in this market. All you can do is hold on for the ride and hope to recognize the top, which is difficult at best. Having said that, any top would almost certainly be short-term. I suspect there may be much more upside in the weeks ahead. Now, having said that, don't get overly bullish either. We can be bullish and optimistic and we certainly have good reason for being so, but the market can punish us when we least expect it. I am just following the indicators (with an eye on political maneuverings), which is not the same thing as a crystal ball (it sometimes seems that way).

For tomorrow, we're overbought and could get a pullback after Thursday's pop. The options are mostly neutral. NAAIM came in neutral, but is still leaning bullish and there are no bears in the reading. They know better than to get in front of a train. Breadth hit a fresh all-time high again.

Sit back and enjoy the action. I'm going 40/40/20 CSI on Friday.