coolhand

TSP Legend

- Reaction score

- 530

Here's stock on my "watch" list as of today.

View attachment 23546

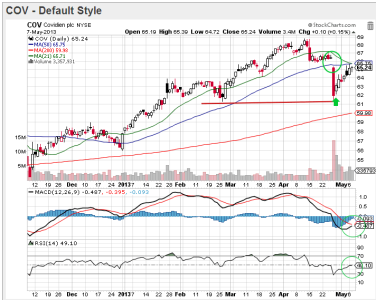

Covidien (previous known as Tyco Healthcare) is a large medical supply and equipment company. It's taking a pretty good hit today as a result of missing its revenue estimate for the 2nd quarter. You can read about it here. The news was hardly something to get overly bearish about, but price has been struggling a bit even before today's announcement. In my opinion, the news presents a good buying opportunity.

I've drawn three support line targets for this stock. It's currently at the first one, near the upper-$61s. However, RSI and MACD are still pointing down. RSI is also showing that it's oversold as of today. That's why it's not yet a buy for me, only a watch. As a longer term buy and hold stock, it's current price is relatively attractive now, but there's a good chance it may get even more attractive in the days ahead. Once it appears RSI and MACD are turning, I'd consider buying this stock either as a short term trade, or a longer term buy and hold. It pays about a 1.6% quarterly dividend.

Remember, it's only a watch for the moment. That may change in the not too distant future, but we'll have to see how the technical picture develops.

One trading day later and COV is up about 2% at the open. It's not a confirmed upside move yet, but I'm thinking the bottom is probably in for now.