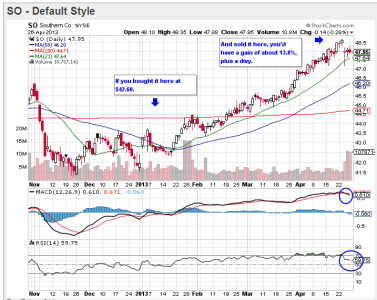

The stock (ETR) that I posted about here almost a month ago was a big winner. I said it was poised for a possible big run in mid 62 area and in fact it ran all the way to an intraday high of 70.70 on 19 April. So if you bought this stock say around 62.75 you would have a gain of 11.24% in less than a month if you were lucky enough to sell at the high. And it may go higher, but that was a fast and deep run, so I'm not expecting a lot more upside in the short term. It's actually due for some consolidation as are many other stocks on the big boards.

But what I really wanted to post was another stock that appears poised for some upside action.

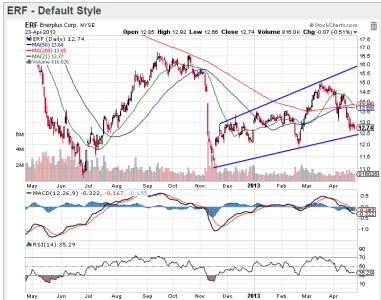

View attachment 23487

Enerplus Corp. is an oil and natural gas play with interests in Canada and the US. It's current yield is 8.31% and is paid on a monthly basis. That's a very nice dividend. They just announced a cash dividend in the amount of CDN $0.09 per share and that will be payable on May 21, 2013 to all shareholders of record at the close of business on May 3, 2013. The ex-dividend date for this payment is May 1, 2013.

On the chart itself, price tagged the upper trend line in mid-March and has retraced not too far from the lower trend line. If RSI and MACD turn up and price remains above that lower trend line, I'd expect this stock to begin another cycle back up to the upper trend line once again, or at least the $15 area. If it falls below that lower trend, I'd look for support in the $12 area and then the lower 11s. Given this market has rallied hard for almost 4 months now, I'd not be surprised with more downside action should the broader market finally decide to make a sustained run lower. But for a longer term buy and hold play, I think price is attractive right where it is at present.