coolhand

TSP Legend

- Reaction score

- 530

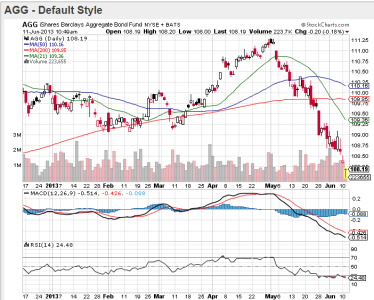

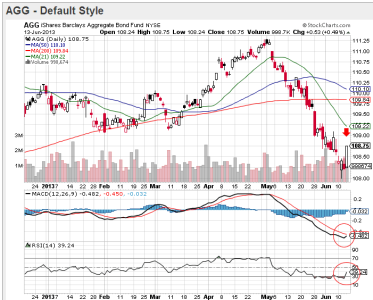

Bonds in general are certainly looking increasingly risky these days. But I still maintain them as part of a diversified portfolio. Last week, I sold some of my junk bonds to raise to raise some cash, but kept FAX, which I felt was a buy last week. But short term support didn't hold for FAX as it's now hitting lows not seen since April or June of 2012. It still appears to be an attractive long term buy and I'm certainly going to hold my position in it. That's why I focus on dividend paying instruments. They provide extra protection in any market environment.