-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

Okay, change one. I am no longer tracking the Seven Sentinels, but I did decide to keep my profile on the tracker at the last minute.

And while I've taken a lengthy hiatus from posting on a regular basis, I'm going to try to find the time to post a bit more. Tonight I'd like to post a chart of a stock that I bought yesterday another that I bought today. I treat my IRAs a bit differently than TSP as I have a whole lot more flexibility in the brokerage account.

The first stock I picked up is Microsoft. You can see that the 50 dma passed through the 200 dma not too long ago and price is now much more attractive. This is still a solid company and they are sitting on a mountain of cash. Not to mention they pay a decent quarterly dividend of about 3.3%.

Very similar situation with Southern Company. The 50 dma is below the 200 dma and the company is on solid footing. And being a utility they should do well in an economic downturn. This bull market is getting long-in-the-tooth after all. They pay a quarterly dividend of about 4.5%.

I generally expect to hold these stocks for the longer term. They appear to have good upside potential and as I mentioned, will pay handsome dividends while I wait for anticipated price appreciation in the months to come.

And while I've taken a lengthy hiatus from posting on a regular basis, I'm going to try to find the time to post a bit more. Tonight I'd like to post a chart of a stock that I bought yesterday another that I bought today. I treat my IRAs a bit differently than TSP as I have a whole lot more flexibility in the brokerage account.

The first stock I picked up is Microsoft. You can see that the 50 dma passed through the 200 dma not too long ago and price is now much more attractive. This is still a solid company and they are sitting on a mountain of cash. Not to mention they pay a decent quarterly dividend of about 3.3%.

Very similar situation with Southern Company. The 50 dma is below the 200 dma and the company is on solid footing. And being a utility they should do well in an economic downturn. This bull market is getting long-in-the-tooth after all. They pay a quarterly dividend of about 4.5%.

I generally expect to hold these stocks for the longer term. They appear to have good upside potential and as I mentioned, will pay handsome dividends while I wait for anticipated price appreciation in the months to come.

JamesE

TSP Strategist

- Reaction score

- 4

I found that the Seven Sentinels were late to the party all the time. Even though I consider myself an intermediate term trader, the big moves would happen and I was late. Man, I got slaughtered last summer during the whipsaw. Probably should have switched to the short term system during that time frame. Clawed my way back to -1% at the EOY by just staying in from 9-14 on. Don is awesome at seeing the huge market moves in advance, I gotta give him that.

coolhand

TSP Legend

- Reaction score

- 530

I found that the Seven Sentinels were late to the party all the time. Even though I consider myself an intermediate term trader, the big moves would happen and I was late. Man, I got slaughtered last summer during the whipsaw. Probably should have switched to the short term system during that time frame. Clawed my way back to -1% at the EOY by just staying in from 9-14 on. Don is awesome at seeing the huge market moves in advance, I gotta give him that.

This market's character has changed much over the course of the last few years. All too often when the market decided to change direction, it did so very quickly and would whipsaw intermediate term traders/investors out of position. This is no accident. The market knows more than all of us combined. Intermediate term traders need to have a short term way to gauge increasing downside and upside risk when playing the intermedate term. That's what I try to do. It's not just about trying to beat the market, but just as importantly or perhaps more importantly it's also about risk management. Following a given system from signal to signal may not be the best approach, but that system is still a valuable tool in one's arsenal. Market savvy and other indicators also need to be deployed. Not everyone will agree with my position here, and that's okay. To each their own.

Bquat

TSP Talk Royalty

- Reaction score

- 717

Coolhand you come up with some of the best comments. Thanks and glad your sticking around.This market's character has changed much over the course of the last few years. All too often when the market decided to change direction, it did so very quickly and would whipsaw intermediate term traders/investors out of position. This is no accident. The market knows more than all of us combined. Intermediate term traders need to have a short term way to gauge increasing downside and upside risk when playing the intermedate term. That's what I try to do. It's not just about trying to beat the market, but just as importantly or perhaps more importantly it's also about risk management. Following a given system from signal to signal may not be the best approach, but that system is still a valuable tool in one's arsenal. Market savvy and other indicators also need to be deployed. Not everyone will agree with my position here, and that's okay. To each their own.

MrJohnRoss

Market Veteran

- Reaction score

- 58

I agree with your commentary about whipsaws with timing systems, as I've been the victim several times myself in the last few months. This may be a good time to implement a buffer to minimize these effects. The markets are constantly changing, and what worked a year or two ago may not work as well as today.

Keep up the good work, Jim.

Keep up the good work, Jim.

coolhand

TSP Legend

- Reaction score

- 530

I agree with your commentary about whipsaws with timing systems, as I've been the victim several times myself in the last few months. This may be a good time to implement a buffer to minimize these effects. The markets are constantly changing, and what worked a year or two ago may not work as well as today.

Keep up the good work, Jim.

Thanks John.

Yes, system effectiveness can vary as market character changes. That's why past returns are not guarantees of future success. Most pros will tell us that and it's very true. It's also the reason why I like to buy solid, dividend paying companies as well as hold various bond instruments outside TSP. My high yield corporate bonds have been kicking butt for a long time and I suspect that will continue for another couple of years yet. I find that deploying more than one investment/trading strategy helps me sleep better too. Especially as one's portfolio gets larger.

coolhand

TSP Legend

- Reaction score

- 530

Two stocks I purchased about 2 weeks ago (Microsoft and Southern Company) have been rising ever since I posted their charts on 1/9/13. That's too short of a time to get overly excited about it, but I still think the entry price was right and that they will continue to do well over time. I have two more charts this evening for companies I'm currently watching (Birch, are you listening?  ).

).

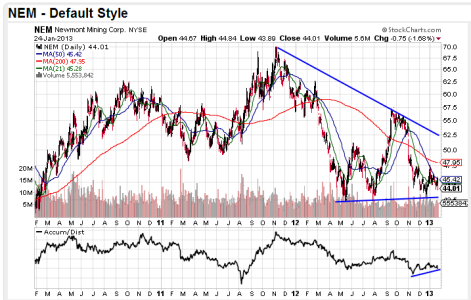

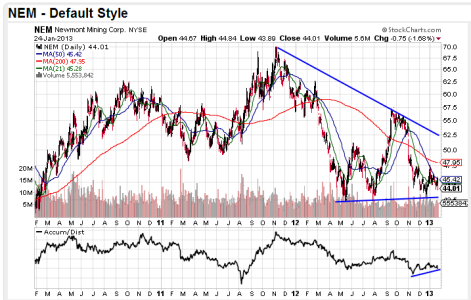

The first chart is Newmont Mining Corp. I'm seeing a possible triple bottom reversal pattern setting up, but the stock has yet to confirm this pattern with a breakout in the $48 area (the accum/dist line has a positive divergence over the past 2 months). For a longer term buy and hold strategy, the stock has potential. And it pays a quarterly 3.1% dividend, which makes it more attractive to investors.

I find Barrick Gold Corp. intriguing, mainly because I'm thinking that over the long haul, gold may begin another ramp higher, which I would think may put upward pressure on this company's stock. Looking at the chart, price is sitting right at the lower support line and the accum/dist line is showing a negative divergence, which suggests it's heading lower. But like Newmont Mining, it may be a stock worth watching for the longer term buy and hold investor. Let's look at a shorter term view of this stock.

We can see that support has been holding around the $33 area since mid-November. And again, that A/D line suggests it will probably fail to the downside in the short term. If that happens, this stock will begin to look attractive at some lower price. I'll be watching that A/D line for a clue in the weeks ahead. And this stock pays a quarterly dividend of about 2.7%.

So when the bull market finally ends, will gold and mining stocks find favor?

The first chart is Newmont Mining Corp. I'm seeing a possible triple bottom reversal pattern setting up, but the stock has yet to confirm this pattern with a breakout in the $48 area (the accum/dist line has a positive divergence over the past 2 months). For a longer term buy and hold strategy, the stock has potential. And it pays a quarterly 3.1% dividend, which makes it more attractive to investors.

I find Barrick Gold Corp. intriguing, mainly because I'm thinking that over the long haul, gold may begin another ramp higher, which I would think may put upward pressure on this company's stock. Looking at the chart, price is sitting right at the lower support line and the accum/dist line is showing a negative divergence, which suggests it's heading lower. But like Newmont Mining, it may be a stock worth watching for the longer term buy and hold investor. Let's look at a shorter term view of this stock.

We can see that support has been holding around the $33 area since mid-November. And again, that A/D line suggests it will probably fail to the downside in the short term. If that happens, this stock will begin to look attractive at some lower price. I'll be watching that A/D line for a clue in the weeks ahead. And this stock pays a quarterly dividend of about 2.7%.

So when the bull market finally ends, will gold and mining stocks find favor?

coolhand

TSP Legend

- Reaction score

- 530

I don't have time post specifics this morning, but I'm seeing capitulation in sentiment and smart money moving to the short side. I'm thinking we have more weakness dead ahead, but the trend is still up, so this may be a buying opportunity in the longer term. Of course the big question is "how much weakness"? Given liquidity is still at extreme levels, that will serve as an offset to selling pressure as it has the whole month of January. It has not backed down yet. If that liquidity falls off significantly, the downside may be deeper (and faster) than many expect. That's what makes it challenging to gauge potential downside action. It's also a counter trend trade and carries increased risk for those who would try and short this situation. For now, I'm looking for some measure of continued weakness in the days ahead.

coolhand

TSP Legend

- Reaction score

- 530

It's extremely normal for markets to test the 50-day exponential moving averages - but let's hope from much higher levels to make the pain more tolerable. The kind of buying we get off the 50-day tests will be prescient for the bull.

I do agree with you. I also highly doubt we are near a longer term top. Given the action so far this morning, it's obvious any weakness will be from higher still.

coolhand

TSP Legend

- Reaction score

- 530

There's a high probability that the intermediate term is about to roll over to a sell if today's action holds. However, there's a good chance that volatility may keep folks guessing about the longer term in the days ahead. In other words, don't be surprised if we bounce back up to previous levels in the days ahead in spite of what I perceive to be increasing risk on the long side.

Frixxxx

Moderator

- Reaction score

- 131

There's a high probability that the intermediate term is about to roll over to a sell if today's action holds. However, there's a good chance that volatility may keep folks guessing about the longer term in the days ahead. In other words, don't be surprised if we bounce back up to previous levels in the days ahead in spite of what I perceive to be increasing risk on the long side.

I think if the short-term longs don't drag this down, the long-longs (I love making crap up) will prevail.

Good to see you CH!

JimmyJoe

TSP Analyst

- Reaction score

- 8

I love what you said... Made my afternoon. Anything... Just get that market moving up.:toung:I think if the short-term longs don't drag this down, the long-longs (I love making crap up) will prevail.

Good to see you CH!

Similar threads

- Replies

- 0

- Views

- 152

- Replies

- 0

- Views

- 169

- Replies

- 0

- Views

- 120

- Replies

- 0

- Views

- 130

- Replies

- 0

- Views

- 86