-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

burrocrat's Account Talk

- Thread starter burrocrat

- Start date

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Re: burro's ark

hooowheeee! i feel like leonardo dicaprio on the bow of the titanic, except without the pretty topless rich girl part!

sure i took a (0.75%) hit on the first tally, but the next two days freakin rocked! the trick to every trade is to exit as gracefully as you enter. easier said than done, but that was lighting in a bottle. i was at 6.4% at the start and then i whacked the market for about plus 4% net. out double d's on a 72 hour round turn. whack! that's right, who's your daddy?

now i can cruise out the year and unless the gov defaults pull +10%, and i'm out of trades anyways. i love it when a plan comes together.

total bizzaro world. i am so glad i am out of the market now because the geopolitical tension and sinking commodities game should worry us all.

i don't care if the market rockets up an additional 10% or if it turns and cuts the knees out from under everyone. i pulled +10% on the year and the 1%'ers can suck it! i saw what i wanted and i got it. that don't happen very often.

wheeee! wheeee, wheee, wheeeeee!

this move into the market is a hot hit and git trade, i am hoping to scalp a bounce and grab some quick gains then get right back out before the weekend.

i really had to consider and force my self to push the 'submit' button to make the ift go through this morning, i was hesitant. usually that means i might've grabbed something big by the tail and it will work out really good, or very, very bad. we shall soon see. ideal scenario is 2+% in 48 hours and gone.

if the trade goes south on me i'll face an even tougher choice, because i hate to sell a loss.

hooowheeee! i feel like leonardo dicaprio on the bow of the titanic, except without the pretty topless rich girl part!

sure i took a (0.75%) hit on the first tally, but the next two days freakin rocked! the trick to every trade is to exit as gracefully as you enter. easier said than done, but that was lighting in a bottle. i was at 6.4% at the start and then i whacked the market for about plus 4% net. out double d's on a 72 hour round turn. whack! that's right, who's your daddy?

now i can cruise out the year and unless the gov defaults pull +10%, and i'm out of trades anyways. i love it when a plan comes together.

total bizzaro world. i am so glad i am out of the market now because the geopolitical tension and sinking commodities game should worry us all.

i don't care if the market rockets up an additional 10% or if it turns and cuts the knees out from under everyone. i pulled +10% on the year and the 1%'ers can suck it! i saw what i wanted and i got it. that don't happen very often.

wheeee! wheeee, wheee, wheeeeee!

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Re: JPCavin just had to ask. Why, oh Lord, why???

now i'm no chart wizard, can't even understand them, but i know a setup when i see it.

the market over the last 2 days laid out maximum bait and got maximum bite. everybody and their dog is long now, this is where the floor usually falls out from underneath.

wheeee!

now i'm no chart wizard, can't even understand them, but i know a setup when i see it.

the market over the last 2 days laid out maximum bait and got maximum bite. everybody and their dog is long now, this is where the floor usually falls out from underneath.

wheeee!

O

OBXTrader

Guest

Re: JPCavin just had to ask. Why, oh Lord, why???

I was too Euphoric this morning, so went to G Fund COB today (Friday's closing price). Would have preferred to stay in, but I guess I will roll around in my cash until January.

I was too Euphoric this morning, so went to G Fund COB today (Friday's closing price). Would have preferred to stay in, but I guess I will roll around in my cash until January.

now i'm no chart wizard, can't even understand them, but i know a setup when i see it.

the market over the last 2 days laid out maximum bait and got maximum bite. everybody and their dog is long now, this is where the floor usually falls out from underneath.

wheeee!

limebalz

New Contributor

- Reaction score

- 2

Re: JPCavin just had to ask. Why, oh Lord, why???

I'm going to be long into next week. I want the S&P to surpass record (2075) and gain another 15-20 points until I pull out for the year (before S&P hits 2100). I see a flat like clay road in the last few days of December and early January until another small dip.

Then it's a small buy to get a sweet 1-2% to start the year.

I was too Euphoric this morning, so went to G Fund COB today (Friday's closing price). Would have preferred to stay in, but I guess I will roll around in my cash until January.

I'm going to be long into next week. I want the S&P to surpass record (2075) and gain another 15-20 points until I pull out for the year (before S&P hits 2100). I see a flat like clay road in the last few days of December and early January until another small dip.

Then it's a small buy to get a sweet 1-2% to start the year.

uscfanhawaii

TSP Pro

- Reaction score

- 18

Re: JPCavin just had to ask. Why, oh Lord, why???

yeah...did you see the Sentiment Survey from yesterday?! 75% Bulls, 15% Bears. That's gotta be a bearish signal by anybody's system!

now i'm no chart wizard, can't even understand them, but i know a setup when i see it.

the market over the last 2 days laid out maximum bait and got maximum bite. everybody and their dog is long now, this is where the floor usually falls out from underneath.

wheeee!

yeah...did you see the Sentiment Survey from yesterday?! 75% Bulls, 15% Bears. That's gotta be a bearish signal by anybody's system!

burrocrat

TSP Talk Royalty

- Reaction score

- 162

burros-ark update, holiday edition: what a crazy week of surprises and presents, it looks like several residents took advantage of sale prices to increase their haul under the tree. several arkers were negative returns earlier in the week but are above zero and positive now, so that is something to sing about. lots more beating the g and f funds now too, a good reason to be jolly. a few are sitting on nice returns for the year through wise decisions. one is even beating all the indices and laughing all the way to the top 10 autotracker bank. then there is donkey, i was fortunate enough to get in front of most of that rush of fed good tidings and cheer, probably one of the best trades of my life, so far. thank you santa, ho ho ho!

arkers vs indices:

>g: 62%

>f: 39%

>c: 8%

>s: 31%

>i: 92%

alevin/mouse, 6, 0.66%, m, caroler

amoeba/hare, 6, 2.30%, m, jolly

birchtree/elephant, 5, 0.02, m, caroler

bmnevue/penguin, 7, 16.92%, m, jingle bells

boghie/lion, 6, 7.04%, m, wise man

burrocrat/donkey, 1, 10.40%, g, jingle balls

fwm/racoon, 9, (9.35%), m, coal

jonfresno/kangarooo, 8, 3.70%, s, jolly

jpcavin/cougar, 8, 8.06%, m, wise woman

jth/wolf, 3, 2.15%, g, jolly

mrbowl/owl, 3, 3.00%, f, jolly

pessoptimist/squirrel, 7, 9.22%, m, wise man

whipsaw/hawk, 7, 1.38, m, caroler

el vira = 76-65 = 11/65 = 17%. bullish in the extreme. only 2 are 100% g and 1 is 100% f, the rest hold some mix including equities. contrarian signal triggered. sell.

housekeeping: mid-week i will be retreating to one of the last best places with no cell reception or internet access to unplug and unwind with family. the next ark update may not be available until late sunday or possibly monday and too late to be actionable for monday's ift deadline. burros-ark trading system will go live for the new year at some point after that, i'm not sure if it will execute the first trade when the signal generates, on the last close of the year, or on the first day the new year. also i may toy with how the indicators are represented and communicated, but i am more of a cocktail napkin than spreadsheet type so who knows?

all is well. enjoy your holidays with family or in whatever manner as is tradition for you. it's a wonderful time of year, and it's soyal, the shortest day, solstice, tomorrow the sun comes back around for another turn of the wheel. if possible, get out today and dance around the fire.

merry christmas and here's to a profitable new year!

arkers vs indices:

>g: 62%

>f: 39%

>c: 8%

>s: 31%

>i: 92%

alevin/mouse, 6, 0.66%, m, caroler

amoeba/hare, 6, 2.30%, m, jolly

birchtree/elephant, 5, 0.02, m, caroler

bmnevue/penguin, 7, 16.92%, m, jingle bells

boghie/lion, 6, 7.04%, m, wise man

burrocrat/donkey, 1, 10.40%, g, jingle balls

fwm/racoon, 9, (9.35%), m, coal

jonfresno/kangarooo, 8, 3.70%, s, jolly

jpcavin/cougar, 8, 8.06%, m, wise woman

jth/wolf, 3, 2.15%, g, jolly

mrbowl/owl, 3, 3.00%, f, jolly

pessoptimist/squirrel, 7, 9.22%, m, wise man

whipsaw/hawk, 7, 1.38, m, caroler

el vira = 76-65 = 11/65 = 17%. bullish in the extreme. only 2 are 100% g and 1 is 100% f, the rest hold some mix including equities. contrarian signal triggered. sell.

housekeeping: mid-week i will be retreating to one of the last best places with no cell reception or internet access to unplug and unwind with family. the next ark update may not be available until late sunday or possibly monday and too late to be actionable for monday's ift deadline. burros-ark trading system will go live for the new year at some point after that, i'm not sure if it will execute the first trade when the signal generates, on the last close of the year, or on the first day the new year. also i may toy with how the indicators are represented and communicated, but i am more of a cocktail napkin than spreadsheet type so who knows?

all is well. enjoy your holidays with family or in whatever manner as is tradition for you. it's a wonderful time of year, and it's soyal, the shortest day, solstice, tomorrow the sun comes back around for another turn of the wheel. if possible, get out today and dance around the fire.

merry christmas and here's to a profitable new year!

burrocrat

TSP Talk Royalty

- Reaction score

- 162

today i had a life-changing experience, i just have to tell about it. i picked up my new glasses today.

i forgot there was so much detail and texture in the world, wow! everything is sharp and clear. i can read road signs from a long ways away instead of just catching part of the first line just before i blow past. streetlamps look like lights not big fuzzy suns. everyone is so beautiful!

and oh the boobs, there are boobs everywhere! and i don't even have to squint like a pervert to see them!

i should've got glasses a long time ago.

i forgot there was so much detail and texture in the world, wow! everything is sharp and clear. i can read road signs from a long ways away instead of just catching part of the first line just before i blow past. streetlamps look like lights not big fuzzy suns. everyone is so beautiful!

and oh the boobs, there are boobs everywhere! and i don't even have to squint like a pervert to see them!

i should've got glasses a long time ago.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Re: JPCavin just had to ask. Why, oh Lord, why???

burros-ark update: sort of.

without all the hassle, system remains on sell and will start the new year in the g fund due to overbought conditions, geopolitical tensions, deteriorating commodities markets, and contrarion sentiment.

tommorow will be a good day for year-end analysis, with a new signal after friday actionable for monday.

happy new year.

burros-ark update: sort of.

without all the hassle, system remains on sell and will start the new year in the g fund due to overbought conditions, geopolitical tensions, deteriorating commodities markets, and contrarion sentiment.

tommorow will be a good day for year-end analysis, with a new signal after friday actionable for monday.

happy new year.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

burros-ark year end analysis:

how did arkers fare against.a buy and hold each fund strategery?

>g: 54%, that means 46% actively traded themselves out of gains their grandpa could've got sitting in cash on his ash.

>=f: 39%, that means 61% couldn't beat corporate junk bonds in a market that expected rising interest rates.

>c: 8%, bmnevue is a jerk and a show off.

>s: 31%, the no brainer small cap index made approximately 2/3 of arkers look dumb.

>i: 92%, usa usa usa, the cleanest dirty shirt in the laundry.

alevin/mouse: 0.72%, no go

amoeba/turtle: 2.80%, show

birchtree/elephant: (0.90%), no go

bmnevue/penguin: 16.60%, gold

bohgie/lion: 6.73%, flow, tied f fund i never would've guessed

burrocrat/donkey: 10.47%, silver, i really like silver

fireweathermet/racoon: (9.35%), honorable mention

jonfresno/kangaroo: 4.23%, show

jpcavin/cougar: 8.04%, flow

jth/wolf: 2.27%, no go

mrbowl/owl: 2.04%, no go

pessoptimist/squirrel, 8.90%, bronze

whipsaw/hawk: 1.48%, no go

average of all arkers: 4.16%, which is very close to kangaroo's return so s/he is the bellweather. i wish i knew if if it was jo n fresno or jon fresno.

how did arkers fare against.a buy and hold each fund strategery?

>g: 54%, that means 46% actively traded themselves out of gains their grandpa could've got sitting in cash on his ash.

>=f: 39%, that means 61% couldn't beat corporate junk bonds in a market that expected rising interest rates.

>c: 8%, bmnevue is a jerk and a show off.

>s: 31%, the no brainer small cap index made approximately 2/3 of arkers look dumb.

>i: 92%, usa usa usa, the cleanest dirty shirt in the laundry.

alevin/mouse: 0.72%, no go

amoeba/turtle: 2.80%, show

birchtree/elephant: (0.90%), no go

bmnevue/penguin: 16.60%, gold

bohgie/lion: 6.73%, flow, tied f fund i never would've guessed

burrocrat/donkey: 10.47%, silver, i really like silver

fireweathermet/racoon: (9.35%), honorable mention

jonfresno/kangaroo: 4.23%, show

jpcavin/cougar: 8.04%, flow

jth/wolf: 2.27%, no go

mrbowl/owl: 2.04%, no go

pessoptimist/squirrel, 8.90%, bronze

whipsaw/hawk: 1.48%, no go

average of all arkers: 4.16%, which is very close to kangaroo's return so s/he is the bellweather. i wish i knew if if it was jo n fresno or jon fresno.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Re: burro's ark

burrocrat's historical returns (not to be confused with hysterical returns, those are two different things):

counting only full-year returns of which i now have 5 of them:

2014, 10.47%

2013, 5.06%

2012, 16.36%

2011, (-3.12%)

2010, 9.55%

---------------

5 year average, 7.66%

i am ok with that, actually quite proud of it, and i did it my way. my goal each year is 12%. my system seems to have potential for double digit upsides while for the most part avoiding damaging losses, plus it's fun and free.

don't tell the market, but i plan to kick its butt in 2015.

burrocrat's historical returns (not to be confused with hysterical returns, those are two different things):

counting only full-year returns of which i now have 5 of them:

2014, 10.47%

2013, 5.06%

2012, 16.36%

2011, (-3.12%)

2010, 9.55%

---------------

5 year average, 7.66%

i am ok with that, actually quite proud of it, and i did it my way. my goal each year is 12%. my system seems to have potential for double digit upsides while for the most part avoiding damaging losses, plus it's fun and free.

don't tell the market, but i plan to kick its butt in 2015.

kave

TSP Strategist

- Reaction score

- 14

Re: burro's ark

I hear ya Burrocrat! Let's go get it!!

burrocrat's historical returns (not to be confused with hysterical returns, those are two different things):

counting only full-year returns of which i now have 5 of them:

2014, 10.47%

2013, 5.06%

2012, 16.36%

2011, (-3.12%)

2010, 9.55%

---------------

5 year average, 7.66%

i am ok with that, actually quite proud of it, and i did it my way. my goal each year is 12%. my system seems to have potential for double digit upsides while for the most part avoiding damaging losses, plus it's fun and free.

don't tell the market, but i plan to kick its butt in 2015.

I hear ya Burrocrat! Let's go get it!!

Boghie

Market Veteran

- Reaction score

- 368

I think I hate the AutoTracker

I think I hate the AutoTracker. Yowser, back in the day I could go on a site like this and tell everyone I made 26%. But, no, everybody knows I made 6.7%. Yuk. This ain't any fun. The C Funders are having all the fun. Oh well.

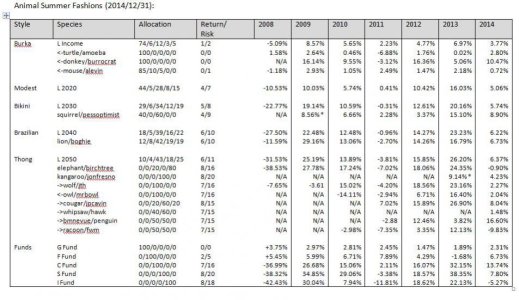

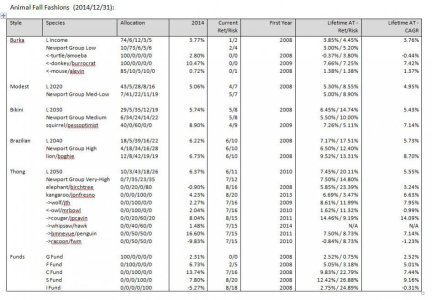

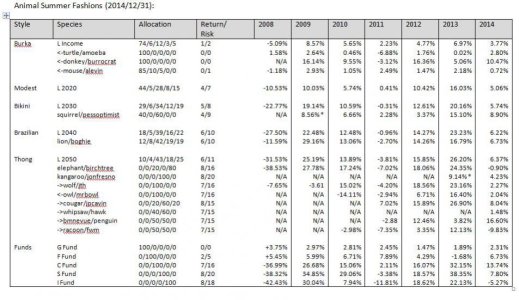

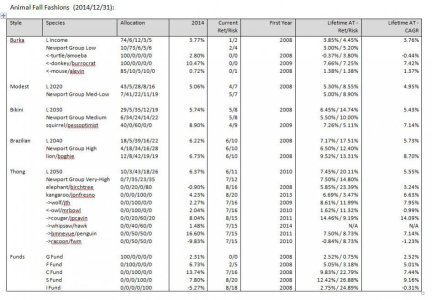

Here are the 2014 Stats:

Annual Returns:

CAGR/IRR Numbers:

The S&P500 (C) overwhelmed everything. The AGG (F) did a lot better than expected and a tad better than average, but in the end anyone who sat in the C Fund banked it. The rest of us - swinger or allocators or SWAGers - lost a ton of points to the C Fund. That is not a good thing because we are not taking full advantage of the huge upswings that help compensate for the declines. But, perhaps, we shall not participate fully in the declines. Time shall tell...

Nice job Burro on that last trade. I think you must be insider trading:toung:.

I think I hate the AutoTracker. Yowser, back in the day I could go on a site like this and tell everyone I made 26%. But, no, everybody knows I made 6.7%. Yuk. This ain't any fun. The C Funders are having all the fun. Oh well.

Here are the 2014 Stats:

Annual Returns:

CAGR/IRR Numbers:

The S&P500 (C) overwhelmed everything. The AGG (F) did a lot better than expected and a tad better than average, but in the end anyone who sat in the C Fund banked it. The rest of us - swinger or allocators or SWAGers - lost a ton of points to the C Fund. That is not a good thing because we are not taking full advantage of the huge upswings that help compensate for the declines. But, perhaps, we shall not participate fully in the declines. Time shall tell...

Nice job Burro on that last trade. I think you must be insider trading:toung:.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

Re: I think I hate the AutoTracker

thanks boghie, i'm glad you stopped by. no insider trading here, but it would be dishonest of me not to disclose that after many imprudent life experiences i seem to have acquired a feel for when the real insiders might be trading and i don't mind hanging my nuts out there trying to catch a swing. that's what nuts are for right?

i was hoping you'd do a year-end cagr analysis, i really look forward to those. i think i am starting to understand it a bit more after someone explained it to me as 'eeli' expected earning of lifetime investment. i'm unsure if that applies equally to an active trading style versus a buy and hold a particular allocation style, but i'm making progress.

for 2015 i personally plan to continue my mostly out of the market strategery and wait for short term hot strikes during extreme market uncertainty, ideally in and out within a matter of days and not holding long over weekends unless i get tricked into a losing trade and have to hold for a period of time for it to come back around so as not to book a loss.

burros-ark is now has an official autotracker entry which is separate from my personal trades and it will follow the weekly ark signals generated over the weekend (typically sunday) and executing a buy, sell, or hold trade each monday before ift deadline to be effective cob monday. it will follow every signal until out of trades for the month.

also, for fun and because i know it is not always a pleasant experience to be an ark denizen, i am offering a prize for the best performing full-year ark denizen at year end. the only way to get kicked off the ark is to join a premium service which hides your public trades rendering them useless in my system, or to jump and go for a swim. i can't tell you what the prize is going to be because i don't have it yet, but i hope it's shiny and worth about $20 bucks.

i have a proposal for you boghie. i would like to give you the same prize if you would do regular quarterly and year-end cagr analysis on burros-ark system and residents. sort of like paying for your services except not really because this is all for fun and not at all to be construed as investment advice. more like a mutual gift exchange between friends. the keys to the back office are in the fake rock next to the garden nome by the porch and the combination to the safe is taped under my keyboard.

happy new year. let's rock.

Nice job Burro on that last trade. I think you must be insider trading:toung:.

thanks boghie, i'm glad you stopped by. no insider trading here, but it would be dishonest of me not to disclose that after many imprudent life experiences i seem to have acquired a feel for when the real insiders might be trading and i don't mind hanging my nuts out there trying to catch a swing. that's what nuts are for right?

i was hoping you'd do a year-end cagr analysis, i really look forward to those. i think i am starting to understand it a bit more after someone explained it to me as 'eeli' expected earning of lifetime investment. i'm unsure if that applies equally to an active trading style versus a buy and hold a particular allocation style, but i'm making progress.

for 2015 i personally plan to continue my mostly out of the market strategery and wait for short term hot strikes during extreme market uncertainty, ideally in and out within a matter of days and not holding long over weekends unless i get tricked into a losing trade and have to hold for a period of time for it to come back around so as not to book a loss.

burros-ark is now has an official autotracker entry which is separate from my personal trades and it will follow the weekly ark signals generated over the weekend (typically sunday) and executing a buy, sell, or hold trade each monday before ift deadline to be effective cob monday. it will follow every signal until out of trades for the month.

also, for fun and because i know it is not always a pleasant experience to be an ark denizen, i am offering a prize for the best performing full-year ark denizen at year end. the only way to get kicked off the ark is to join a premium service which hides your public trades rendering them useless in my system, or to jump and go for a swim. i can't tell you what the prize is going to be because i don't have it yet, but i hope it's shiny and worth about $20 bucks.

i have a proposal for you boghie. i would like to give you the same prize if you would do regular quarterly and year-end cagr analysis on burros-ark system and residents. sort of like paying for your services except not really because this is all for fun and not at all to be construed as investment advice. more like a mutual gift exchange between friends. the keys to the back office are in the fake rock next to the garden nome by the porch and the combination to the safe is taped under my keyboard.

happy new year. let's rock.

Last edited:

Similar threads

- Replies

- 3

- Views

- 486

- Replies

- 9

- Views

- 480