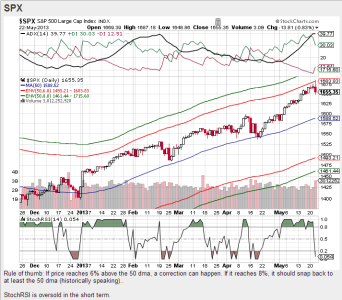

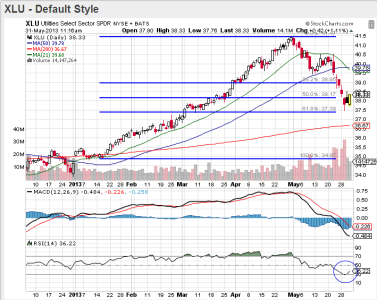

I posted this chart a while back and thought it would be a good time to revisit it given we're hitting news highs almost daily on the indexes.

View attachment 23818

This is a chart of the S&P 500 (C fund). I've included some envelopes that show where price would be at 6% and 8% levels relative to the 50 day moving average. As a general rule, if price reaches 6% above the 50 dma, a pullback is possible near term. If it reaches 8% above the 50 dma, a pull back to at least the 50 dma is possible near term. This is a general rule and this is not an ordinary market. Still, it provides some measure of risk management in markets experiencing large moves either up or down. In this case, I'm really only watching the upper envelop and price is getting closer to that 6% above the 50 dma mark.

The wild card is all that liquidity and the emotional response this market may elicit as more traders and investors are left standing on the sidelines as the indexes continue their trek higher. This is just a scenario, but if we hit those levels it may be prudent to take something off the table. Having said that, regardless if we see a pullback at those levels or not, this market is very likely headed higher in the weeks and months ahead. This just doesn't look like a longer term top being made, but it could be a short to intermediate term one. And given we aren't overly flexible with IFTs, it may not be worth chasing lower prices if one can't get reinvested quickly if need be.

Just some thoughts I'd like to share. I'm still 100% invested here.